Answered step by step

Verified Expert Solution

Question

1 Approved Answer

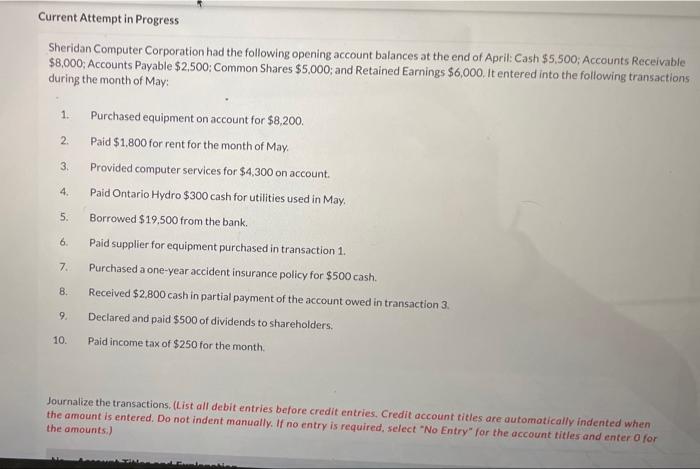

Current Attempt in Progress Sheridan Computer Corporation had the following opening account balances at the end of April: Cash $5,500; Accounts Receivable $8,000; Accounts Payable

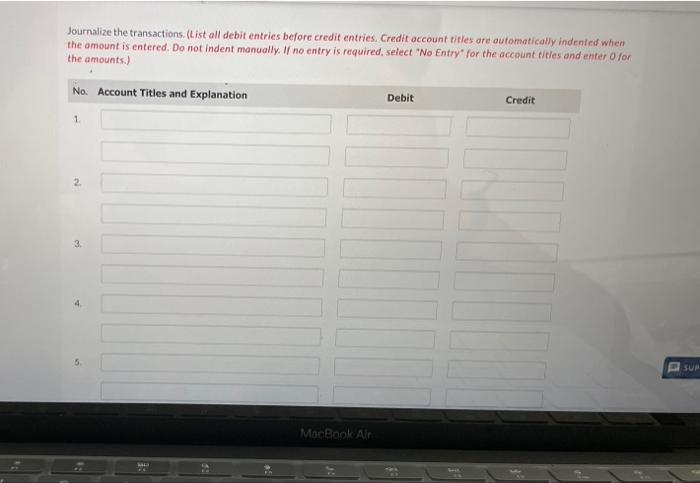

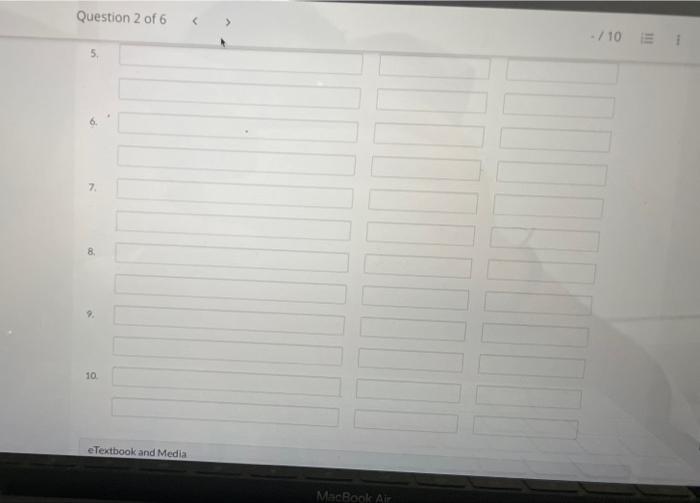

Current Attempt in Progress Sheridan Computer Corporation had the following opening account balances at the end of April: Cash $5,500; Accounts Receivable $8,000; Accounts Payable $2,500; Common Shares $5,000; and Retained Earnings $6,000. It entered into the following transactions during the month of May: 1. Purchased equipment on account for $8,200. Paid $1,800 for rent for the month of May. Provided computer services for $4,300 on account. Paid Ontario Hydro $300 cash for utilities used in May. Borrowed $19,500 from the bank. Paid supplier for equipment purchased in transaction 1. Purchased a one-year accident insurance policy for $500 cash. Received $2,800 cash in partial payment of the account owed in transaction 3. Declared and paid $500 of dividends to shareholders. Paid income tax of $250 for the month. 2. 3. 4. 5. 6. 7. 8. 9. 10. Journalize the transactions. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started