Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Current Attempt in Progress Whispering Winds Company is performing a post-audit of a project completed one year ago. The initial estimates were that the

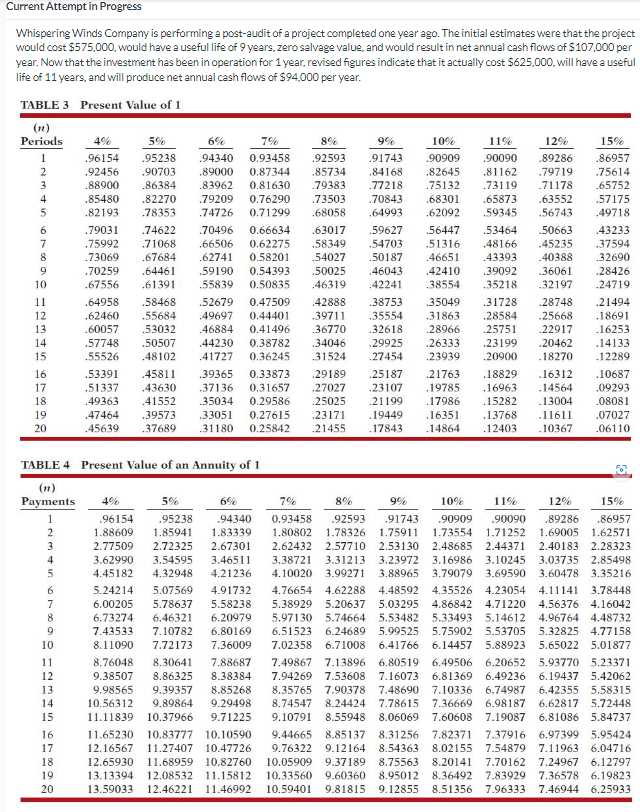

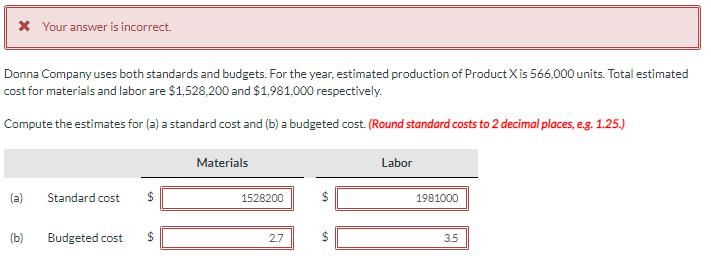

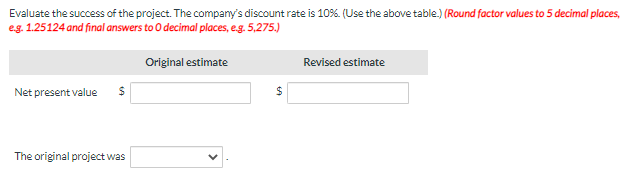

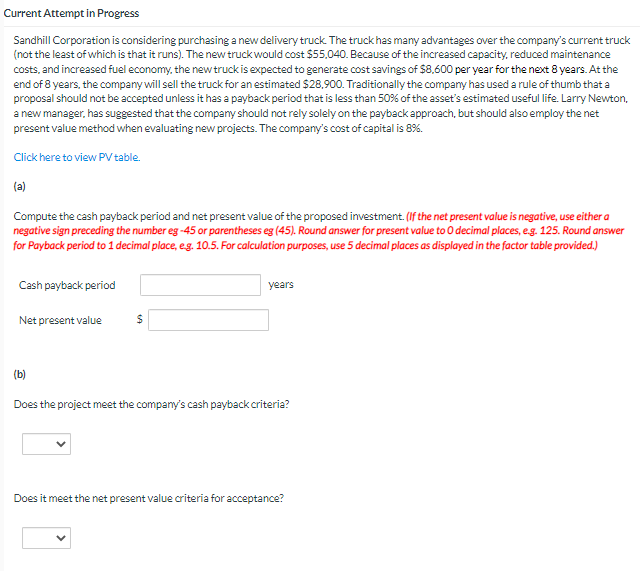

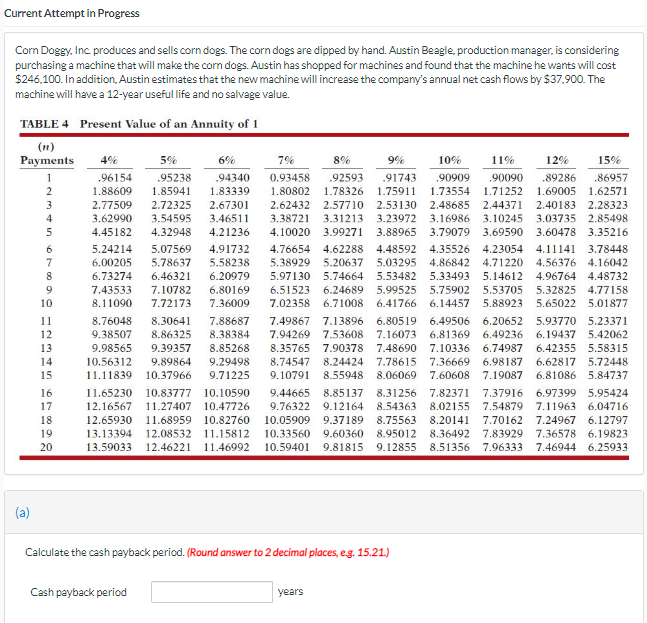

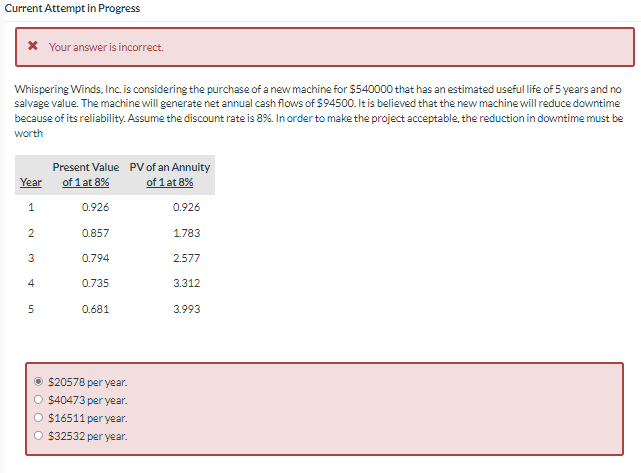

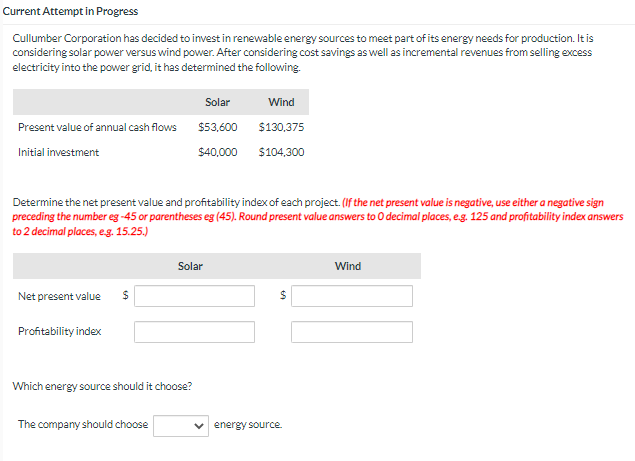

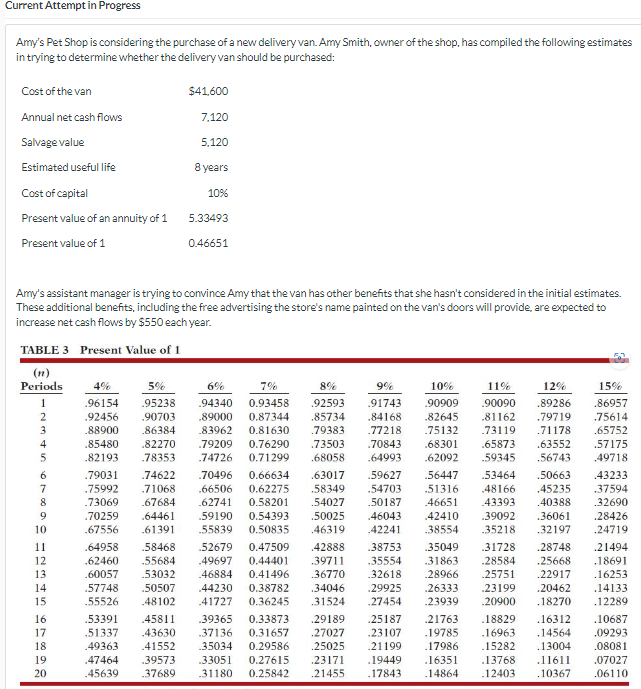

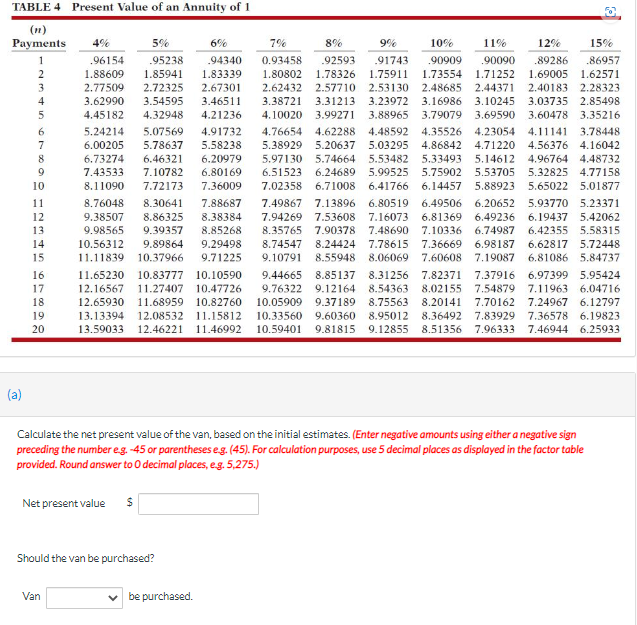

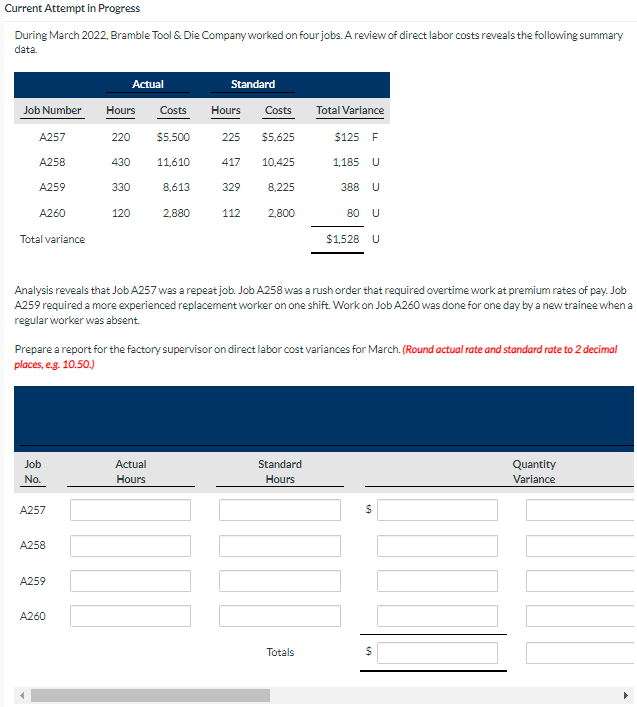

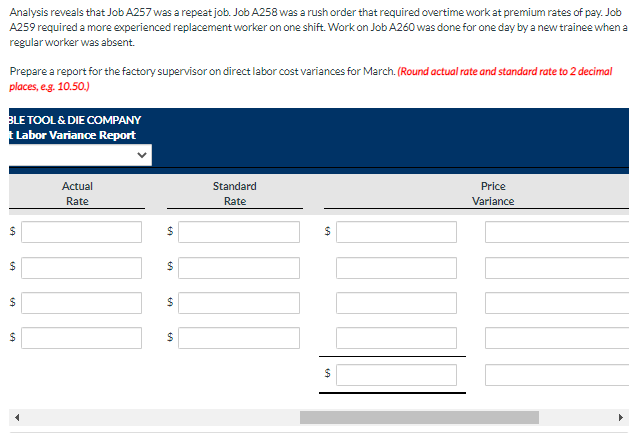

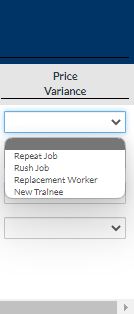

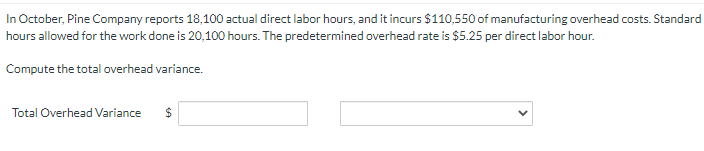

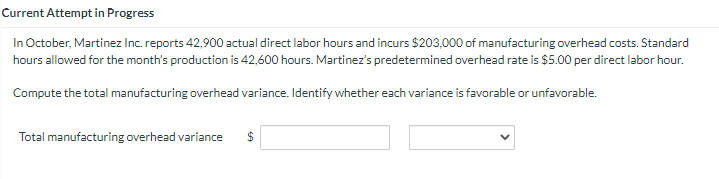

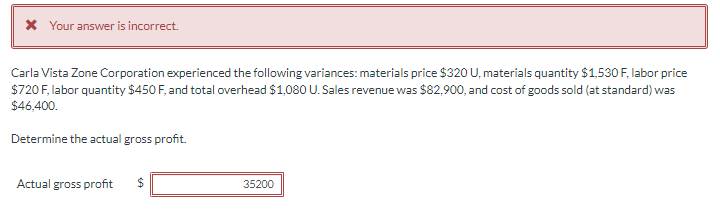

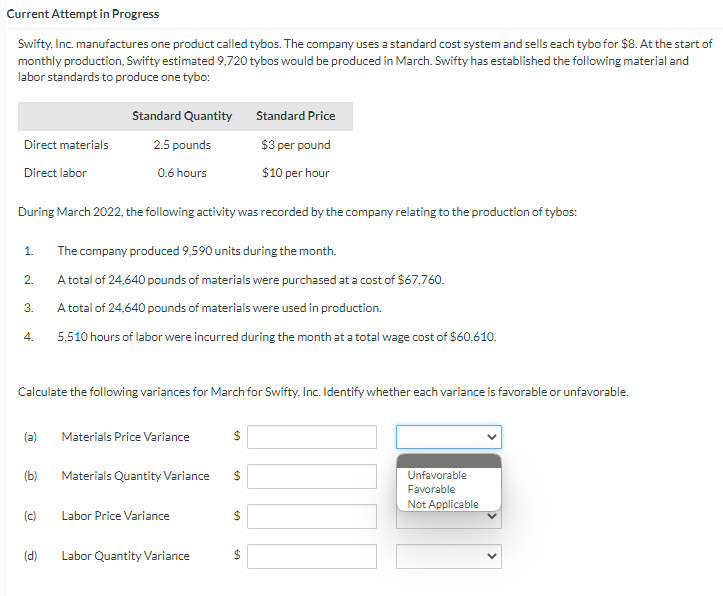

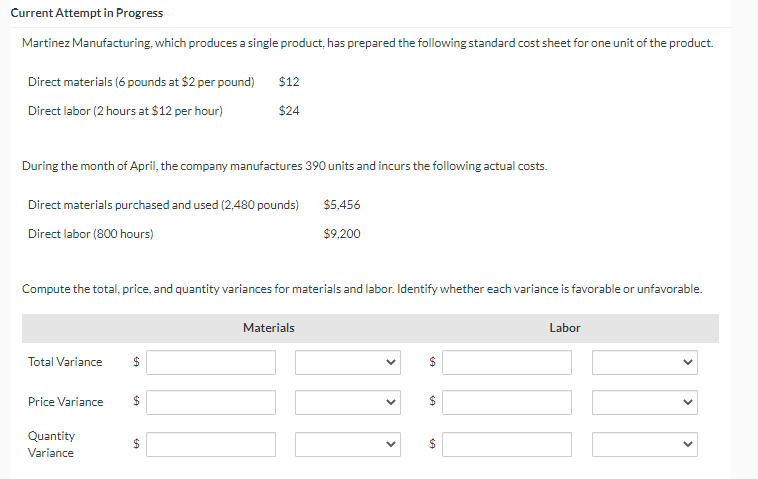

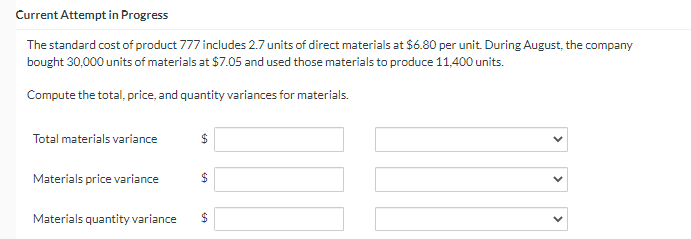

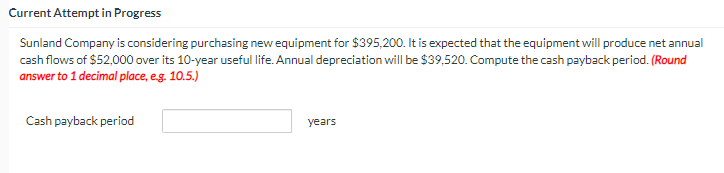

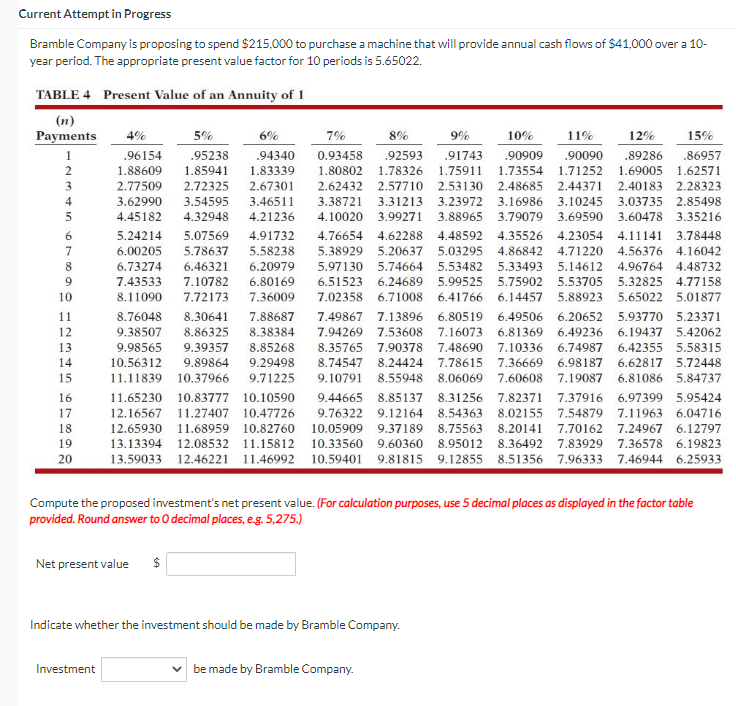

Current Attempt in Progress Whispering Winds Company is performing a post-audit of a project completed one year ago. The initial estimates were that the project would cost $575,000, would have a useful life of 9 years, zero salvage value, and would result in net annual cash flows of $107,000 per year. Now that the investment has been in operation for 1 year, revised figures indicate that it actually cost $625,000, will have a useful life of 11 years, and will produce net annual cash flows of $94,000 per year. TABLE 3 Present Value of 1 (n) Periods 4% 5% 6% 7% 8% 9% 10% 11% 12% 15% 1 .96154 .95238 .94340 0.93458 .92593 .91743 .90909 10 11 2345 68890 12345 .92456 .90703 .89000 0.87344 .85734 .88900 .85480 5 .82193 .79031 .86384 .83962 .82270 .79209 .78353 .74622 .70496 0.81630 .79383 .84168 .77218 .75132 .90090 .82645 .81162 .89286 .86957 .79719 .75614 .73119 .71178 .65752 0.76290 .73503 .70843 .68301 .65873 .63552 .57175 .74726 0.71299 .68058 .64993 .62092 .59345 .56743 .49718 0.66634 .63017 .59627 .56447 .53464 .50663 .43233 7 .75992 .71068 .66506 0.62275 .58349 .54703 .51316 .48166 .45235 .37594 .73069 .67684 .62741 0.58201 .54027 .50187 .46651 .43393 .40388 .32690 .70259 .64461 .59190 0.54393 .50025 .46043 .42410 .39092 .36061 .28426 .67556 .61391 .55839 0.50835 .46319 .42241 .38554 .35218 .32197 .24719 .64958 .58468 .52679 0.47509 .42888 .38753 .35049 .31728 .28748 .21494 .62460 .55684 .49697 0.44401 .39711 .35554 .31863 .28584 .25668 .18691 .60057 .53032 .57748 .50507 .44230 0.38782 .55526 .48102 .41727 .46884 0.41496 .36770 .32618 .28966 .25751 .22917 .16253 .34046 .29925 .26333 .23199 .20462 .14133 0.36245 .31524 .27454 .23939 .20900 .18270 .12289 16 .53391 17 .51337 18 .49363 .45811 .39365 .43630 .41552 0.33873 .29189 .25187 .21763 .18829 .16312 .10687 .37136 0.31657 .27027 .23107 .19785 .16963 .14564 .09293 .35034 0.29586 .25025 21199 19 .47464 .39573 .33051 0.27615 .23171 .19449 20 .45639 .37689 .31180 0.25842 .21455 .17843 .17986 .15282 .16351 .14864 .13004 .08081 .13768 .11611 .12403 .07027 .10367 .06110 TABLE 4 Present Value of an Annuity of 1 (11) Payments 4% 1 23456789o 10 11 12 13 14 15 16 17 18 19 20 9% 10% 11% 12% 5% 6% 7% 8% 15% .96154 .95238 .94340 0.93458 .92593 .91743 .90909 .90090 .89286 .86957 1.88609 1.85941 1.83339 1.80802 1.78326 1.75911 1.73554 1.71252 1.69005 1.62571 2.77509 2.72325 2.67301 2.62432 2.57710 2.53130 2.48685 2.44371 2.40183 2.28323 3.62990 3.54595 3.46511 3.38721 3.31213 3.23972 3.16986 3.10245 3.03735 2.85498 4.45182 4.32948 4.21236 4.10020 3.99271 3.88965 3.79079 3.69590 3.60478 3.35216 5.24214 5.07569 4.91732 4.76654 4.62288 4.48592 4.35526 4.23054 4.11141 3.78448 6.00205 5.78637 5.58238 5.38929 5.20637 5.03295 4.86842 4.71220 4.56376 4.16042 6.73274 6.46321 6.20979 5.97130 5.74664 5.53482 5.33493 5.14612 4.96764 4.48732 7.43533 7.10782 6.80169 6.51523 6.24689 5.99525 5.75902 5.53705 5.32825 4.77158 8.11090 7.72173 7.36009 7.02358 6.71008 6.41766 6.14457 5.88923 5.65022 5.01877 8.76048 8.30641 7.88687 7.49867 7.13896 6.80519 6.49506 6.20652 5.93770 5.23371 9.38507 8.86325 8.38384 7.94269 7.53608 7.16073 6.81369 6.49236 6.19437 5.42062 9.98565 9.39357 8.85268 8.35765 7.90378 7.48690 7.10336 6.74987 6.42355 5.58315 10.56312 9.89864 9.29498 8.74547 8.24424 7.78615 7.36669 6.98187 6.62817 5.72448 11.11839 10.37966 9.71225 9.10791 8.55948 8.06069 7.60608 7.19087 6.81086 5.84737 11.65230 10.83777 10.10590 9.44665 8.85137 8.31256 7.82371 7.37916 6.97399 5.95424 12.16567 11.27407 10.47726 9.76322 9.12164 8.54363 8.02155 7.54879 7.11963 6.04716 12.65930 11.68959 10.82760 10.05909 9.37189 8.75563 8.20141 7.70162 7.24967 6.12797 13.13394 12.08532 11.15812 10.33560 9.60360 8.95012 8.36492 7.83929 7.36578 6.19823 13.59033 12.46221 11.46992 10.59401 9.81815 9.12855 8.51356 7.96333 7.46944 6.25933 * Your answer is incorrect. Donna Company uses both standards and budgets. For the year, estimated production of Product X is 566,000 units. Total estimated cost for materials and labor are $1,528,200 and $1,981,000 respectively. Compute the estimates for (a) a standard cost and (b) a budgeted cost. (Round standard costs to 2 decimal places, e.g. 1.25.) (a) Standard cost $ (b) Budgeted cost $ Materials 1528200 2.7 LA LA $ Labor 1981000 3.5 Evaluate the success of the project. The company's discount rate is 10%. (Use the above table.) (Round factor values to 5 decimal places, e.g. 1.25124 and final answers to O decimal places, e.g. 5,275.) Original estimate Revised estimate Net present value $ $ The original project was Current Attempt in Progress Sandhill Corporation is considering purchasing a new delivery truck. The truck has many advantages over the company's current truck (not the least of which is that it runs). The new truck would cost $55,040. Because of the increased capacity, reduced maintenance costs, and increased fuel economy, the new truck is expected to generate cost savings of $8,600 per year for the next 8 years. At the end of 8 years, the company will sell the truck for an estimated $28,900. Traditionally the company has used a rule of thumb that a proposal should not be accepted unless it has a payback period that is less than 50% of the asset's estimated useful life. Larry Newton, a new manager, has suggested that the company should not rely solely on the payback approach, but should also employ the net present value method when evaluating new projects. The company's cost of capital is 8%. Click here to view PV table. (a) Compute the cash payback period and net present value of the proposed investment. (If the net present value is negative, use either a negative sign preceding the number eg-45 or parentheses eg (45). Round answer for present value to O decimal places, e.g. 125. Round answer for Payback period to 1 decimal place, e.g. 10.5. For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Cash payback period years Net present value $ (b) Does the project meet the company's cash payback criteria? Does it meet the net present value criteria for acceptance? Current Attempt in Progress Corn Doggy, Inc. produces and sells corn dogs. The corn dogs are dipped by hand. Austin Beagle, production manager, is considering purchasing a machine that will make the corn dogs. Austin has shopped for machines and found that the machine he wants will cost $246,100. In addition, Austin estimates that the new machine will increase the company's annual net cash flows by $37,900. The machine will have a 12-year useful life and no salvage value. TABLE 4 Present Value of an Annuity of 1 (n) Payments 4% 5% 1 .96154 .95238 1.85941 234in 5 7 68899 10 11 12 13 14 15 16 17 18 19 20 8% 9% 10% 11% 15% 6% 7% 12% .94340 0.93458 .92593 .91743 .90909 .90090 .89286 .86957 1.88609 1.83339 1.80802 1.78326 1.75911 1.73554 1.71252 1.69005 1.62571 2.77509 2.72325 2.67301 2.62432 2.57710 2.53130 2.48685 2.44371 2.40183 2.28323 3.62990 3.54595 3.46511 3.38721 3.31213 3.23972 3.16986 3.10245 3.03735 2.85498 4.45182 4.32948 4.21236 4.10020 3.99271 3.88965 3.79079 3.69590 3.60478 3.35216 5.24214 5.07569 4.91732 4.76654 4.62288 4.48592 4.35526 4.23054 4.11141 3.78448 6.00205 5.78637 5.58238 5.38929 5.20637 5.03295 4.86842 4.71220 4.56376 4.16042 6.73274 6.46321 6.20979 5.97130 5.74664 5.53482 5.33493 5.14612 4.96764 4.48732 7.43533 7.10782 6.80169 6.51523 6.24689 5.99525 5.75902 5.53705 5.32825 4.77158 8.11090 7.72173 7.36009 7.02358 6.71008 6.41766 6.14457 5.88923 5.65022 5.01877 8.76048 8.30641 7.88687 7.49867 7.13896 6.80519 6.49506 6.20652 5.93770 5.23371 9.38507 8.86325 8.38384 7.94269 7.53608 7.16073 6.81369 6.49236 6.19437 5.42062 9.98565 9.39357 8.85268 8.35765 7.90378 7.48690 7.10336 6.74987 6.42355 5.58315 10.56312 9.89864 9.29498 8.74547 8.24424 7.78615 7.36669 6.98187 6.62817 5.72448 11.11839 10.37966 9.71225 9.10791 8.55948 8.06069 7.60608 7.19087 6.81086 5.84737 11.65230 10.83777 10.10590 9.44665 8.85137 8.31256 7.82371 7.37916 6.97399 5.95424 12.16567 11.27407 10.47726 9.76322 9.12164 8.54363 8.02155 7.54879 7.11963 6.04716 12.65930 11.68959 10.82760 10.05909 9.37189 8.75563 8.20141 7.70162 7.24967 6.12797 13.13394 12.08532 11.15812 10.33560 9.60360 8.95012 8.36492 7.83929 7.36578 6.19823 13.59033 12.46221 11.46992 10.59401 9.81815 9.12855 8.51356 7.96333 7.46944 6.25933 (a) Calculate the cash payback period. (Round answer to 2 decimal places, e.g. 15.21.) Cash payback period years Current Attempt in Progress * Your answer is incorrect. Whispering Winds, Inc. is considering the purchase of a new machine for $540000 that has an estimated useful life of 5 years and no salvage value. The machine will generate net annual cash flows of $94500. It is believed that the new machine will reduce downtime because of its reliability. Assume the discount rate is 8%. In order to make the project acceptable, the reduction in downtime must be worth Present Value PV of an Annuity of 1 at 8% Year of 1 at 8% 1 0.926 0.926 2 0.857 1.783 3 0.794 2.577 4 0.735 3.312 5 0.681 3.993 $20578 per year. $40473 per year. $16511 per year. $32532 per year. Current Attempt in Progress Cullumber Corporation has decided to invest in renewable energy sources to meet part of its energy needs for production. It is considering solar power versus wind power. After considering cost savings as well as incremental revenues from selling excess electricity into the power grid, it has determined the following. Solar Wind Present value of annual cash flows $53,600 $130,375 Initial investment $40,000 $104,300 Determine the net present value and profitability index of each project. (If the net present value is negative, use either a negative sign preceding the number eg-45 or parentheses eg (45). Round present value answers to O decimal places, e.g. 125 and profitability index answers to 2 decimal places, e.g. 15.25.) Net present value $ Profitability index Solar Which energy source should it choose? The company should choose energy source. $ Wind Current Attempt in Progress Amy's Pet Shop is considering the purchase of a new delivery van. Amy Smith, owner of the shop, has compiled the following estimates in trying to determine whether the delivery van should be purchased: Cost of the van $41,600 Annual net cash flows 7,120 Salvage value 5,120 Estimated useful life 8 years Cost of capital 10% Present value of an annuity of 1 5.33493 Present value of 1 0.46651 Amy's assistant manager is trying to convince Amy that the van has other benefits that she hasn't considered in the initial estimates. These additional benefits, including the free advertising the store's name painted on the van's doors will provide, are expected to increase net cash flows by $550 each year. TABLE 3 Present Value of 1 (n) Periods 4% 1 .96154 5% .95238 6% 7% 8% 9% 10% 11% .94340 0.93458 .92593 .91743 .90909 .90090 2 .92456 .90703 .89000 0.87344 .85734 .84168 .82645 .81162 12% .89286 .79719 .75614 15% .86957 3 .88900 .86384 4 .85480 .82270 5 .82193 .78353 67890= .73069 .83962 0.81630 .79209 0.76290 .74726 0.71299 .79031 .74622 .70496 0.66634 .75992 .71068 .66506 0.62275 .67684 .62741 0.58201 .79383 .77218 .75132 .73119 .71178 .65752 .73503 .70843 .68301 .68058 .65873 .64993 .62092 .59345 .63552 .57175 .56743 .49718 .63017 .59627 .58349 .54703 .56447 .53464 .50663 .43233 .51316 .48166 .45235 .37594 .54027 .50187 .46651 .43393 .40388 .32690 .70259 .64461 .59190 0.54393 .50025 .46043 .42410 .39092 .36061 .28426 10 .67556 .61391 .55839 0.50835 .46319 .42241 .38554 .35218 .32197 .24719 11 .64958 12 13 .58468 .62460 .55684 .49697 0.44401 .60057 .53032 .46884 .52679 0.47509 .42888 .38753 .35049 .31728 .28748 .21494 .39711 .35554 .31863 .28584 .25668 .18691 0.41496 .36770 .32618 .28966 .25751 .22917 .16253 14 16 17 15 67 .57748 .50507 .44230 0.38782 .34046 .29925 .26333 .23199 .20462 .14133 .55526 .48102 .41727 0.36245 .31524 .27454 .23939 .20900 .18270 .12289 .533911 .45811 .51337 18 .49363 .39365 0.33873 .43630 .37136 0.31657 .41552 .35034 0.29586 .29189 .25187 .21763 .18829 .16312 .10687 .27027 .23107 .19785 .16963 .14564 .09293 .25025 .21199 .17986 .15282 .13004 .08081 19 .47464 20 .45639 .39573 .33051 0.27615 .23171 .37689 .19449 .16351 .13768 .11611 .07027 .31180 0.25842 .21455 .17843 .14864 .12403 .10367 .06110 TABLE 4 Present Value of an Annuity of 1 (n) Payments 4% 5% 1 .96154 2345678 6% 9% 10% 12% 15% 7% 8% 11% .95238 .94340 0.93458 .92593 .91743 .90909 .90090 .89286 .86957 1.88609 1.85941 1.83339 1.80802 1.78326 1.75911 1.73554 1.71252 1.69005 1.62571 2.77509 2.72325 2.67301 2.62432 2.57710 2.53130 2.48685 2.44371 2.40183 2.28323 3.62990 3.54595 3.46511 3.38721 3.31213 3.23972 3.16986 3.10245 3.03735 2.85498 4.45182 4.32948 4.21236 4.10020 3.99271 3.88965 3.79079 3.69590 3.60478 3.35216 4.76654 4.62288 4.48592 4.35526 4.23054 4.11141 3.78448 5.38929 5.20637 5.03295 4.86842 4.71220 4.56376 4.16042 5.97130 5.74664 5.53482 5.33493 5.14612 4.96764 4.48732 6.51523 6.24689 5.99525 5.75902 5.53705 5.32825 4.77158 7.02358 6.71008 6.41766 6.14457 5.88923 5.65022 5.01877 7.49867 7.13896 6.80519 6.49506 6.20652 5.93770 5.23371 7.94269 7.53608 7.16073 6.81369 6.49236 6.19437 5.42062 8.35765 7.90378 7.48690 7.10336 6.74987 6.42355 5.58315 8.74547 8.24424 7.78615 7.36669 6.98187 6.62817 5.72448 9.10791 8.55948 8.06069 7.60608 7.19087 6.81086 5.84737 9.44665 8.85137 8.31256 7.82371 7.37916 6.97399 5.95424 9.76322 9.12164 8.54363 8.02155 7.54879 7.11963 6.04716 10.05909 9.37189 8.75563 8.20141 7.70162 7.24967 6.12797 10.33560 9.60360 8.95012 8.36492 7.83929 7.36578 6.19823 10.59401 9.81815 9.12855 8.51356 7.96333 7.46944 6.25933 9 10 11 12 13 14 15 16 17 18 19 20 5.24214 5.07569 4.91732 6.00205 5.78637 5.58238 6.73274 6.46321 6.20979 7.43533 7.10782 6.80169 8.11090 7.72173 7.36009 8.76048 8.30641 7.88687 9.38507 8.86325 8.38384 9.98565 9.39357 8.85268 10.56312 9.89864 9.29498 11.11839 10.37966 9.71225 11.65230 10.83777 10.10590 12.16567 11.27407 10.47726 12.65930 11.68959 10.82760 13.13394 12.08532 11.15812 13.59033 12.46221 11.46992 (a) Calculate the net present value of the van, based on the initial estimates. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45). For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round answer to O decimal places, e.g. 5,275.) Net present value $ Should the van be purchased? Van be purchased. Current Attempt in Progress During March 2022, Bramble Tool & Die Company worked on four jobs. A review of direct labor costs reveals the following summary data. Actual Standard Job Number Hours Costs Hours Costs Total Variance A257 220 $5,500 225 $5,625 $125 F A258 430 11,610 417 10,425 1,185 U A259 330 8,613 329 8.225 388 U A260 120 2,880 112 2,800 80 U Total variance $1,528 U Analysis reveals that Job A257 was a repeat job. Job A258 was a rush order that required overtime work at premium rates of pay. Job A259 required a more experienced replacement worker on one shift. Work on Job A260 was done for one day by a new trainee when a regular worker was absent. Prepare a report for the factory supervisor on direct labor cost variances for March. (Round actual rate and standard rate to 2 decimal places, e.g. 10.50.) Job No. Actual Hours Standard Hours A257 A258 A259 A260 10 $ Totals $ Quantity Variance Analysis reveals that Job A257 was a repeat job. Job A258 was a rush order that required overtime work at premium rates of pay. Job A259 required a more experienced replacement worker on one shift. Work on Job A260 was done for one day by a new trainee when a regular worker was absent. Prepare a report for the factory supervisor on direct labor cost variances for March. (Round actual rate and standard rate to 2 decimal places, e.g. 10.50.) BLE TOOL & DIE COMPANY t Labor Variance Report 69 $ $ 69 Actual Rate $ 69 $ $ $ $ Standard Rate 67 $ Price Variance Price Variance Repeat Job Rush Job Replacement Worker New Trainee In October, Pine Company reports 18,100 actual direct labor hours, and it incurs $110,550 of manufacturing overhead costs. Standard hours allowed for the work done is 20,100 hours. The predetermined overhead rate is $5.25 per direct labor hour. Compute the total overhead variance. Total Overhead Variance Current Attempt in Progress In October, Martinez Inc. reports 42,900 actual direct labor hours and incurs $203,000 of manufacturing overhead costs. Standard hours allowed for the month's production is 42,600 hours. Martinez's predetermined overhead rate is $5.00 per direct labor hour. Compute the total manufacturing overhead variance. Identify whether each variance is favorable or unfavorable. Total manufacturing overhead variance $ * Your answer is incorrect. Carla Vista Zone Corporation experienced the following variances: materials price $320 U, materials quantity $1,530 F, labor price $720 F, labor quantity $450 F, and total overhead $1,080 U. Sales revenue was $82,900, and cost of goods sold (at standard) was $46,400. Determine the actual gross profit. Actual gross profit $ 35200 Current Attempt in Progress Swifty, Inc. manufactures one product called tybos. The company uses a standard cost system and sells each tybo for $8. At the start of monthly production, Swifty estimated 9,720 tybos would be produced in March. Swifty has established the following material and labor standards to produce one tybo: Standard Quantity Standard Price Direct materials 2.5 pounds $3 per pound 0.6 hours $10 per hour Direct labor During March 2022, the following activity was recorded by the company relating to the production of tybos: 1. The company produced 9,590 units during the month. 2. A total of 24,640 pounds of materials were purchased at a cost of $67,760. 3. A total of 24,640 pounds of materials were used in production. 4. 5,510 hours of labor were incurred during the month at a total wage cost of $60,610. Calculate the following variances for March for Swifty, Inc. Identify whether each variance is favorable or unfavorable. (a) Materials Price Variance (b) Materials Quantity Variance (c) Labor Price Variance (d) Labor Quantity Variance 6A $ 69 $ 6A $ Unfavorable Favorable Not Applicable LA $ Current Attempt in Progress Martinez Manufacturing, which produces a single product, has prepared the following standard cost sheet for one unit of the product. Direct materials (6 pounds at $2 per pound) Direct labor (2 hours at $12 per hour) $12 $24 During the month of April, the company manufactures 390 units and incurs the following actual costs. Direct materials purchased and used (2,480 pounds) $5,456 Direct labor (800 hours) $9,200 Compute the total, price, and quantity variances for materials and labor. Identify whether each variance is favorable or unfavorable. Materials Labor Total Variance Price Variance Quantity Variance SA $ SA A SA $ Current Attempt in Progress The standard cost of product 777 includes 2.7 units of direct materials at $6.80 per unit. During August, the company bought 30,000 units of materials at $7.05 and used those materials to produce 11,400 units. Compute the total, price, and quantity variances for materials. Total materials variance SA $ Materials price variance $ Materials quantity variance $ Current Attempt in Progress Sunland Company is considering purchasing new equipment for $395,200. It is expected that the equipment will produce net annual cash flows of $52,000 over its 10-year useful life. Annual depreciation will be $39,520. Compute the cash payback period. (Round answer to 1 decimal place, e.g. 10.5.) Cash payback period years Current Attempt in Progress Bramble Company is proposing to spend $215,000 to purchase a machine that will provide annual cash flows of $41,000 over a 10- year period. The appropriate present value factor for 10 periods is 5.65022. TABLE 4 Present Value of an Annuity of 1 (n) Payments 4% 5% 6% 8% 1 .95238 2 3 4 2. 5 10 68899 11 12 13 14 15 16 17 18 19 20 7% 9% 10% 15% .96154 .94340 0.93458 .92593 .91743 .90909 .90090 .89286 .86957 1.88609 1.85941 1.83339 1.80802 1.78326 1.75911 1.73554 1.71252 1.69005 1.62571 2.77509 2.72325 2.67301 2.62432 2.57710 2.53130 2.48685 2.44371 2.40183 2.28323 3.62990 3.54595 3.46511 3.38721 3.31213 3.23972 3.16986 3.10245 3.03735 2.85498 4.45182 4.32948 4.21236 4.10020 3.99271 3.88965 3.79079 3.69590 3.60478 3.35216 5.24214 5.07569 4.91732 4.76654 4.62288 4.48592 4.35526 4.23054 4.11141 3.78448 6.00205 5.78637 5.58238 5.38929 5.20637 5.03295 4.86842 4.71220 4.56376 4.16042 6.73274 6.46321 6.20979 5.97130 5.74664 5.53482 5.33493 5.14612 4.96764 4.48732 7.43533 7.10782 6.80169 6.51523 6.24689 5.99525 5.75902 5.53705 5.32825 4.77158 8.11090 7.72173 7.36009 7.02358 6.71008 6.41766 6.14457 5.88923 5.65022 5.01877 8.76048 8.30641 7.88687 7.49867 7.13896 6.80519 6.49506 6.20652 9.38507 8.86325 8.38384 7.94269 7.53608 7.16073 6.81369 6.49236 9.98565 9.39357 8.85268 8.35765 7.90378 7.48690 7.10336 6.74987 10.56312 9.89864 9.29498 8.74547 8.24424 7.78615 7.36669 6.98187 11.11839 10.37966 9.71225 9.10791 8.55948 8.06069 7.60608 7.19087 11.65230 10.83777 10.10590 9.44665 8.85137 8.31256 7.82371 7.37916 6.97399 5.95424 12.16567 11.27407 10.47726 9.76322 9.12164 8.54363 8.02155 7.54879 7.11963 6.04716 12.65930 11.68959 10.82760 10.05909 9.37189 8.75563 8.20141 7.70162 7.24967 6.12797 13.13394 12.08532 11.15812 10.33560 9.60360 8.95012 8.36492 7.83929 7.36578 6.19823 13.59033 12.46221 11.46992 10.59401 9.81815 9.12855 8.51356 7.96333 7.46944 6.25933 11% 12% 5.93770 5.23371 6.19437 5.42062 6.42355 5.58315 6.62817 5.72448 6.81086 5.84737 Compute the proposed investment's net present value. (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round answer to O decimal places, e.g. 5,275.) Net present value $ Indicate whether the investment should be made by Bramble Company. Investment be made by Bramble Company.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started