Answered step by step

Verified Expert Solution

Question

1 Approved Answer

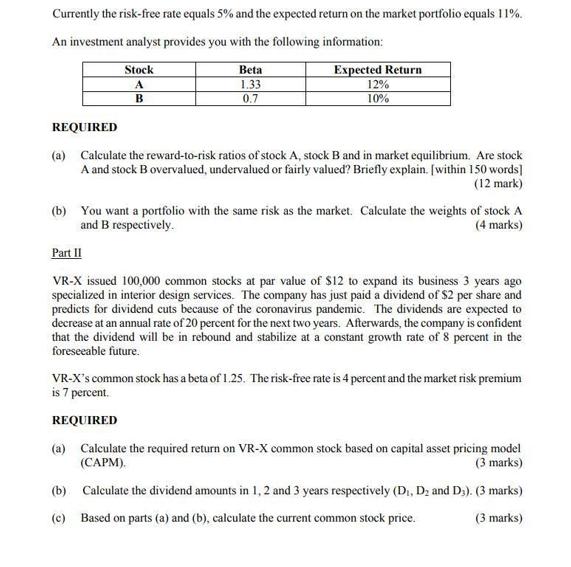

Currently the risk-free rate equals 5% and the expected return on the market portfolio equals 11%. An investment analyst provides you with the following

Currently the risk-free rate equals 5% and the expected return on the market portfolio equals 11%. An investment analyst provides you with the following information: Expected Return Stock A Beta 1.33 B 0.7 REQUIRED 12% 10% (a) Calculate the reward-to-risk ratios of stock A, stock B and in market equilibrium. Are stock A and stock B overvalued, undervalued or fairly valued? Briefly explain. [within 150 words] (12 mark) (b) You want a portfolio with the same risk as the market. Calculate the weights of stock A and B respectively. (4 marks) Part II VR-X issued 100,000 common stocks at par value of $12 to expand its business 3 years ago specialized in interior design services. The company has just paid a dividend of $2 per share and predicts for dividend cuts because of the coronavirus pandemic. The dividends are expected to decrease at an annual rate of 20 percent for the next two years. Afterwards, the company is confident that the dividend will be in rebound and stabilize at a constant growth rate of 8 percent in the foreseeable future. VR-X's common stock has a beta of 1.25. The risk-free rate is 4 percent and the market risk premium is 7 percent. REQUIRED (a) Calculate the required return on VR-X common stock based on capital asset pricing model (CAPM). (3 marks) (b) Calculate the dividend amounts in 1, 2 and 3 years respectively (D1, D2 and D3). (3 marks) (c) Based on parts (a) and (b), calculate the current common stock price. (3 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started