Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Currently, TCB's total assets is RM70 million in which 65% is financed by equity. TCB had never issued preferred shares. TCB's cost of equity

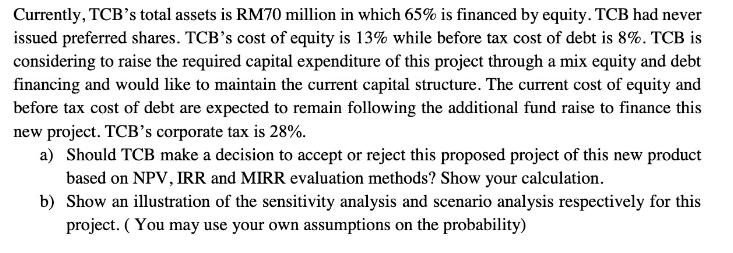

Currently, TCB's total assets is RM70 million in which 65% is financed by equity. TCB had never issued preferred shares. TCB's cost of equity is 13% while before tax cost of debt is 8%. TCB is considering to raise the required capital expenditure of this project through a mix equity and debt financing and would like to maintain the current capital structure. The current cost of equity and before tax cost of debt are expected to remain following the additional fund raise to finance this new project. TCB's corporate tax is 28%. a) Should TCB make a decision to accept or reject this proposed project of this new product based on NPV, IRR and MIRR evaluation methods? Show your calculation. b) Show an illustration of the sensitivity analysis and scenario analysis respectively for this project. (You may use your own assumptions on the probability)

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Here are the workings for evaluating the project based on NPV IRR and MIRR Assumptions Initial investment for the project RMX amount not provided Cash ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started