Answered step by step

Verified Expert Solution

Question

1 Approved Answer

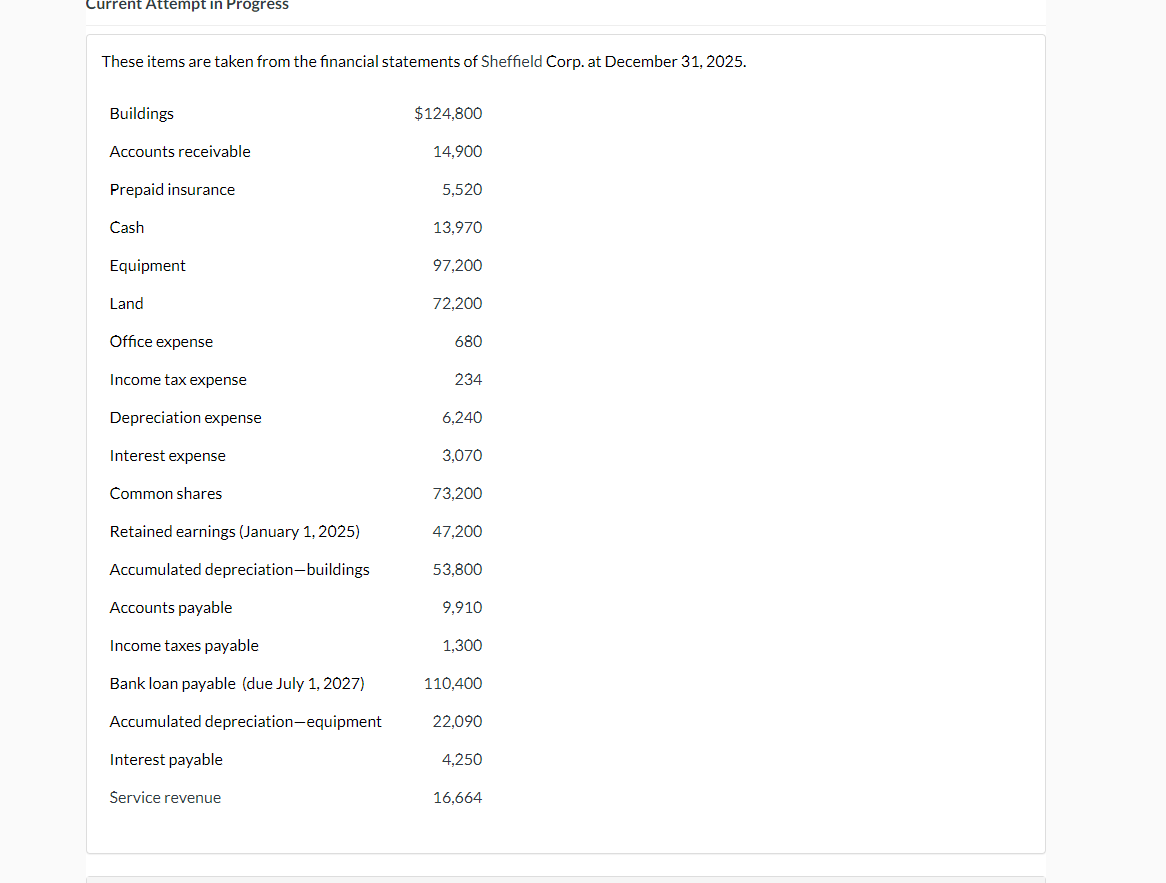

Current Attempt in Progress These items are taken from the financial statements of Sheffield Corp. at December 31, 2025. Buildings $124,800 Accounts receivable 14,900

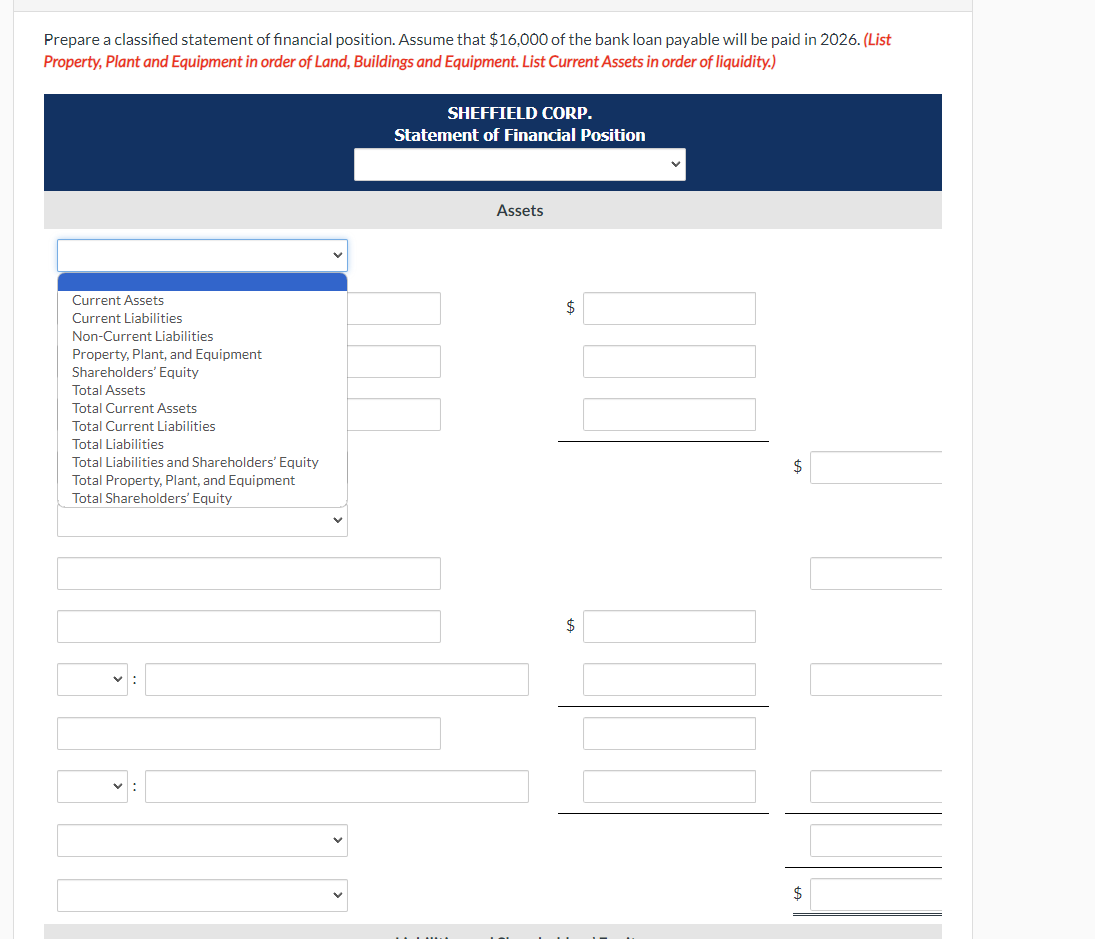

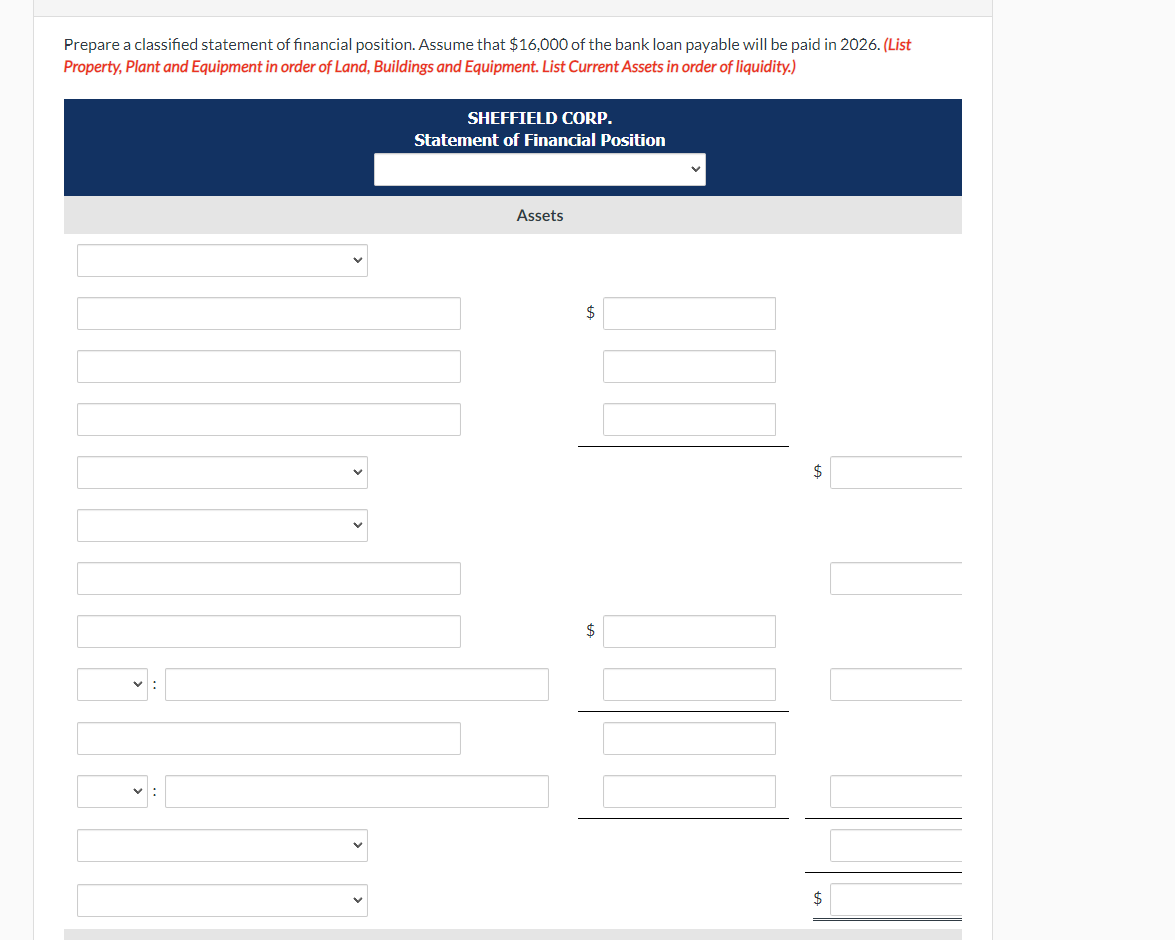

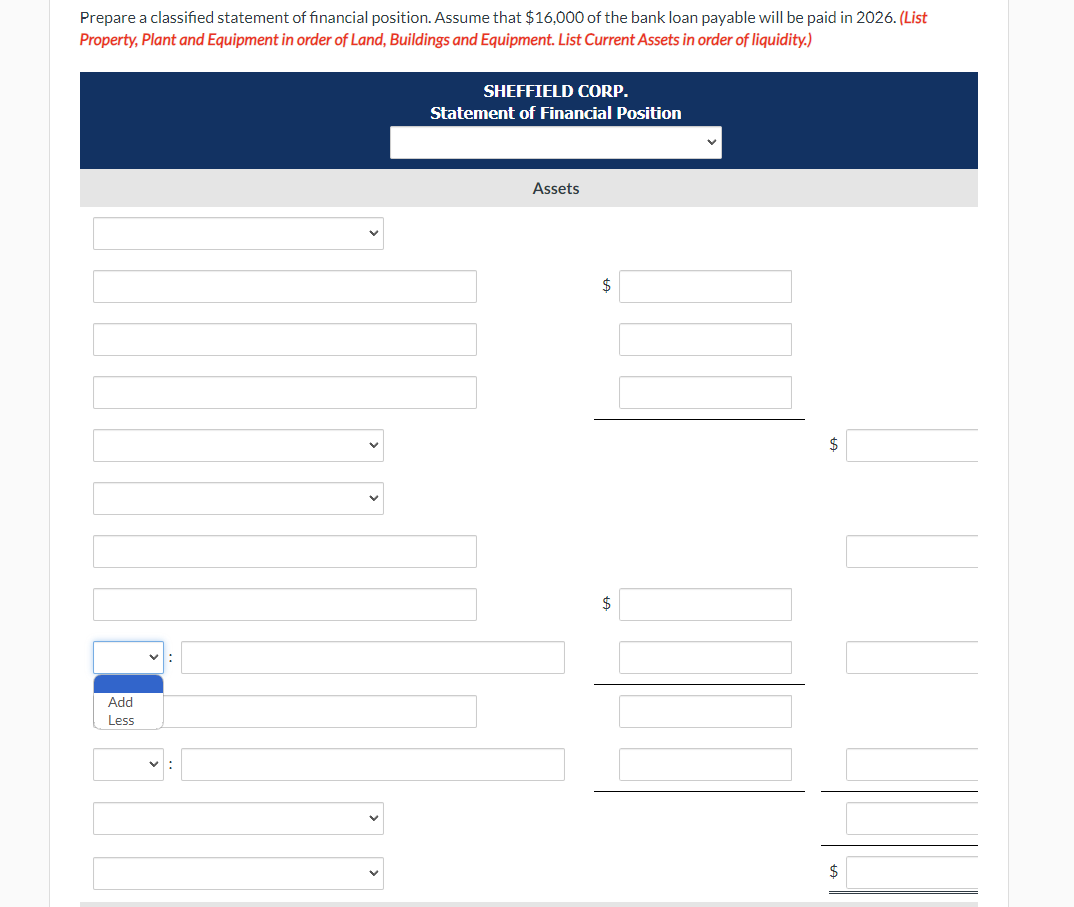

Current Attempt in Progress These items are taken from the financial statements of Sheffield Corp. at December 31, 2025. Buildings $124,800 Accounts receivable 14,900 Prepaid insurance 5,520 Cash 13,970 Equipment 97,200 Land 72,200 Office expense 680 Income tax expense 234 Depreciation expense 6,240 Interest expense 3,070 Common shares 73,200 Retained earnings (January 1, 2025) 47,200 Accumulated depreciation-buildings 53,800 Accounts payable 9,910 Income taxes payable 1,300 Bank loan payable (due July 1, 2027) 110,400 Accumulated depreciation-equipment 22,090 Interest payable 4,250 Service revenue 16,664 Prepare a classified statement of financial position. Assume that $16,000 of the bank loan payable will be paid in 2026. (List Property, Plant and Equipment in order of Land, Buildings and Equipment. List Current Assets in order of liquidity.) SHEFFIELD CORP. Statement of Financial Position Current Assets Current Liabilities Non-Current Liabilities Property, Plant, and Equipment Shareholders' Equity Total Assets Total Current Assets Total Current Liabilities Total Liabilities Total Liabilities and Shareholders' Equity Total Property, Plant, and Equipment Total Shareholders' Equity Assets $ $ $ Prepare a classified statement of financial position. Assume that $16,000 of the bank loan payable will be paid in 2026. (List Property, Plant and Equipment in order of Land, Buildings and Equipment. List Current Assets in order of liquidity.) SHEFFIELD CORP. Statement of Financial Position Assets $ $ $ Prepare a classified statement of financial position. Assume that $16,000 of the bank loan payable will be paid in 2026. (List Property, Plant and Equipment in order of Land, Buildings and Equipment. List Current Assets in order of liquidity.) SHEFFIELD CORP. Statement of Financial Position Add Less Assets $ $ $ Liabilities and Shareholders' Equity $ +A +A $ $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started