Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cusack Inc. wholesales candy to a variety of retail stores. Inventory at the beginning of the year totaled $6,000. During the current month, the

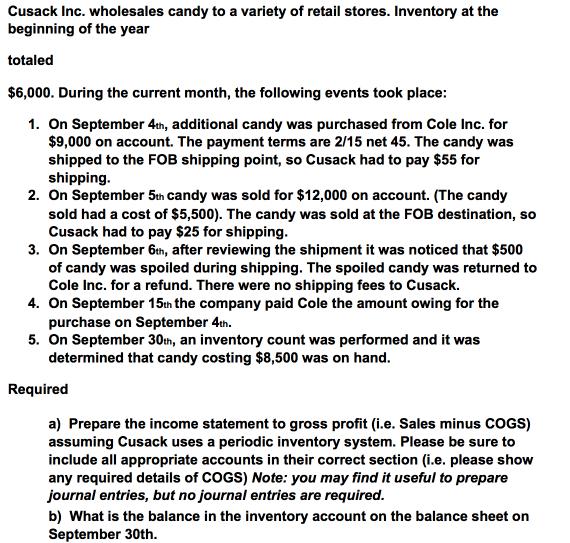

Cusack Inc. wholesales candy to a variety of retail stores. Inventory at the beginning of the year totaled $6,000. During the current month, the following events took place: 1. On September 4th, additional candy was purchased from Cole Inc. for $9,000 on account. The payment terms are 2/15 net 45. The candy was shipped to the FOB shipping point, so Cusack had to pay $55 for shipping. 2. On September 5th candy was sold for $12,000 on account. (The candy sold had a cost of $5,500). The candy was sold at the FOB destination, so Cusack had to pay $25 for shipping. 3. On September 6th, after reviewing the shipment it was noticed that $500 of candy was spoiled during shipping. The spoiled candy was returned to Cole Inc. for a refund. There were no shipping fees to Cusack. 4. On September 15th the company paid Cole the amount owing for the purchase on September 4th. 5. On September 30th, an inventory count was performed and it was determined that candy costing $8,500 was on hand. Required a) Prepare the income statement to gross profit (i.e. Sales minus COGS) assuming Cusack uses a periodic inventory system. Please be sure to include all appropriate accounts in their correct section (i.e. please show any required details of COGS) Note: you may find it useful to prepare journal entries, but no journal entries are required. b) What is the balance in the inventory account on the balance sheet on September 30th.

Step by Step Solution

★★★★★

3.52 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a Calculation of Cost of Goods Sold COGS Beginning Inventory 6000 Plus Purcha...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started