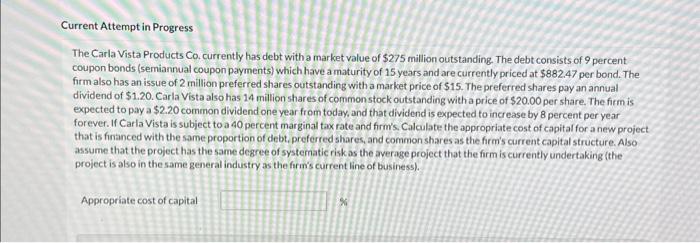

Current Attempt in Progress The Carla Vista Products Co. currently has debt with a market value of $275 million outstanding. The debt consists of 9 percent coupon bonds (semiannual coupon payments) which have a maturity of 15 years and are currently priced at $882.47 per bond. The firm also has an issue of 2 million preferred shares outstanding with a market price of $15. The preferred shares pay an annual dividend of \$1.20. Carla Vista also has 14 million shares of common stock outstanding witha price of $20.00 per share. The firm is expected to pay a $2.20 common dividend one year from today, and that dividend is expected to increase by 8 percent per year forever. If Carla Vista is subject to a 40 percent marginal tax rate and firm's. Calculate the appropriate cost of capital for a new project that is financed with the same proportion of debt, preferred shares, and common shares as the firm's current capital structure. Also assume that the project has the same degree of systematic risk as the average project that the firm is currently undertaking (the project is also in the same general industry as the firm's current line of business). Appropriate cost of capital Current Attempt in Progress The Carla Vista Products Co. currently has debt with a market value of $275 million outstanding. The debt consists of 9 percent coupon bonds (semiannual coupon payments) which have a maturity of 15 years and are currently priced at $882.47 per bond. The firm also has an issue of 2 million preferred shares outstanding with a market price of $15. The preferred shares pay an annual dividend of \$1.20. Carla Vista also has 14 million shares of common stock outstanding witha price of $20.00 per share. The firm is expected to pay a $2.20 common dividend one year from today, and that dividend is expected to increase by 8 percent per year forever. If Carla Vista is subject to a 40 percent marginal tax rate and firm's. Calculate the appropriate cost of capital for a new project that is financed with the same proportion of debt, preferred shares, and common shares as the firm's current capital structure. Also assume that the project has the same degree of systematic risk as the average project that the firm is currently undertaking (the project is also in the same general industry as the firm's current line of business). Appropriate cost of capital