Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cushion inc. recently acquired Avalon Stuffing. Avalon Stuffing has an annual capacity of 5,000,000 meters of stuffing and sold 3,500,000 meters last year at

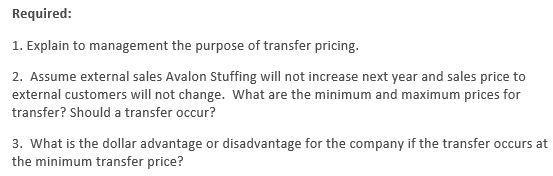

Cushion inc. recently acquired Avalon Stuffing. Avalon Stuffing has an annual capacity of 5,000,000 meters of stuffing and sold 3,500,000 meters last year at a price of $4.5 per meter to outside customers. The purpose of the acquisition was to furnish stuffing for cushions. Cushion needs 2,000,000 meters of stuffing per year. Production costs per meter at capacity of Avalon Stuffing are as follows: Direct materials $.50 Direct processing labour 1.50 Variable processing overhead 0.20 Fixed processing overhead 0.30 Total $2.50 Management is trying to decide what transfer price to use for sales from the newly acquired company to the Cushion Inc. The manbger of Avalon Stuffing suggests $4.50, the market pric e, is appropriate. The manager of Cushion Inc. suggests the cost of $2.50 should be used, or perhaps a lower price since fixed overhead cost should be recomputed with the larger volume. Cushion Inc has purchased stuffing outside suppliers for $3.40 per meter. Selling expenses for Avalon to outside customers is $0.74 per meter. The only selling cost for Avalon for sales to Cushion Inc is commissions of $0.25 per meter. Cushion Inc has a requirement that will cost an extra $0.10 per meter in material costs. Required: 1. Explain to management the purpose of transfer pricing. 2. Assume external sales Avalon Stuffing will not increase next year and sales price to external customers will not change. What are the minimum and maximum prices for transfer? Should a transfer occur? 3. What is the dollar advantage or disadvantage for the company if the transfer occurs at the minimum transfer price?

Step by Step Solution

★★★★★

3.35 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 The purpose of transfer price Determination of a fair and equitabl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started