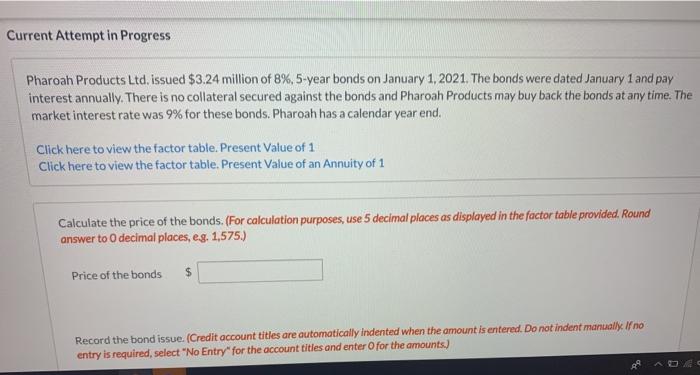

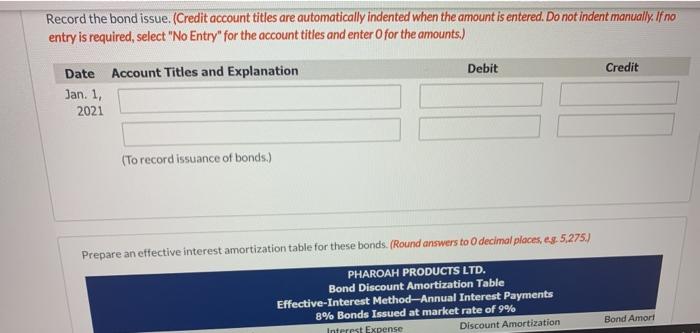

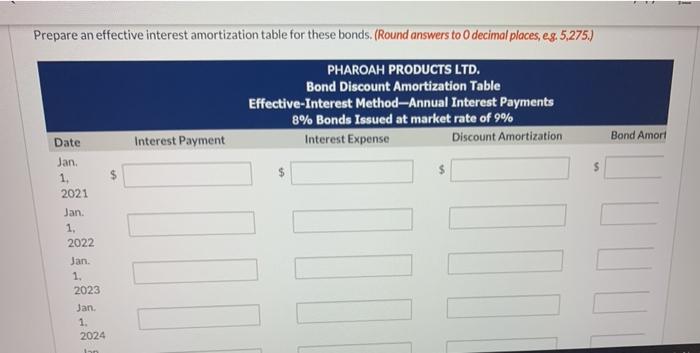

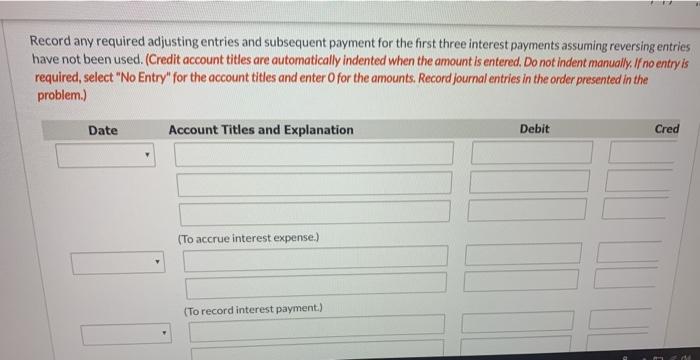

Current Attempt in Progress Pharoah Products Ltd. issued $3.24 million of 8%, 5-year bonds on January 1, 2021. The bonds were dated January 1 and pay interest annually. There is no collateral secured against the bonds and Pharoah Products may buy back the bonds at any time. The market interest rate was 9% for these bonds. Pharoah has a calendar year end. Click here to view the factor table. Present Value of 1 Click here to view the factor table. Present Value of an Annuity of 1 Calculate the price of the bonds. (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round answer to decimal places, eg, 1,575.) Price of the bonds $ Record the bond issue. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter Ofor the amounts.) Record the bond issue. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Debit Credit Date Account Titles and Explanation Jan. 1, 2021 (To record issuance of bonds.) Prepare an effective interest amortization table for these bonds. (Round answers to decimal places, es: 5,275.) PHAROAH PRODUCTS LTD. Bond Discount Amortization Table Effective-Interest Method-Annual Interest Payments 8% Bonds Issued at market rate of 9% Interest Expense Discount Amortization Bond Amort Prepare an effective interest amortization table for these bonds. (Round answers to decimal places, eg. 5,275.) PHAROAH PRODUCTS LTD. Bond Discount Amortization Table Effective-Interest Method-Annual Interest Payments 8% Bonds Issued at market rate of 9% Interest Expense Discount Amortization Bond Amort Interest Payment $ Date Jan 1. 2021 Jan. 1, 2022 Jan. 1. 2023 Jan. 1. 2024 Record any required adjusting entries and subsequent payment for the first three interest payments assuming reversing entries have not been used. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Cred (To accrue interest expense.) (To record interest payment.) (To accrue interest expense.) (To record interest payment.) (To accrue interest expense.) (To record interest payment.)