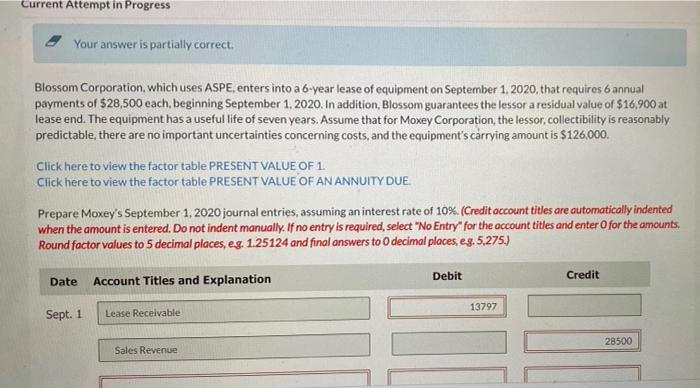

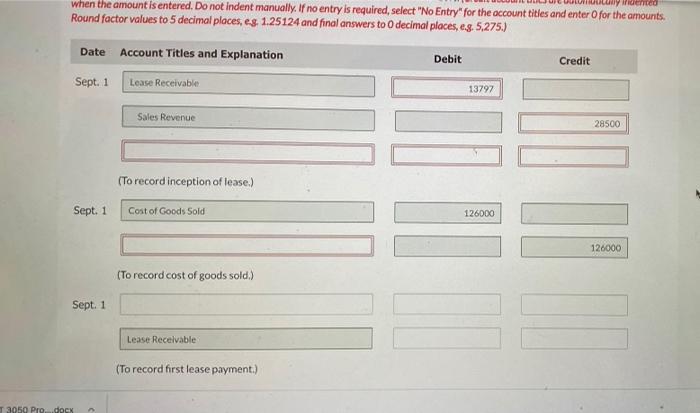

Current Attempt in Progress Your answer is partially correct Blossom Corporation, which uses ASPE, enters into a 6-year lease of equipment on September 1, 2020, that requires 6 annual payments of $28,500 each, beginning September 1, 2020. In addition, Blossom guarantees the lessor a residual value of $16,900 at lease end. The equipment has a useful life of seven years. Assume that for Moxey Corporation, the lessor, collectibility is reasonably predictable, there are no important uncertainties concerning costs, and the equipment's carrying amount is $126,000. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY DUE Prepare Moxey's September 1, 2020 journal entries, assuming an interest rate of 10%. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts. Round factor values to 5 decimal places, eg. 1.25124 and final answers to decimal places, eg. 5,275.) Date Credit Debit Account Titles and Explanation 13797 Sept. 1 Lease Receivable 28500 Sales Revenue med when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts. Round factor values to 5 decimal places, eg 1.25124 and final answers to decimal places, e.g. 5,275.) Date Account Titles and Explanation Debit Credit Sept. 1 Lease Receivable 13797 Sales Revenue 28500 (To record inception of lease.) Sept. 1 Cost of Goods Sold 126000 IN 126000 (To record cost of goods sold.) Sept. 1 Lease Recelvable (To record first lease payment.) T 3050 Pre docx Current Attempt in Progress Your answer is partially correct Blossom Corporation, which uses ASPE, enters into a 6-year lease of equipment on September 1, 2020, that requires 6 annual payments of $28,500 each, beginning September 1, 2020. In addition, Blossom guarantees the lessor a residual value of $16,900 at lease end. The equipment has a useful life of seven years. Assume that for Moxey Corporation, the lessor, collectibility is reasonably predictable, there are no important uncertainties concerning costs, and the equipment's carrying amount is $126,000. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY DUE Prepare Moxey's September 1, 2020 journal entries, assuming an interest rate of 10%. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts. Round factor values to 5 decimal places, eg. 1.25124 and final answers to decimal places, eg. 5,275.) Date Credit Debit Account Titles and Explanation 13797 Sept. 1 Lease Receivable 28500 Sales Revenue med when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts. Round factor values to 5 decimal places, eg 1.25124 and final answers to decimal places, e.g. 5,275.) Date Account Titles and Explanation Debit Credit Sept. 1 Lease Receivable 13797 Sales Revenue 28500 (To record inception of lease.) Sept. 1 Cost of Goods Sold 126000 IN 126000 (To record cost of goods sold.) Sept. 1 Lease Recelvable (To record first lease payment.) T 3050 Pre docx