Answered step by step

Verified Expert Solution

Question

1 Approved Answer

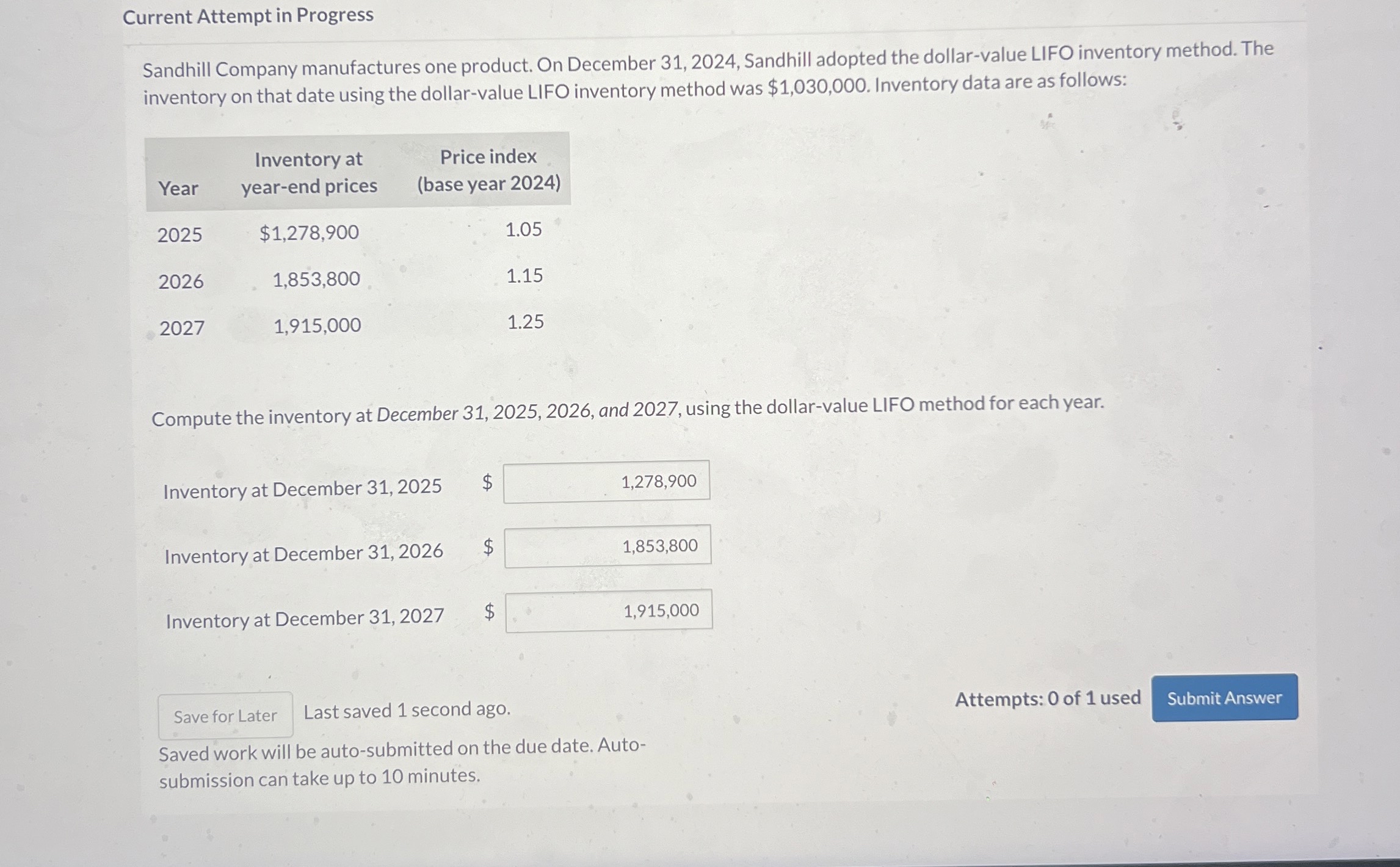

Current Attempt in Progress Sandhill Company manufactures one product. On December 3 1 , 2 0 2 4 , Sandhill adopted the dollar - value

Current Attempt in Progress

Sandhill Company manufactures one product. On December Sandhill adopted the dollarvalue LIFO inventory method. The inventory on that date using the dollarvalue LIFO inventory method was $ Inventory data are as follows:

tableYeartableInventory atyearend pricestablePrice indexbase year $

Compute the inventory at December and using the dollarvalue LIFO method for each year.

Inventory at December $

Inventory at December $

Inventory at December $

Last saved second ago.

Attempts: of used

Saved work will be autosubmitted on the due date. Autosubmission can take up to minutes.

Current Attempt in Progress

Sandhill Company manufactures one product. On December Sandhill adopted the dollarvalue LIFO inventory method. The inventory on that date using the dollarvalue LIFO inventory method was $ Inventory data are as follows:

tableYeartableInventory atyearend pricestablePrice indexbase year $

Compute the inventory at December and using the dollarvalue LIFO method for each year.

Inventory at December $

Inventory at December $

Inventory at December $

Last saved second ago.

Attempts: of used

Saved work will be autosubmitted on the due date. Autosubmission can take up to minutes.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started