Answered step by step

Verified Expert Solution

Question

1 Approved Answer

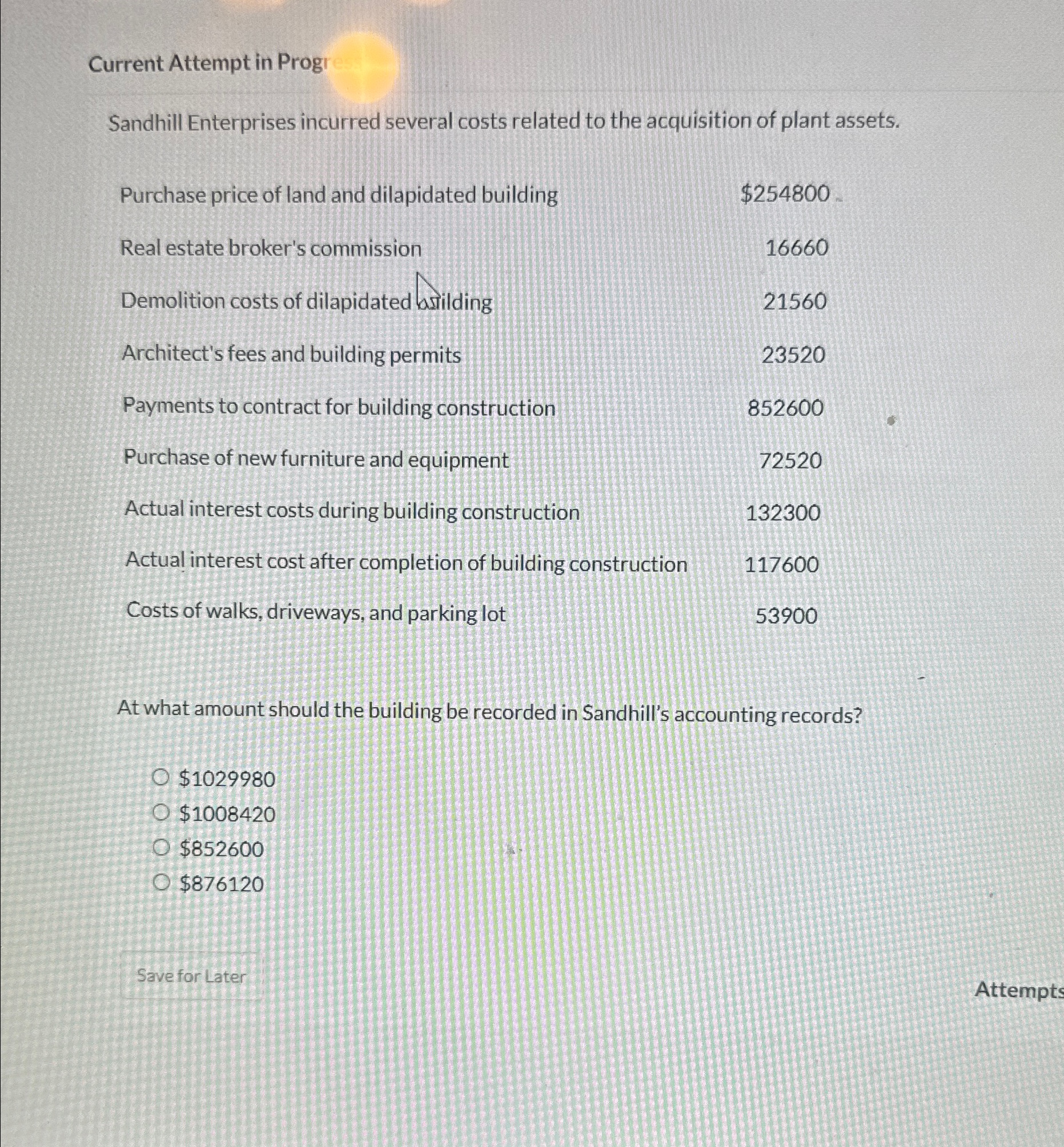

Current Attempt in Progress Sandhill Enterprises incurred several costs related to the acquisition of plant assets. Purchase price of land and dilapidated building $254800

Current Attempt in Progress Sandhill Enterprises incurred several costs related to the acquisition of plant assets. Purchase price of land and dilapidated building $254800 Real estate broker's commission 16660 Demolition costs of dilapidated silding 21560 Architect's fees and building permits 23520 Payments to contract for building construction 852600 Purchase of new furniture and equipment 72520 Actual interest costs during building construction 132300 Actual interest cost after completion of building construction 117600 Costs of walks, driveways, and parking lot 53900 At what amount should the building be recorded in Sandhill's accounting records? O $1029980 O $1008420 O $852600 O $876120 Save for Later Attempts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started