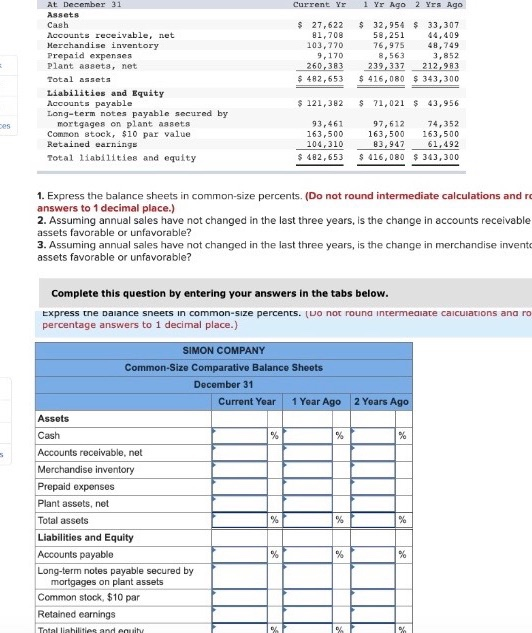

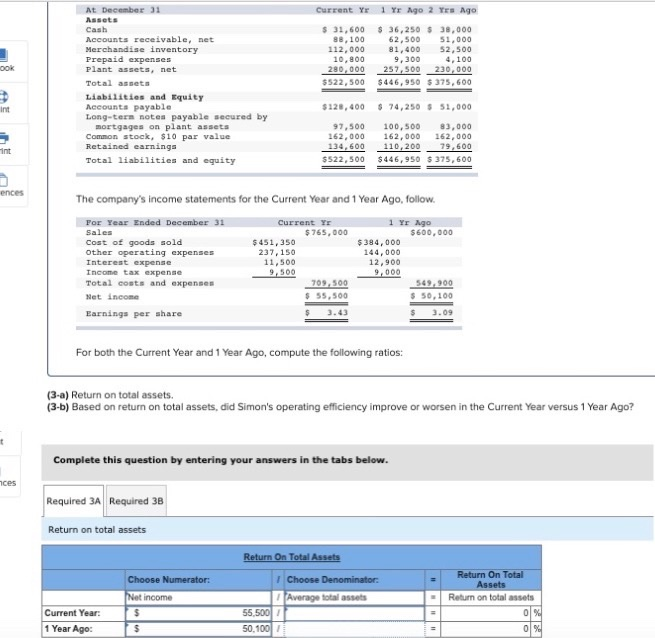

Current Yr 1 Yr Ago 2 Yrs Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant asseta, net Total Assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 27,622 81,708 103, 770 9,170 260,383 $ 482,653 $ 32,954 $ 33, 307 58, 251 44,409 76,975 48,749 8,563 3,852 239,337 212,983 $ 416,080 $ 343,300 $ 121,382 $ 71,021 $ 43,956 Des 93, 461 163,500 104,310 $ 482,653 97,612 74,352 163,500 163,500 83,947 61,492 $ 416,080 $ 343,300 1. Express the balance sheets in common-size percents. (Do not round intermediate calculations and re answers to 1 decimal place.) 2. Assuming annual sales have not changed in the last three years, is the change in accounts receivable assets favorable or unfavorable? 3. Assuming annual sales have not changed in the last three years, is the change in merchandise invente assets favorable or unfavorable? Complete this question by entering your answers in the tabs below. Express the balance sheets in common-size percents. (Do not rouna intermediate calculations and ro percentage answers to 1 decimal place.) SIMON COMPANY Common-Size Comparative Balance Sheets December 31 Current Year 1 Year Ago 2 Years Ago Assets Cash % % % Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets % Liabilities and Equity Accounts payable % % Long-term notes payable secured by mortgages on plant assets Common stock, $10 par Retained earnings % % Total liabilities and equity Current yr 1 Yr Ago 2 Tes Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-tern notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 31,600 88,100 112,000 10.800 280,000 $522,500 $ 36,250 $ 38,000 62,500 51,000 81,400 52,500 9,300 4,100 257,500 230,000 $ 446,950 $375,600 OOK 3 int $128,400 97,500 162,000 134,600 $522,500 $ 74,250 $ 51,000 100, 500 83,000 162,000 162,000 110,200 79,600 $446,950 $375,600 int ences The company's income statements for the Current Year and 1 Year Ago, follow. For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income tax expense Total costs and expenses Net income Earnings per share Current YE $765,000 $451,350 237,150 11,500 9,500 709,500 $ 55,500 3.43 1 yr ago $600,000 $384,000 144,000 12,900 9,000 549,900 $ 50,100 3.09 For both the current Year and 1 Year Ago, compute the following ratios: (3-a) Return on total assets. (3-b) Based on return on total assets, did Simon's operating efficiency improve or worsen in the Current Year versus 1 Year Ago? Complete this question by entering your answers in the tabs below. ces Required 3A Required 38 Return on total assets Return On Total Assets Choose Numerator: Net income $ $ Choose Denominator: Average total assets 55,5001 50.1001 Return On Total Assets Return on total assets 0 % = Current Year: 1 Year Ago: 0 %