Answered step by step

Verified Expert Solution

Question

1 Approved Answer

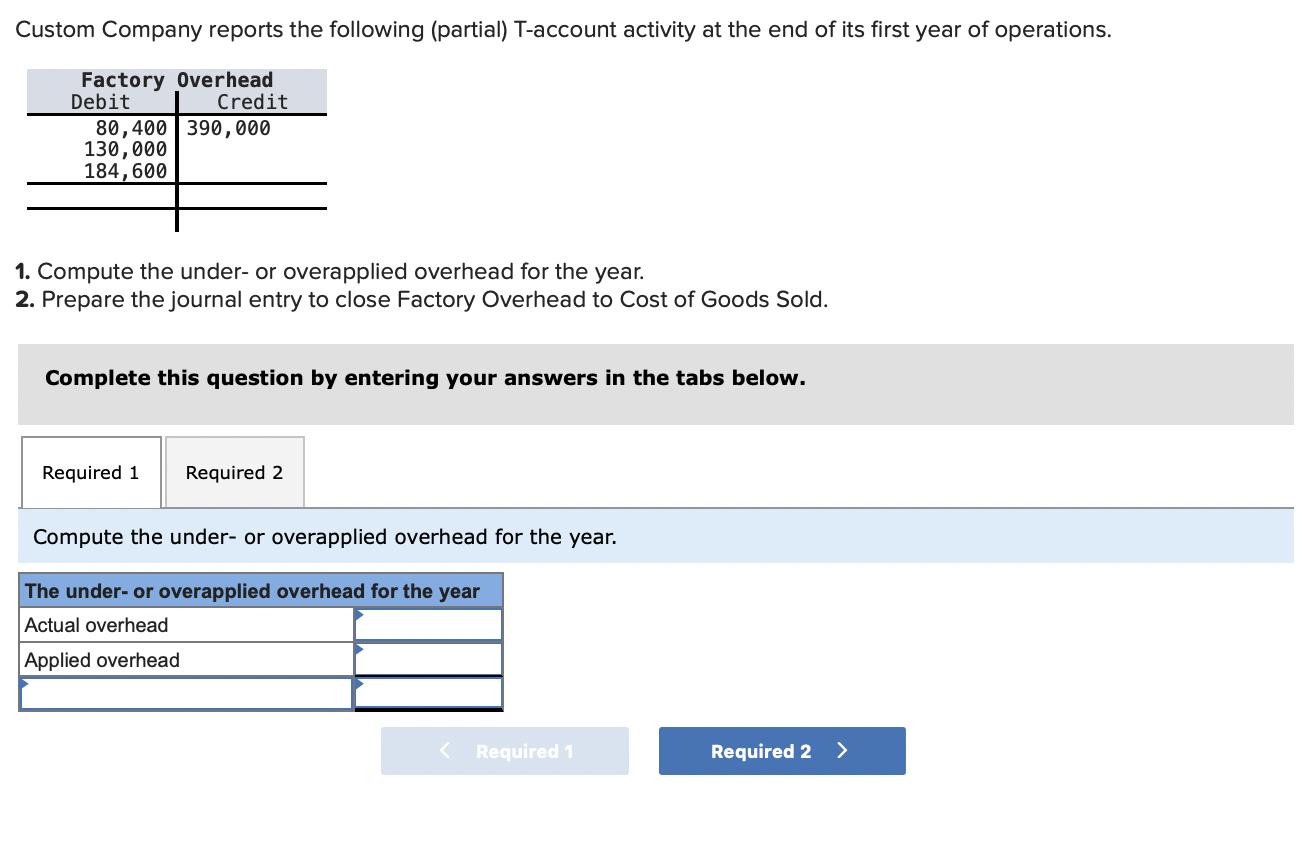

Custom Company reports the following (partial) T-account activity at the end of its first year of operations. Factory Overhead Debit Credit 80,400 390,000 130,000

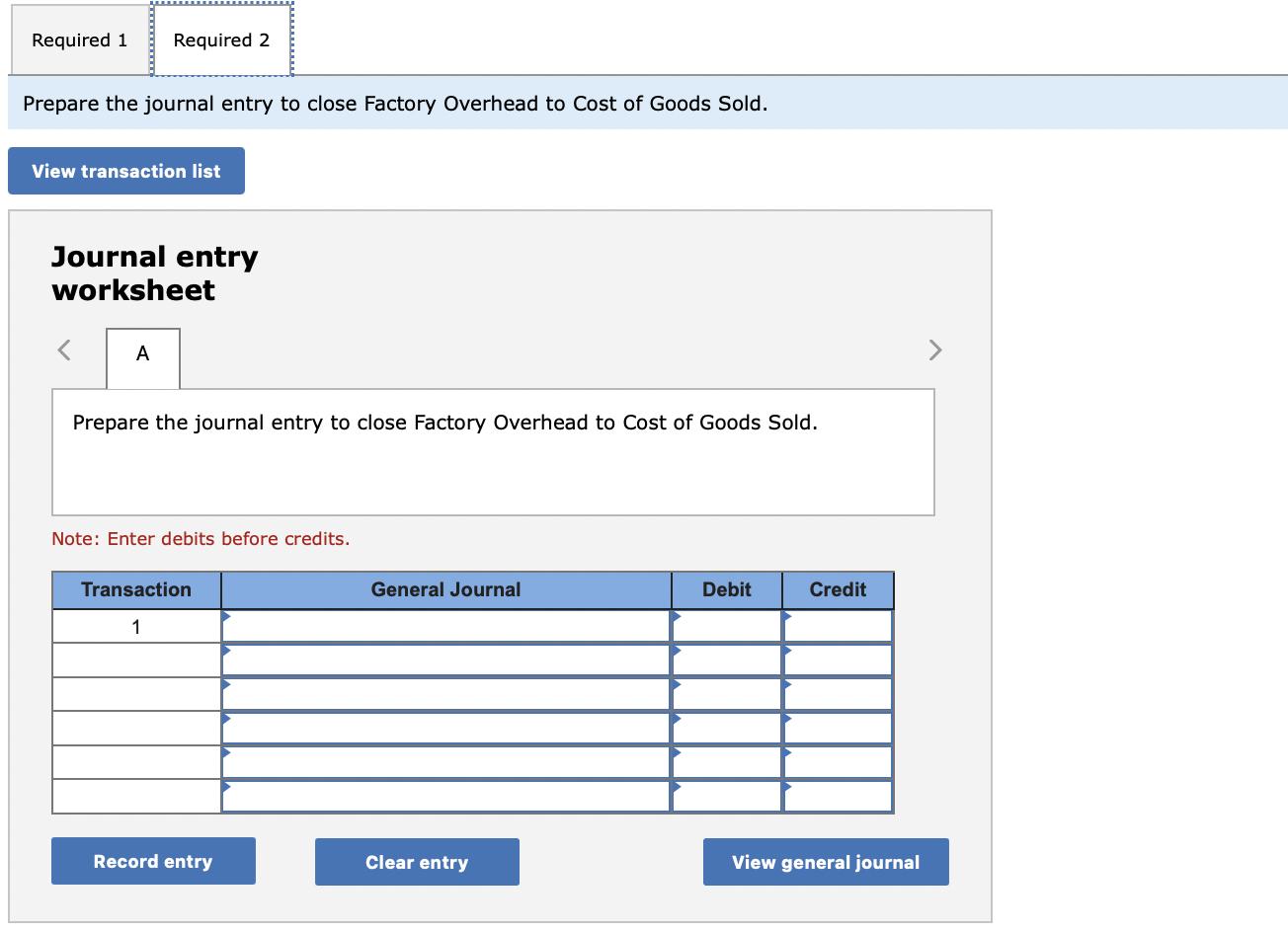

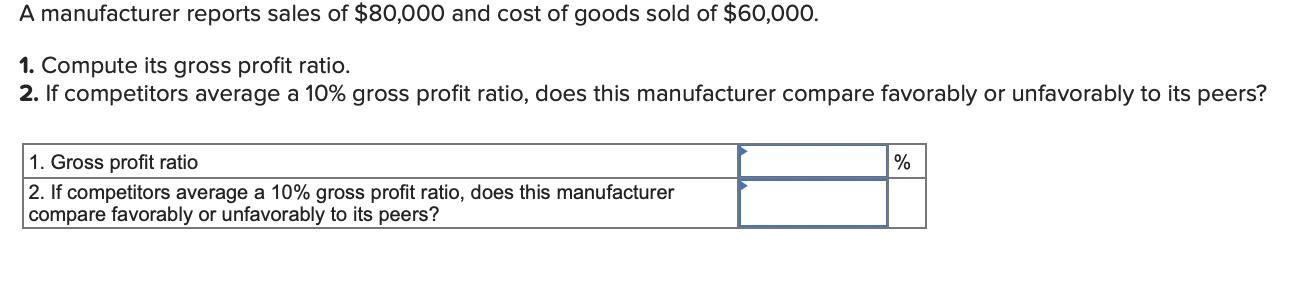

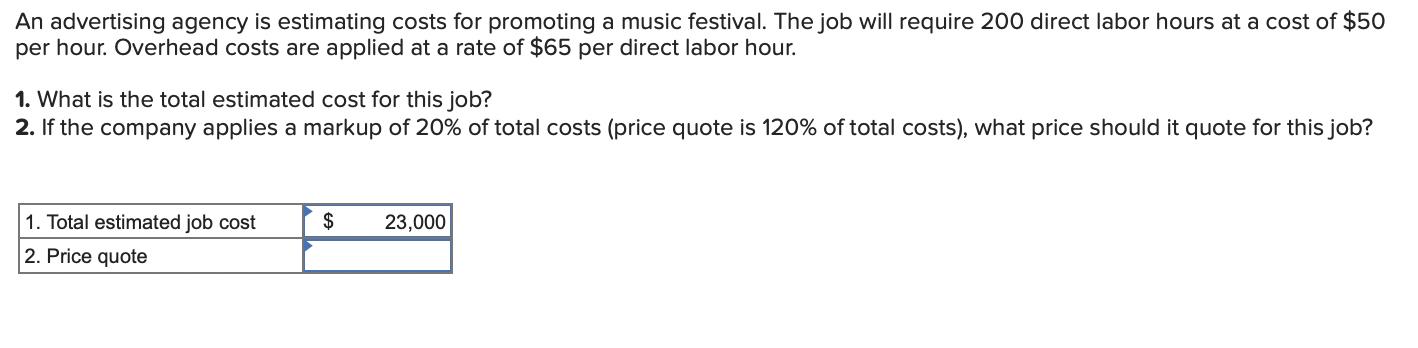

Custom Company reports the following (partial) T-account activity at the end of its first year of operations. Factory Overhead Debit Credit 80,400 390,000 130,000 184, 600 1. Compute the under- or overapplied overhead for the year. 2. Prepare the journal entry to close Factory Overhead to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the under- or overapplied overhead for the year. The under- or overapplied overhead for the year Actual overhead Applied overhead < Required 1 Required 2 > Required 1 Required 2 Prepare the journal entry to close Factory Overhead to Cost of Goods Sold. View transaction list Journal entry worksheet < A Prepare the journal entry to close Factory Overhead to Cost of Goods Sold. Note: Enter debits before credits. Transaction 1 Record entry General Journal Clear entry Debit Credit View general journal A manufacturer reports sales of $80,000 and cost of goods sold of $60,000. 1. Compute its gross profit ratio. 2. If competitors average a 10% gross profit ratio, does this manufacturer compare favorably or unfavorably to its peers? 1. Gross profit ratio 2. If competitors average a 10% gross profit ratio, does this manufacturer compare favorably or unfavorably to its peers? % An advertising agency is estimating costs for promoting a music festival. The job will require 200 direct labor hours at a cost of $50 per hour. Overhead costs are applied at a rate of $65 per direct labor hour. 1. What is the total estimated cost for this job? 2. If the company applies a markup of 20% of total costs (price quote is 120% of total costs), what price should it quote for this job? 1. Total estimated job cost 2. Price quote $ 23,000 Custom Company reports the following (partial) T-account activity at the end of its first year of operations. Factory Overhead Debit Credit 80,400 390,000 130,000 184, 600 1. Compute the under- or overapplied overhead for the year. 2. Prepare the journal entry to close Factory Overhead to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the under- or overapplied overhead for the year. The under- or overapplied overhead for the year Actual overhead Applied overhead < Required 1 Required 2 > Required 1 Required 2 Prepare the journal entry to close Factory Overhead to Cost of Goods Sold. View transaction list Journal entry worksheet < A Prepare the journal entry to close Factory Overhead to Cost of Goods Sold. Note: Enter debits before credits. Transaction 1 Record entry General Journal Clear entry Debit Credit View general journal A manufacturer reports sales of $80,000 and cost of goods sold of $60,000. 1. Compute its gross profit ratio. 2. If competitors average a 10% gross profit ratio, does this manufacturer compare favorably or unfavorably to its peers? 1. Gross profit ratio 2. If competitors average a 10% gross profit ratio, does this manufacturer compare favorably or unfavorably to its peers? % An advertising agency is estimating costs for promoting a music festival. The job will require 200 direct labor hours at a cost of $50 per hour. Overhead costs are applied at a rate of $65 per direct labor hour. 1. What is the total estimated cost for this job? 2. If the company applies a markup of 20% of total costs (price quote is 120% of total costs), what price should it quote for this job? 1. Total estimated job cost 2. Price quote $ 23,000 Custom Company reports the following (partial) T-account activity at the end of its first year of operations. Factory Overhead Debit Credit 80,400 390,000 130,000 184, 600 1. Compute the under- or overapplied overhead for the year. 2. Prepare the journal entry to close Factory Overhead to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the under- or overapplied overhead for the year. The under- or overapplied overhead for the year Actual overhead Applied overhead < Required 1 Required 2 > Required 1 Required 2 Prepare the journal entry to close Factory Overhead to Cost of Goods Sold. View transaction list Journal entry worksheet < A Prepare the journal entry to close Factory Overhead to Cost of Goods Sold. Note: Enter debits before credits. Transaction 1 Record entry General Journal Clear entry Debit Credit View general journal A manufacturer reports sales of $80,000 and cost of goods sold of $60,000. 1. Compute its gross profit ratio. 2. If competitors average a 10% gross profit ratio, does this manufacturer compare favorably or unfavorably to its peers? 1. Gross profit ratio 2. If competitors average a 10% gross profit ratio, does this manufacturer compare favorably or unfavorably to its peers? % An advertising agency is estimating costs for promoting a music festival. The job will require 200 direct labor hours at a cost of $50 per hour. Overhead costs are applied at a rate of $65 per direct labor hour. 1. What is the total estimated cost for this job? 2. If the company applies a markup of 20% of total costs (price quote is 120% of total costs), what price should it quote for this job? 1. Total estimated job cost 2. Price quote $ 23,000

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answers and Explanation Required 1 The under or overapplied overhead for the year can be calculated ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started