Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Current Attempt in Progress The following information was taken from the records of Tamarisk Inc. for the year 2025: Income tax applicable to income

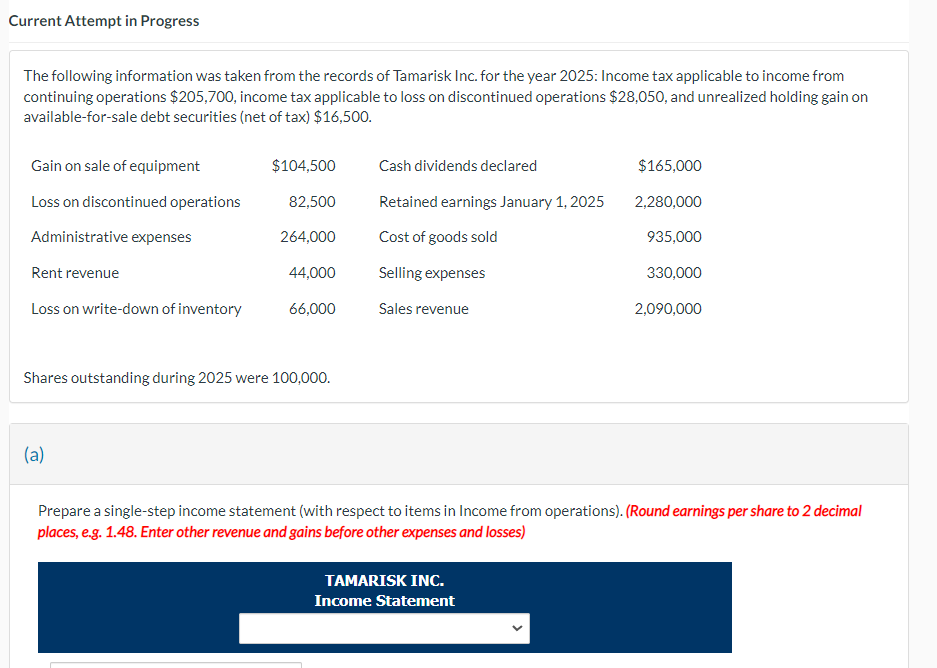

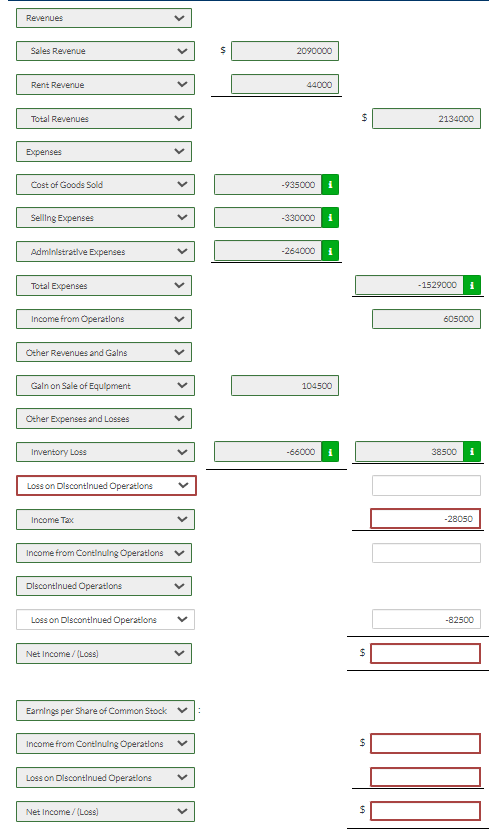

Current Attempt in Progress The following information was taken from the records of Tamarisk Inc. for the year 2025: Income tax applicable to income from continuing operations $205,700, income tax applicable to loss on discontinued operations $28,050, and unrealized holding gain on available-for-sale debt securities (net of tax) $16,500. Gain on sale of equipment $104,500 Cash dividends declared $165,000 Loss on discontinued operations 82,500 Retained earnings January 1, 2025 2,280,000 Administrative expenses 264,000 Cost of goods sold 935,000 Rent revenue 44,000 Selling expenses 330,000 Loss on write-down of inventory 66,000 Sales revenue 2,090,000 Shares outstanding during 2025 were 100,000. (a) Prepare a single-step income statement (with respect to items in Income from operations). (Round earnings per share to 2 decimal places, e.g. 1.48. Enter other revenue and gains before other expenses and losses) TAMARISK INC. Income Statement Revenues Sales Revenue $ 2090000 Rent Revenue Total Revenues Expenses Cost of Goods Sold -935000 Selling Expenses Administrative Expenses Total Expenses Income from Operations Other Revenues and Gains Gain on Sale of Equipment Other Expenses and Losses Inventory Loss Loss on Discontinued Operations Income Tax Income from Continuing Operations Discontinued Operations Loss on Discontinued Operations Net Income/(Loss) Earnings per Share of Common Stock Income from Continuing Operations Loss on Discontinued Operations Net Income/(Loss) -330000 44000 -264000 $ 104500 19 $ 2134000 -1529000 605000 -66000 38500 $ $ -28050 -82500 000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started