Answered step by step

Verified Expert Solution

Question

1 Approved Answer

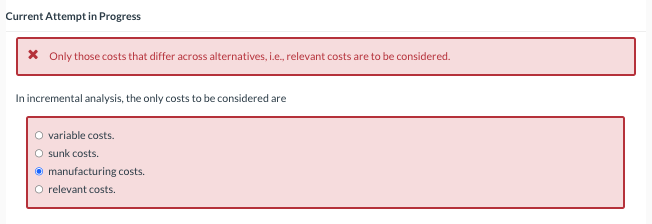

Current Attempt in Progress * Only those costs that differ across alternatives, i.e., relevant costs are to be considered. In incremental analysis, the only

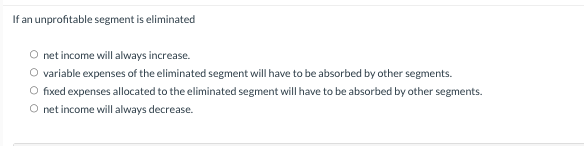

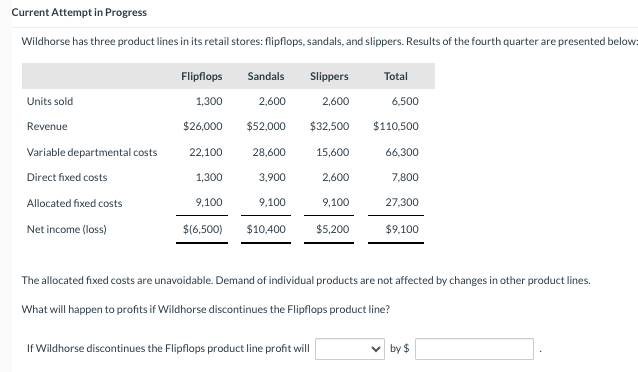

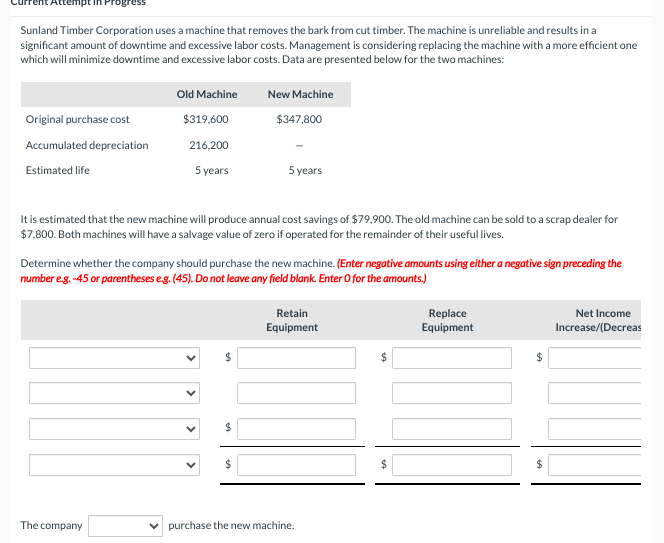

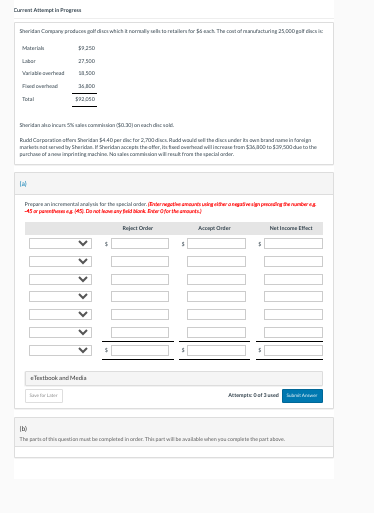

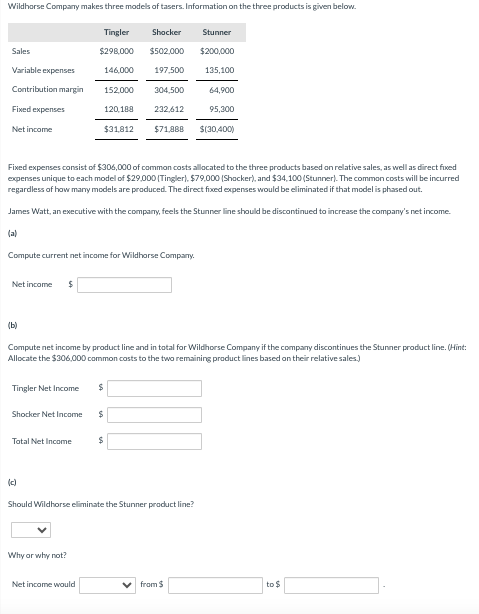

Current Attempt in Progress * Only those costs that differ across alternatives, i.e., relevant costs are to be considered. In incremental analysis, the only costs to be considered are variable costs. O sunk costs. manufacturing costs. O relevant costs. If an unprofitable segment is eliminated O net income will always increase. variable expenses of the eliminated segment will have to be absorbed by other segments. O fixed expenses allocated to the eliminated segment will have to be absorbed by other segments. O net income will always decrease. Current Attempt in Progress Wildhorse has three product lines in its retail stores: flipflops, sandals, and slippers. Results of the fourth quarter are presented below: Units sold Revenue Variable departmental costs Direct fixed costs Allocated fixed costs Net income (loss) Flipflops Sandals 1,300 2,600 $26,000 $52,000 22,100 28,600 1,300 3,900 9,100 9,100 $(6,500) $10,400 Slippers 2,600 6,500 $32,500 $110,500 15,600 66,300 2,600 7,800 9,100 If Wildhorse discontinues the Flipflops product line profit will Total $5,200 27,300 $9,100 The allocated fixed costs are unavoidable. Demand of individual products are not affected by changes in other product lines. What will happen to profits if Wildhorse discontinues the Flipflops product line? by $ Sunland Timber Corporation uses a machine that removes the bark from cut timber. The machine is unreliable and results in a significant amount of downtime and excessive labor costs. Management is considering replacing the machine with a more efficient one which will minimize downtime and excessive labor costs. Data are presented below for the two machines: Original purchase cost Accumulated depreciation Estimated life Old Machine $319,600 216,200 5 years The company New Machine $347,800 It is estimated that the new machine will produce annual cost savings of $79,900. The old machine can be sold to a scrap dealer for $7,800. Both machines will have a salvage value of zero if operated for the remainder of their useful lives. 5 years Determine whether the company should purchase the new machine. (Enter negative amounts using either a negative sign preceding the number e.g.-45 or parentheses e.g. (45). Do not leave any field blank. Enter o for the amounts.) $ Retain Equipment purchase the new machine. $ Replace Equipment $ $ Net Income Increase/(Decreas Current Attempt in Progress Sheridan Company produces golf disc which it normally sells to retailers for $6 each. The cost of manufacturing 25,000 f Materials $9.350 Labor 27.500 Variable overhead 58.500 Fixed overhead 36,000 Total $92,050 Sheridan 5% sales commission ($0.30) on each infign Rudd Corporation offers Sheridan $4.40 per disc for 2,700 discs. Rudd would sell the discs under its own brand noted by Sheridan. If Sheridan accepts the offer, its fed overhead will increase from $35,000 to $39,500 due to the purchase of an imprinting machine. No sales commission will from the special ander. M Prepare an incremental analysis for the special order.ternet amounts using either a negative sign preceding the numbering -45 (45). Do not leave any field blank for the mounts) Reject Order Accept Order Net Income Effect eTextbook and Media Save for Later $ Attempts of used b) The parts of this question must be completed in order. This part will be available when you complete the part above. Wildhorse Company makes three models of tasers. Information on the three products is given below. Sales Variable expenses Contribution margin Fixed expenses Net income Net income $ (b) Shocker Net Income Total Net Income Tingler $298.000 (c) 146,000 Fixed expenses consist of $306,000 of common costs allocated to the three products based on relative sales, as well as direct fixed expenses unique to each model of $29,000 (Tingler). $79,000 (Shocker), and $34,100 (Stunner). The common costs will be incurred regardless of how many models are produced. The direct fixed expenses would be eliminated if that model is phased out. James Watt, an executive with the company, feels the Stunner line should be discontinued to increase the company's net income. (a) Compute current net income for Wildhorse Company. 152,000 Tingler Net Income $ Why or why not? Net income would 120,188 Compute net income by product line and in total for Wildhorse Company if the company discontinues the Stunner product line. (Hint: Allocate the $306,000 common costs to the two remaining product lines based on their relative sales.) 232,612 $31,812 $71,888 Shocker $502,000 197,500 304,500 $ $ Should Wildhorse eliminate the Stunner product line? Stunner $200,000 135,100 64,900 95,300 $(30,400) from $ to $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Multiple Choice Questions If an unprofitable segment is eliminated the relevant costs to be considered are Relevant costs What will happen to profits ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started