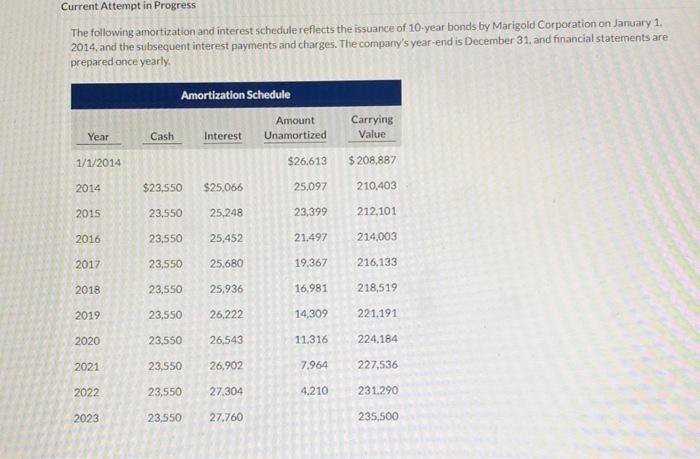

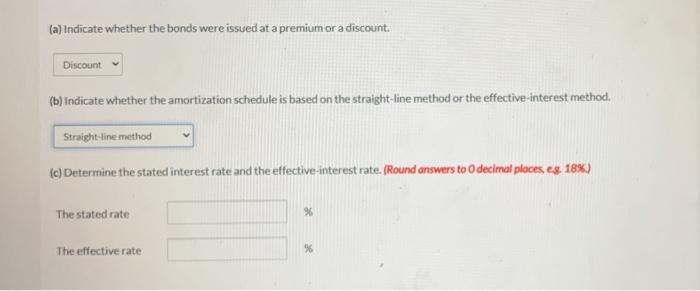

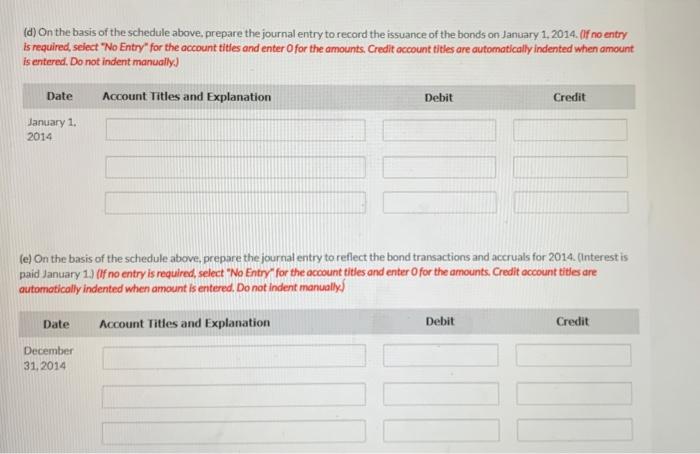

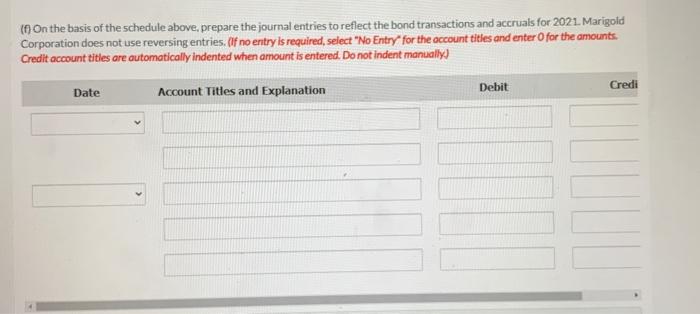

Current Attempt in Progress The following amortization and interest schedule reflects the issuance of 10-year bonds by Marigold Corporation on January 1. 2014, and the subsequent interest payments and charges. The company's year-end is December 31, and financial statements are prepared once yearly Amortization Schedule Amount Unamortized Carrying Value Year Cash Interest 1/1/2014 $26,613 $208,887 2014 $23.550 $25.066 25,097 210,403 2015 23,550 25.248 23,399 212,101 2016 23,550 25,452 21.497 214,003 2017 23,550 25.680 19.367 216,133 2018 23,550 25,936 16.981 218,519 2019 23,550 26.222 14,309 221.191 2020 23.550 26,543 11.316 224,184 2021 23,550 26,902 7.964 227,536 2022 23,550 27.304 4.210 231.290 2023 23,550 27.760 235,500 (a) Indicate whether the bonds were issued at a premium or a discount Discount (b) Indicate whether the amortization schedule is based on the straight-line method or the effective-interest method. Straight-line method (c) Determine the stated interest rate and the effective-interest rate. (Round answers to decimal places, eg. 18%) The stated rate % The effective rate % (d) On the basis of the schedule above, prepare the journal entry to record the issuance of the bonds on January 1, 2014. (If no entry is required, select "No Entry" for the account titles and enter Ofor the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually) Date Account Titles and Explanation Debit Credit January 1. 2014 le) On the basis of the schedule above, prepare the journal entry to reflect the bond transactions and accruals for 2014. (Interestis paid January 13 (f no entry is required, select "No Entry for the account titles and enter for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually/ Date Account Titles and Explanation Debit Credit December 31, 2014 (On the basis of the schedule above, prepare the journal entries to reflect the bond transactions and accruals for 2021. Marigold Corporation does not use reversing entries. Of no entry is required, select "No Entry for the account titles and enter for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually) Date Account Titles and Explanation Debit Credi