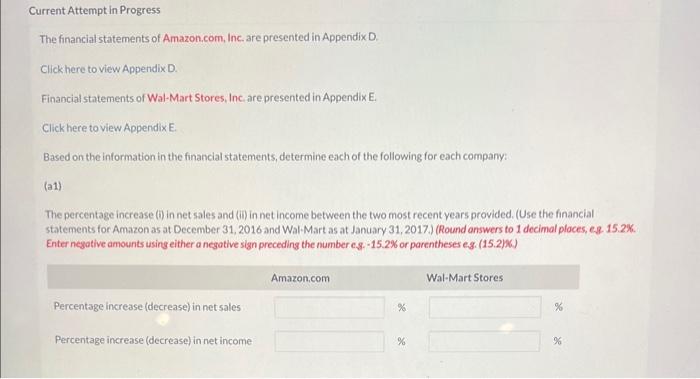

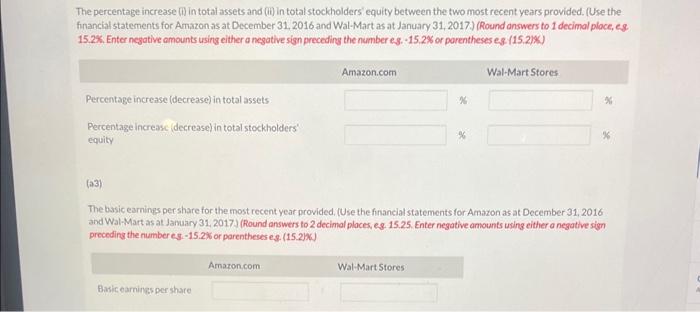

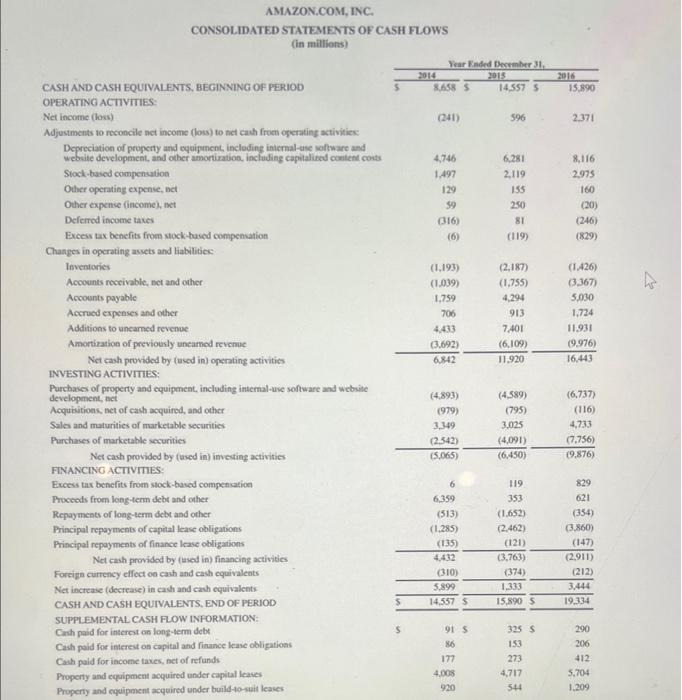

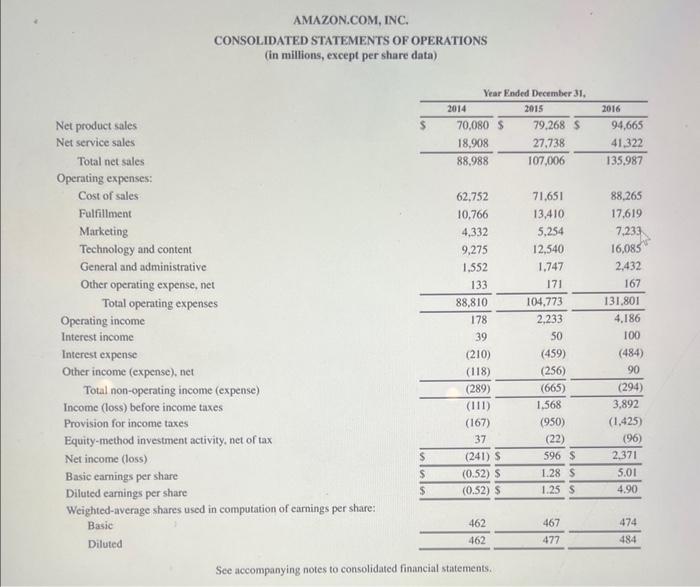

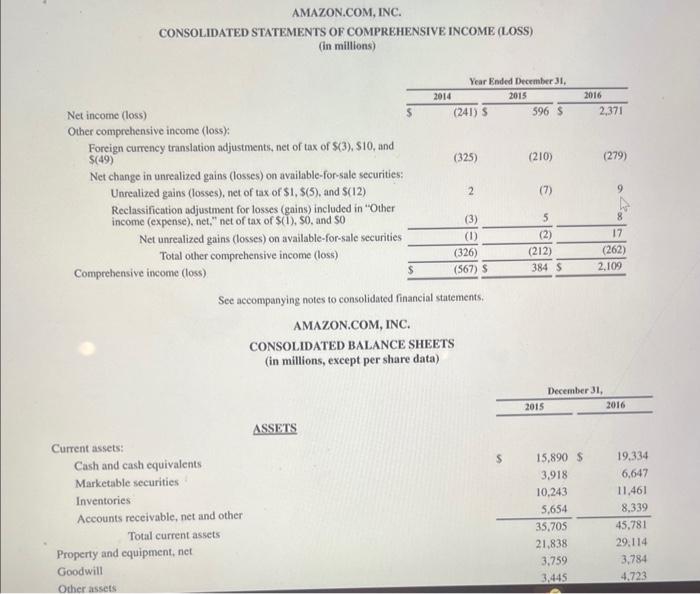

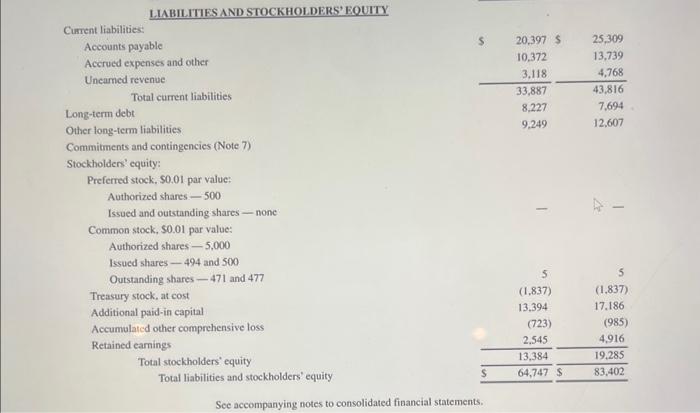

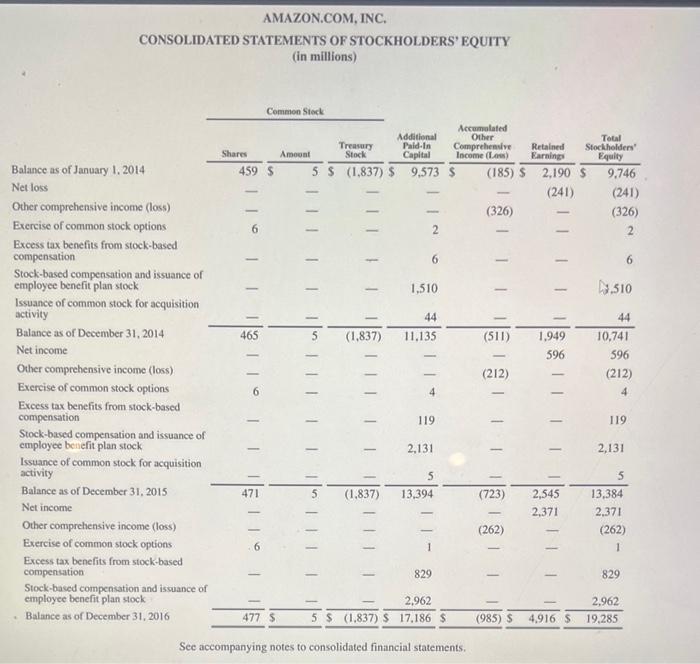

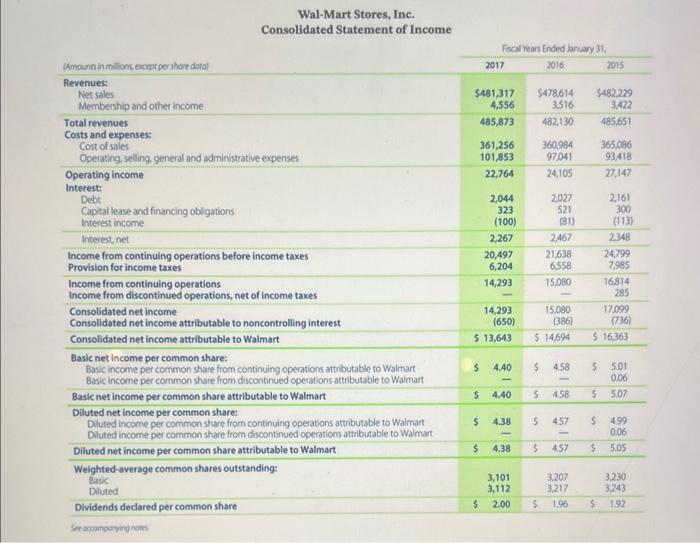

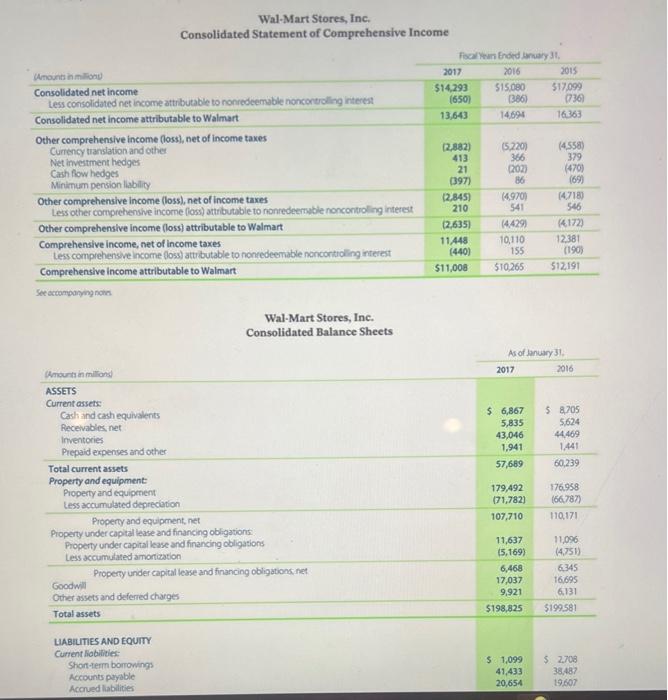

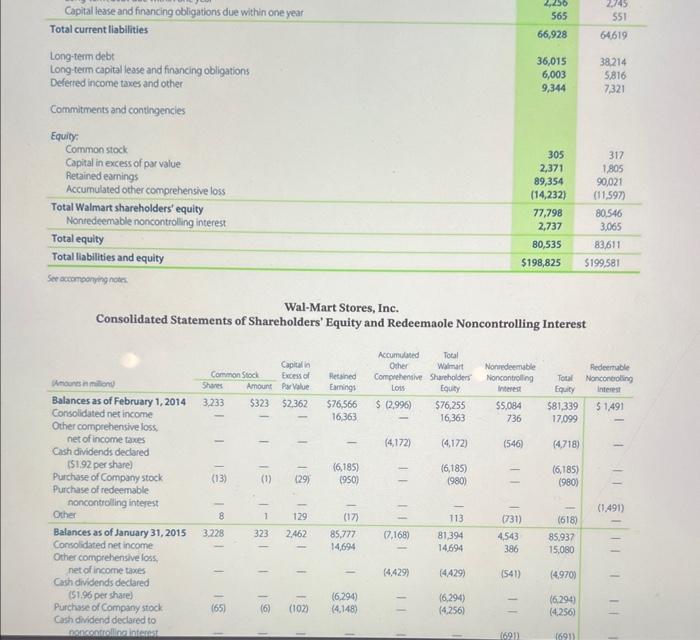

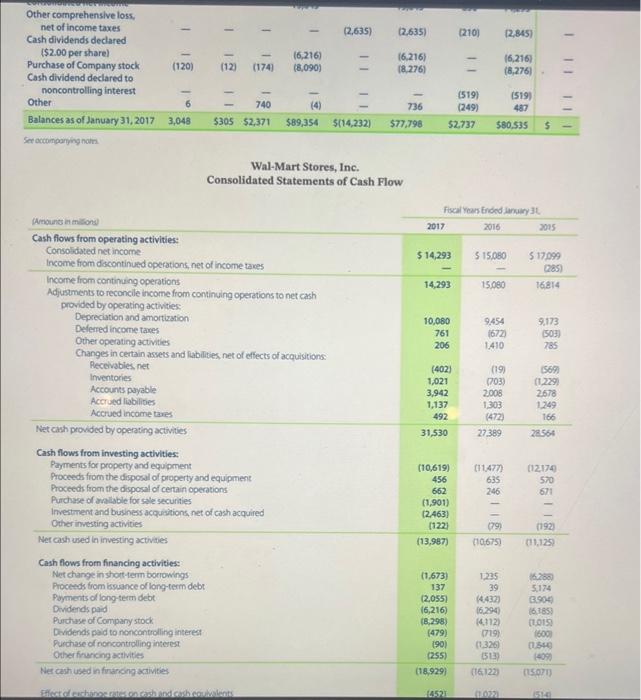

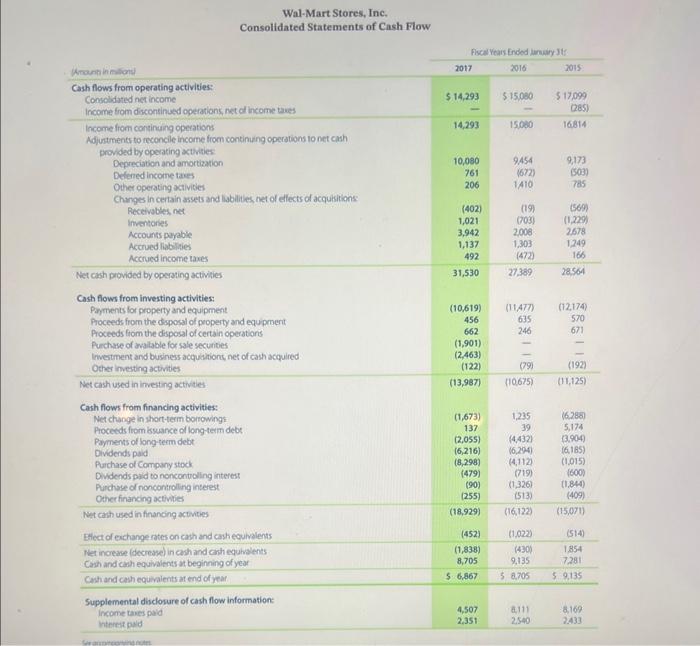

Current Attempt in Progress The financial statements of Amazon.corn, Inc. are presented in Appendix D. Click here to view Appendix D. Financial statements of Wal-Mart Stores, Inc are presented in Appendix E. Click here to view Appendix E. Based on the information in the financial statements, determine each of the following for each company: (a1) The percentage increase (i) in net sales and (ii) in net income between the two most recent years provided. (Use the financial statements for Amazon as at December 31,2016 and Wal-Mart as at January 31, 2017.) (Round answers to 1 decimal ploces, eg. 15.2\%. Enter negative amounts using either a negative sign preceding the number es. 15.2% or parentheses eg. (15.2)\%. The percentage increase (ii) in total assets and (ii) in total stockholders' equity between the two most recent years provided. (Use the financial statements for Amazon as at December 31, 2016 and Wal-Mart as at January 31, 2017.) (Round answers to 1 decimal place, eg 15.2\%. Enter negative amounts using either a negative sign preceding the number es. 15.2% or porentheses eg. (15.2)\%) (a3) The basic earnings per share for the most recent year provided, (Use the financial statements for Amazon as at December 31, 2016 and Wal-Mart as at Jamaary 31, 2017) (Round answers to 2 decimal places, eg. 15.25. Enter negative amounts using either a negative sign preceding the number es 15.2% or parentheseses. (15.2)x) AMAZON,COM, INC. AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF OPERATIONS See accompanying notes to consolidated financial statements. AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (in millions) LLBILITIES AND STOCKHOL DERS' EOUTTY Cument liabilities: Accounts payable Accrued expenses and other Uncamed revenue Total current liabilities Long-term debt Other long-term liabilities Commitments and contingencies (Note 7) Stockholders' equity: Preferred stock, $0.01 par value: Authorized shanes - 500 Issued and outstanding shares - none Common stock, 50.01 par value: Authorized shares - 5,000 Issued shares - 494 and 500 Outstanding shares 471 and 477 Treasury stock, at cost Additional paid-in capital Accumulated other comprehensive loss Retained earnings Total stockholders' equity Total liabilities and stockholders' equity See accompanying notes to consolidated financial statements. AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUTTY (in millions) See accompanying notes to consolidated financial statements. Wal-Mart Stores, Inc. Wal-Mart Stores, Inc. Consolidated Statement of Comprehensive Income Wal-Mart Stores, Inc. Consolidated Statements of Shareholders' Equity and Redeemaole Noncontrolling Interest Wal-Mart Stores, Inc. Wal-Mart Stores, Inc