Answered step by step

Verified Expert Solution

Question

1 Approved Answer

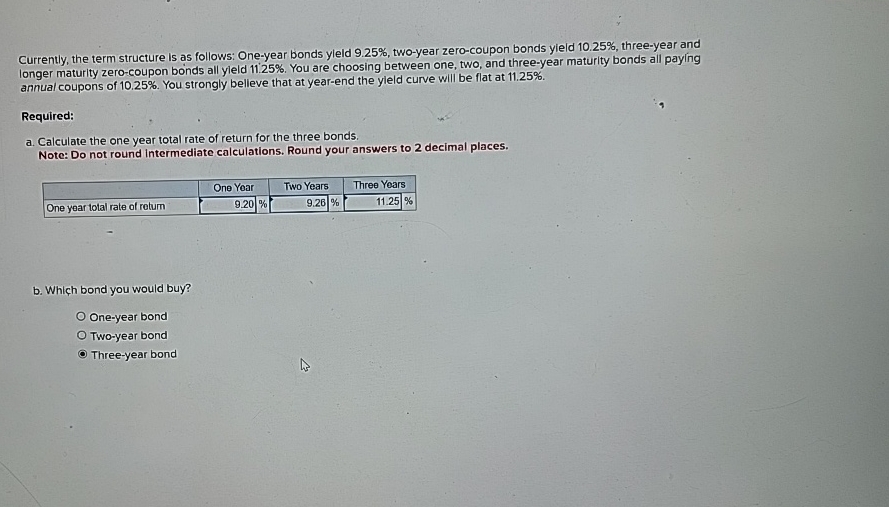

Currently, the term structure is as follows: One - year bonds yleld 9 . 2 5 % , two - year zero - coupon bonds

Currently, the term structure is as follows: Oneyear bonds yleld twoyear zerocoupon bonds yield threeyear and longer maturity zerocoupon boinds all yleld You are choosing between one, two, and threeyear maturity bonds all paying annual coupons of You strongly belleve that at yearend the yield curve will be flat at

Required:

a Calculate the one year total rate of return for the three bonds.

Note: Do not round intermediate calculations. Round your answers to decimal places.

tableOne Year,Two Years,Three Years,One year total rate of return, please show the calculations, not excel.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started