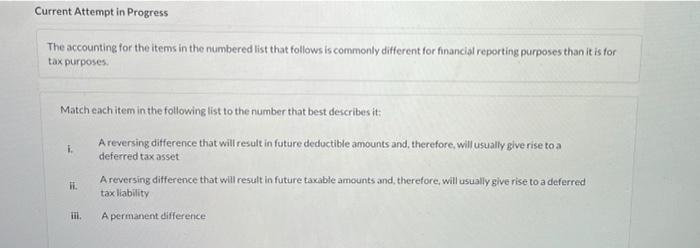

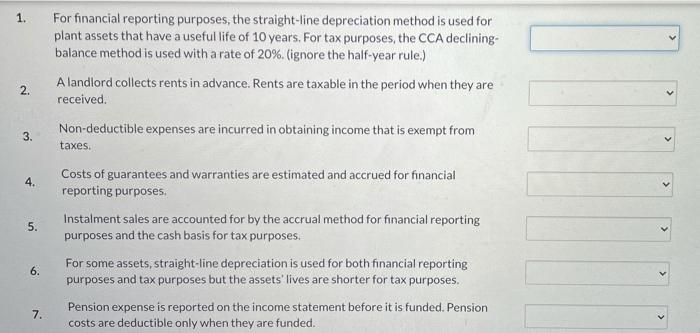

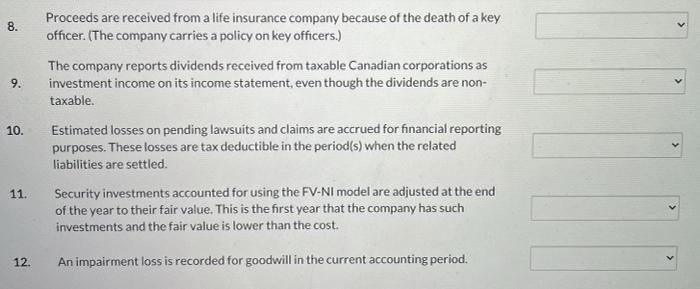

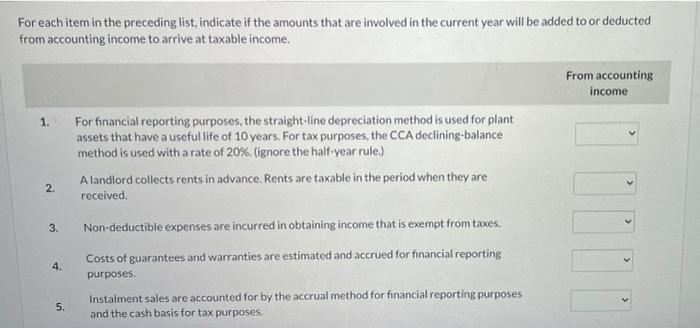

Current Attempt in Progress The accounting for the items in the numbered list that follows is commonly different for financial reporting purposes than it is for tax purposes Match each item in the following list to the number that best describes it: A reversing difference that will result in future deductible amounts and therefore, will usually give rise to a deferred tax asset A reversing difference that will result in future taxable amounts and therefore, will usually give rise to a deferred tax liability A permanent difference IL ii. 1. For financial reporting purposes, the straight-line depreciation method is used for plant assets that have a useful life of 10 years. For tax purposes, the CCA declining- balance method is used with a rate of 20%. (ignore the half-year rule.) A landlord collects rents in advance. Rents are taxable in the period when they are received Non-deductible expenses are incurred in obtaining income that is exempt from 2. 3. > taxes. 4. 5. 5 Costs of guarantees and warranties are estimated and accrued for financial reporting purposes Instalment sales are accounted for by the accrual method for financial reporting purposes and the cash basis for tax purposes. For some assets, straight-line depreciation is used for both financial reporting purposes and tax purposes but the assets' lives are shorter for tax purposes. Pension expense is reported on the income statement before it is funded. Pension costs are deductible only when they are funded. 6. 7. 8. 9. Proceeds are received from a life insurance company because of the death of a key officer. (The company carries a policy on key officers.) The company reports dividends received from taxable Canadian corporations as investment income on its income statement, even though the dividends are non- taxable. Estimated losses on pending lawsuits and claims are accrued for financial reporting purposes. These losses are tax deductible in the period(s) when the related liabilities are settled. Security investments accounted for using the FV-NI model are adjusted at the end of the year to their fair value. This is the first year that the company has such investments and the fair value is lower than the cost. 10. 11. 12. An impairment loss is recorded for goodwill in the current accounting period. For each item in the preceding list, indicate if the amounts that are involved in the current year will be added to or deducted from accounting income to arrive at taxable income. From accounting income 1. For financial reporting purposes, the straight-line depreciation method is used for plant assets that have a useful life of 10 years. For tax purposes, the CCA declining-balance method is used with a rate of 20%. (ignore the half-year rule.) A landlord collects rents in advance. Rents are taxable in the period when they are received 2. 3. 4. Non-deductible expenses are incurred in obtaining income that is exempt from taxes. Costs of guarantees and warranties are estimated and accrued for financial reporting purposes. Instalment sales are accounted for by the accrual method for financial reporting purposes and the cash basis for tax purposes. 5. 6. For some assets, straight-line depreciation is used for both financial reporting purposes and tax purposes but the assets' lives are shorter for tax purposes. 7. 8. Pension expense is reported on the income statement before it is funded. Pension costs are deductible only when they are funded. Proceeds are received from a life insurance company because of the death of a key officer. (The company carries a policy on key officers.) The company reports dividends received from taxable Canadian corporations as investment income on its income statement, even though the dividends are non-taxable. Estimated losses on pending lawsuits and claims are accrued for financial reporting purposes. These losses are tax deductible in the period(s) when the related liabilities are 9. 10. settled 11. Security investments accounted for using the FV-Nl model are adjusted at the end of the year to their fair value. This is the first year that the company has such investments and the fair value is lower than the cost. 12. An impairment loss is recorded for goodwill in the current accounting period