Answered step by step

Verified Expert Solution

Question

1 Approved Answer

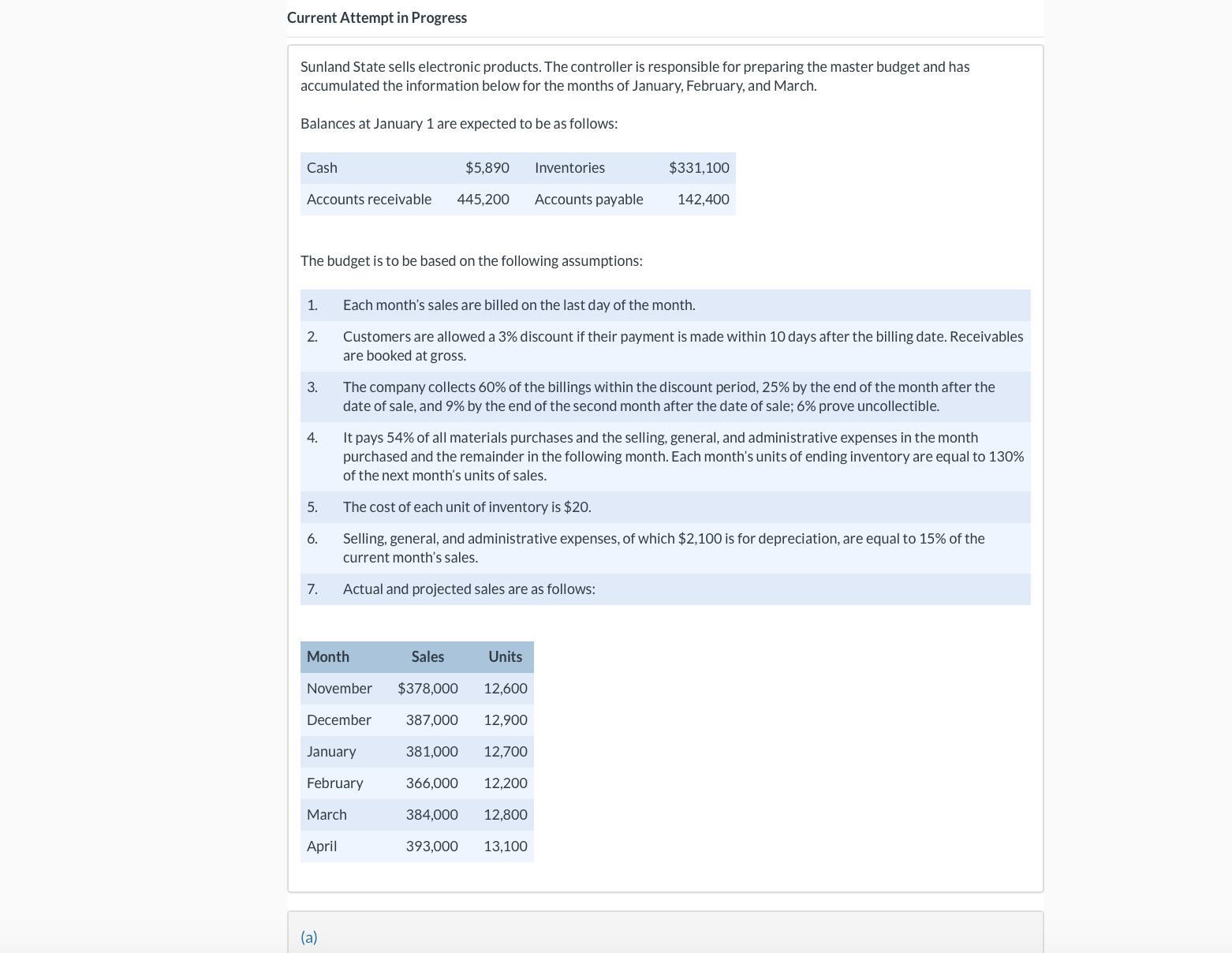

Current Attempt in Progress Sunland State sells electronic products. The controller is responsible for preparing the master budget and has accumulated the information below for

Current Attempt in Progress

Sunland State sells electronic products. The controller is responsible for preparing the master budget and has

accumulated the information below for the months of January, February, and March.

Balances at January are expected to be as follows:

The budget is to be based on the following assumptions:

Each month's sales are billed on the last day of the month.

Customers are allowed a discount if their payment is made within days after the billing date. Receivables

are booked at gross.

The company collects of the billings within the discount period, by the end of the month after the

date of sale, and by the end of the second month after the date of sale; prove uncollectible.

It pays of all materials purchases and the selling, general, and administrative expenses in the month

purchased and the remainder in the following month. Each month's units of ending inventory are equal to

of the next month's units of sales.

The cost of each unit of inventory is $

Selling, general, and administrative expenses, of which $ is for depreciation, are equal to of the

current month's sales.

Actual and projected sales are as follows:

b Calculate the budgeted cash collections during the month of January? What is the Total cash receipts?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started