Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Current Ratio Quick Ratio Cash Ratio Total asset turnover receivables turnover inventory turnover total debt ratio debt-equity ratio equity Multiplier times interest earned ratio profit

Current Ratio

Current Ratio

Quick Ratio

Cash Ratio

Total asset turnover

receivables turnover

inventory turnover

total debt ratio

debt-equity ratio

equity Multiplier

times interest earned ratio

profit margin

return on assets

return on equity

2. Construct the DuPoint identity for the XYZ Coporation

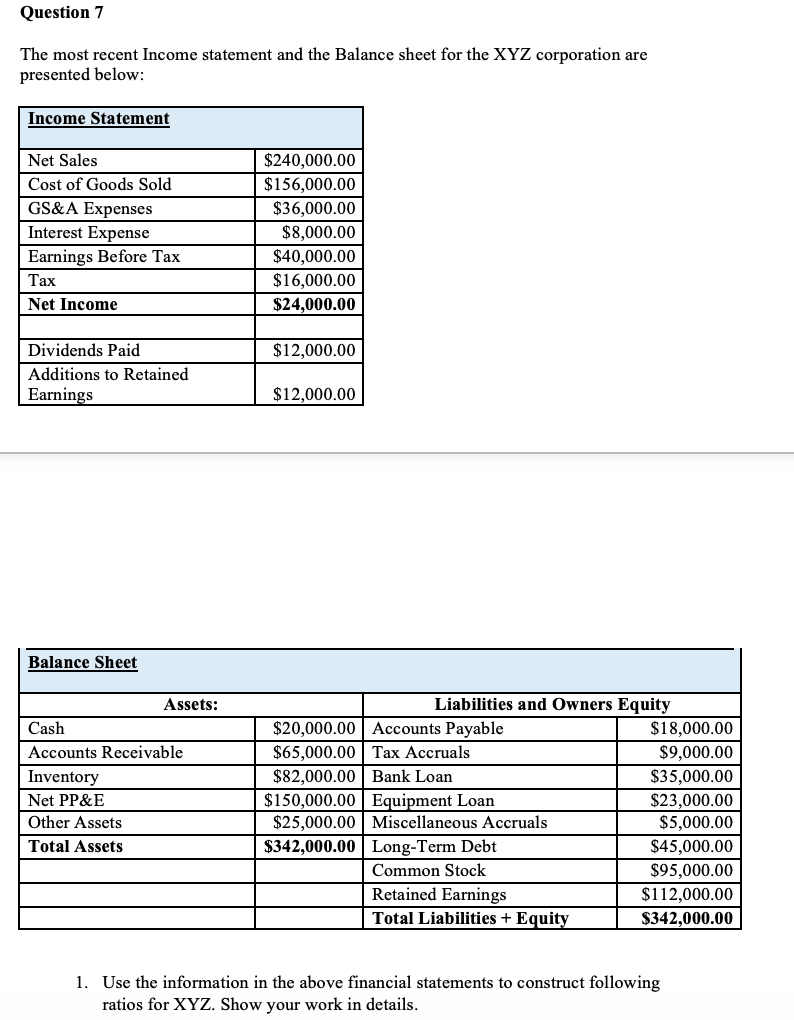

Question 7 The most recent Income statement and the Balance sheet for the XYZ corporation are presented below Income Statement Net Sales Cost of Goods Sold GS&A Expenses Interest Expense Earnings Before Tax $240,000.00 $156,000.00 $36,000.00 $8,000.00 $40,000.00 $16,000.00 $24,000.00 ax Net Income $12,000.00 Dividends Paid Additions to Retained Earnings $12,000.00 Balance Sheet Assets: Liabilities and Owners Equitv $20,000.00 Accounts Payable $65,000.00| Tax Accruals $82,000.00Bank Loan Cash Accounts Receivable Inventory Net PP&E Other Assets Total Assets $18,000.00 S9,000.00 S35,000.00 $23,000.00 S5,000.00 $45,000.00 $95,000.00 S112,000.00 S342,000.00 $150,000.00 Equipment Loan $25,000.00 Miscellaneous Accruals $342,000.00 Long-Term Debt Common Stock Retained Earnings Total Liabilities + Equit 1. Use the information in the above financial statements to construct following ratios for XYZ. Show your work in detailsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started