Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Currently, the inflation rate has been averaging at 4.0% for a few months, and real GDP growth rate is now 2.5% -- as the

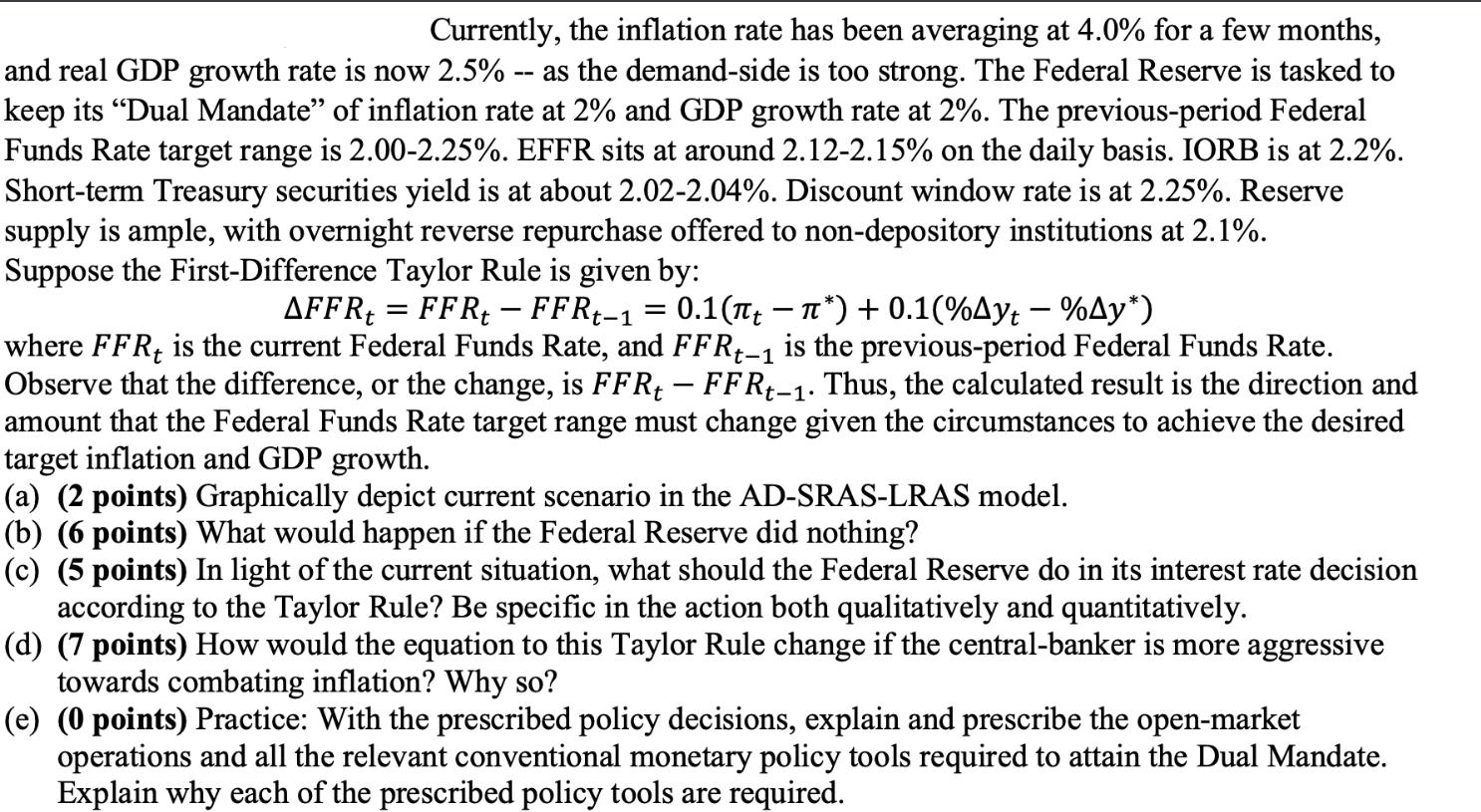

Currently, the inflation rate has been averaging at 4.0% for a few months, and real GDP growth rate is now 2.5% -- as the demand-side is too strong. The Federal Reserve is tasked to keep its "Dual Mandate" of inflation rate at 2% and GDP growth rate at 2%. The previous-period Federal Funds Rate target range is 2.00-2.25%. EFFR sits at around 2.12-2.15% on the daily basis. IORB is at 2.2%. Short-term Treasury securities yield is at about 2.02-2.04%. Discount window rate is at 2.25%. Reserve supply is ample, with overnight reverse repurchase offered to non-depository institutions at 2.1%. Suppose the First-Difference Taylor Rule is given by: AFFRt = FFRt FFRt-1 0.1 (t *) + 0.1(%Ayt-%Ay*) where FFRt is the current Federal Funds Rate, and FFRt-1 is the previous-period Federal Funds Rate. Observe that the difference, or the change, is FFR - FFRt-1. Thus, the calculated result is the direction and amount that the Federal Funds Rate target range must change given the circumstances to achieve the desired target inflation and GDP growth. = (a) (2 points) Graphically depict current scenario in the AD-SRAS-LRAS model. (b) (6 points) What would happen if the Federal Reserve did nothing? (c) (5 points) In light of the current situation, what should the Federal Reserve do in its interest rate decision according to the Taylor Rule? Be specific in the action both qualitatively and quantitatively. (d) (7 points) How would the equation to this Taylor Rule change if the central-banker is more aggressive towards combating inflation? Why so? (e) (0 points) Practice: With the prescribed policy decisions, explain and prescribe the open-market operations and all the relevant conventional monetary policy tools required to attain the Dual Mandate. Explain why each of the prescribed policy tools are required.

Step by Step Solution

★★★★★

3.57 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Federal Reserve Policy and the Dual Mandate Current Scenario Inflation 40 above target Real GDP Growth Ayt 25 above target Target Inflation 20 Target Real GDP Growth y 20 Model a ADSRASLRAS Analysis A...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started