Answered step by step

Verified Expert Solution

Question

1 Approved Answer

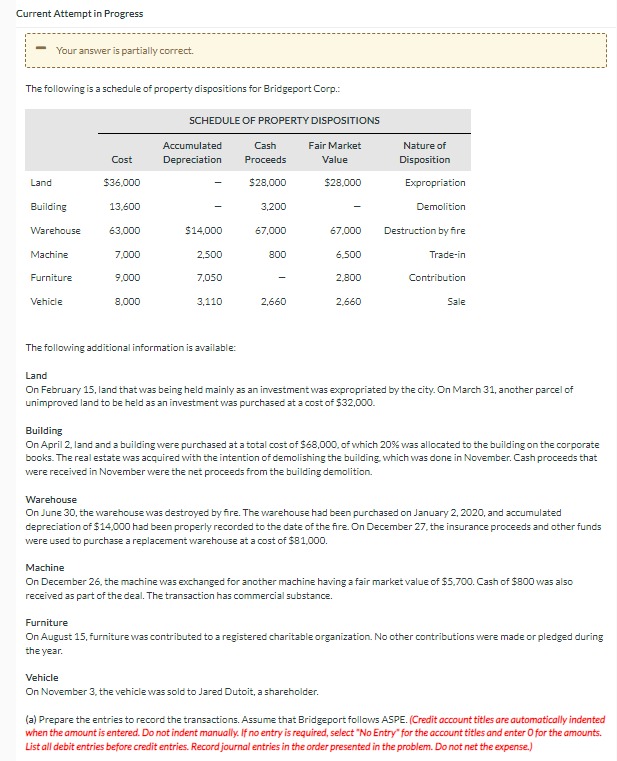

Current Attempt in Progress Your answer is partially correct. The following is a schedule of property dispositions for Bridgeport Corp.: SCHEDULE OF PROPERTY DISPOSITIONS

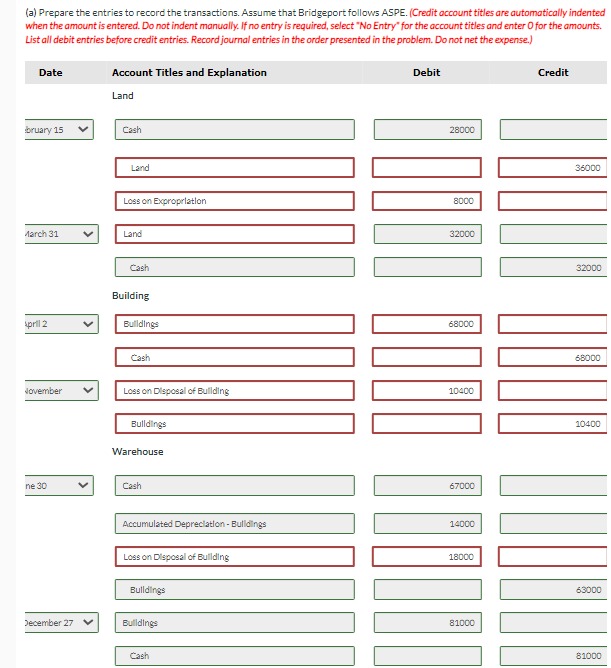

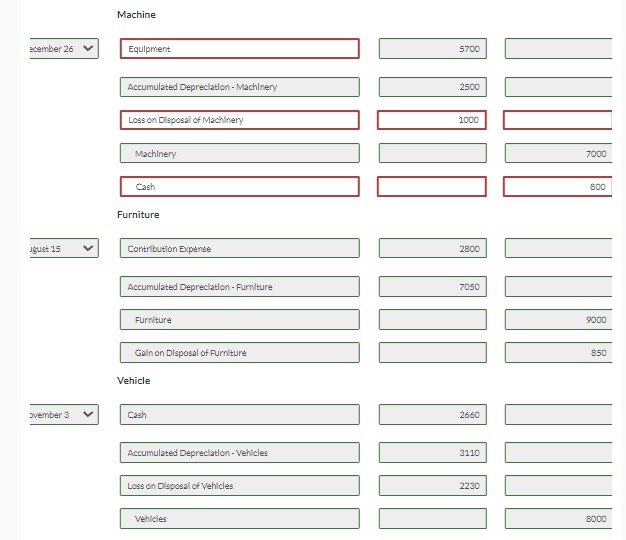

Current Attempt in Progress Your answer is partially correct. The following is a schedule of property dispositions for Bridgeport Corp.: SCHEDULE OF PROPERTY DISPOSITIONS Accumulated Cost Depreciation Cash Proceeds Fair Market Value Nature of Disposition Land $36,000 $28,000 $28,000 Building 13,600 - 3,200 Expropriation Demolition Warehouse 63,000 $14,000 67,000 67,000 Destruction by fire Machine 7,000 2,500 800 6,500 Trade-in Furniture 9,000 7,050 2,800 Contribution Vehicle 8,000 3,110 2,660 2,660 Sale The following additional information is available: Land On February 15, land that was being held mainly as an investment was expropriated by the city. On March 31, another parcel of unimproved land to be held as an investment was purchased at a cost of $32,000. Building On April 2, land and a building were purchased at a total cost of $68,000, of which 20% was allocated to the building on the corporate books. The real estate was acquired with the intention of demolishing the building, which was done in November. Cash proceeds that were received in November were the net proceeds from the building demolition. Warehouse On June 30, the warehouse was destroyed by fire. The warehouse had been purchased on January 2, 2020, and accumulated depreciation of $14,000 had been properly recorded to the date of the fire. On December 27, the insurance proceeds and other funds were used to purchase a replacement warehouse at a cost of $81,000. Machine On December 26, the machine was exchanged for another machine having a fair market value of $5,700. Cash of $800 was also received as part of the deal. The transaction has commercial substance. Furniture On August 15, furniture was contributed to a registered charitable organization. No other contributions were made or pledged during the year. Vehicle On November 3, the vehicle was sold to Jared Dutoit, a shareholder. (a) Prepare the entries to record the transactions. Assume that Bridgeport follows ASPE. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries. Record journal entries in the order presented in the problem. Do not net the expense.) (a) Prepare the entries to record the transactions. Assume that Bridgeport follows ASPE. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries. Record journal entries in the order presented in the problem. Do not net the expense.) Date Account Titles and Explanation Land bruary 15 Cash Land Debit 28000 Loss on Expropriation 8000 March 31 Land \pril 2 Cash Building Buildings Cash 32000 68000 November Loss on Disposal of Building 10400 Buildings Warehouse ne 30 Cash 67000 Accumulated Depreciation - Buildings 14000 Loss on Disposal of Building 18000 Buildings December 27 Buildings 81000 Cash Credit 36000 32000 68000 10400 63000 81000 Machine ecember 26 Equipment Accumulated Depreciation - Machinery Loss on Disposal of Machinery Machinery Cash Furniture Jgust 15 Contribution Expense 5700 2500 1000 2800 Accumulated Depreciation - Furniture 7050 Furniture Gain on Disposal of Furniture Vehicle ovember 3 Cash 2660 Accumulated Depreciation - Vehicles 3110 Loss on Disposal of Vehicles Vehicles 2230 7000 800 9000 850 8000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started