Answered step by step

Verified Expert Solution

Question

1 Approved Answer

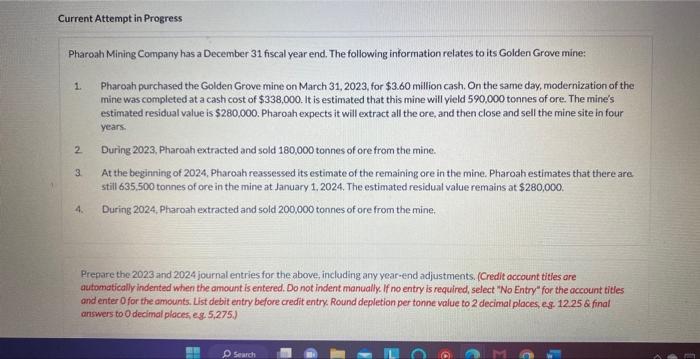

Current Attempt in Progress Pharoah Mining Company has a December 31 fiscal year end. The following information relates to its Golden Grove mine: 1.

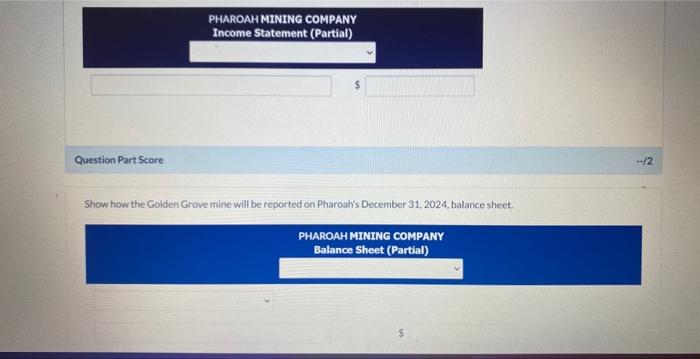

Current Attempt in Progress Pharoah Mining Company has a December 31 fiscal year end. The following information relates to its Golden Grove mine: 1. 2 3 4. Pharoah purchased the Golden Grove mine on March 31, 2023, for $3.60 million cash. On the same day, modernization of the mine was completed at a cash cost of $338,000. It is estimated that this mine will yield 590,000 tonnes of ore. The mine's estimated residual value is $280,000. Pharoah expects it will extract all the ore, and then close and sell the mine site in four years. During 2023, Pharoah extracted and sold 180,000 tonnes of ore from the mine. At the beginning of 2024, Pharoah reassessed its estimate of the remaining ore in the mine. Pharoah estimates that there are still 635,500 tonnes of ore in the mine at January 1, 2024. The estimated residual value remains at $280,000. During 2024, Pharoah extracted and sold 200,000 tonnes of ore from the mine. Prepare the 2023 and 2024 journal entries for the above, including any year-end adjustments. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List debit entry before credit entry. Round depletion per tonne value to 2 decimal places, eg. 12.25 & final answers to O decimal places, eg. 5,275.) Search Question Part Score PHAROAH MINING COMPANY Income Statement (Partial) Show how the Golden Grove mine will be reported on Pharoah's December 31, 2024, balance sheet. PHAROAH MINING COMPANY Balance Sheet (Partial) --12

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started