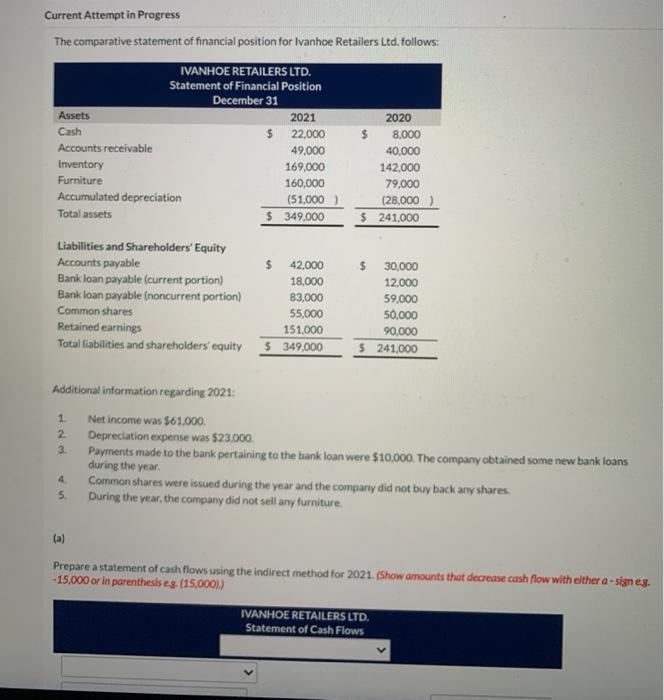

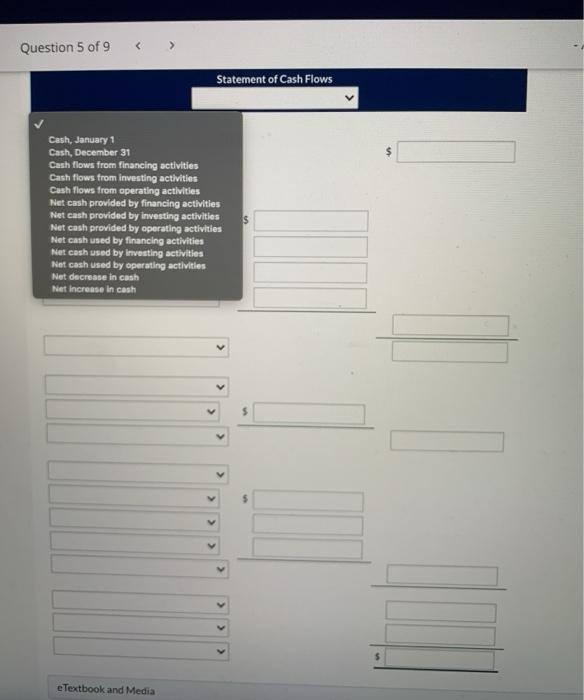

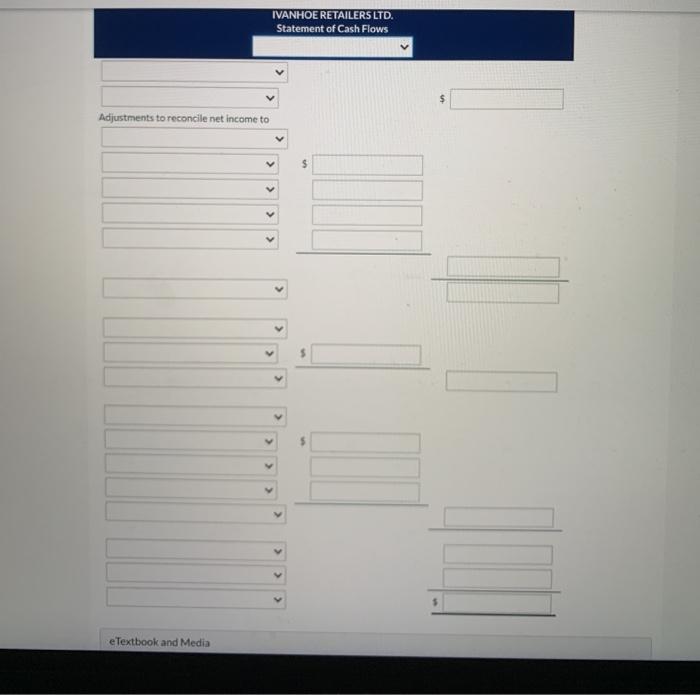

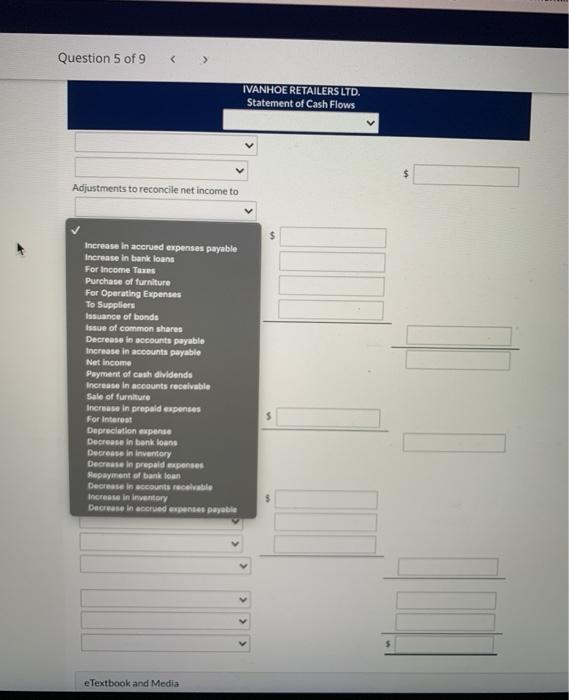

Current Attempt in Progress The comparative statement of financial position for Ivanhoe Retailers Ltd. follows: IVANHOE RETAILERS LTD. Statement of Financial Position December 31 Assets 2021 Cash $ 22,000 Accounts receivable 49,000 Inventory 169,000 Furniture 160,000 Accumulated depreciation (51.000) Total assets $ 349,000 2020 $ 8,000 40,000 142.000 79,000 (28,000) $ 241,000 Liabilities and Shareholders' Equity Accounts payable $ 42,000 Bank loan payable (current portion) 18,000 Bank loan payable (noncurrent portion) 83,000 Common shares 55,000 Retained earnings 151.000 Total liabilities and shareholders' equity $ 349,000 $ 30,000 12.000 59,000 50,000 90,000 $ 241,000 Additional information regarding 2021 Net income was $61.000 Depreciation expense was $23,000. Payments made to the bank pertaining to the bank loan were $10,000. The company obtained some new bank loans during the year Common shares were issued during the year and the company did not buy back any shares. During the year, the company did not sell any furniture 1 2 3 4 5 (a) Prepare a statement of cash flows using the indirect method for 2021. (Show amounts that decrease cash flow with either a - signes -15,000 or in parenthesis es (15,000 IVANHOE RETAILERS LTD. Statement of Cash Flows Question 5 of 9 Statement of Cash Flows Cash, January 1 Cash, December 31 Cash flows from financing activities Cash flows from investing activities Cash flows from operating activities Net cash provided by financing activities Net cash provided by investing activities Net cash provided by operating activities Net cash used by financing activities Net cash used by Investing activities Net cash used by operating activities Net decrease in cash Net Increase in cash v > $ e Textbook and Media IVANHOE RETAILERS LTD. Statement of Cash Flows $ Adjustments to reconcile net income to > e Textbook and Media Question 5 of 9 IVANHOE RETAILERS LTD. Statement of Cash Flows Adjustments to reconcile net income to Increase in accrued expenses payable Increase in bank loans For Income Taxes Purchase of furniture For Operating Expenses To Suppliers Issuance of bonds issue of common shares Decrease in accounts payable Increase in accounts payable Net Income Payment of cash dividends Increase in accounts receivable Sale of furniture Increase in prepaid expenses For interest Depreciation expense Decrease in bank loans Decrease in inventory Decrease in prepaid expenses Kepayment of bank loan Decrease in accounts receivable Increase in inventory Decrease in accrued expenses payable e Textbook and Media