Answered step by step

Verified Expert Solution

Question

1 Approved Answer

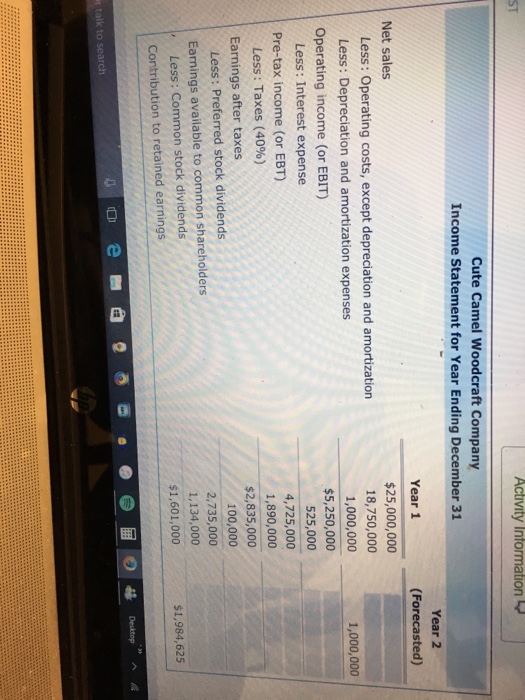

cute Camel woodcraft company's income statement reports data for its first year of operation. The firms CEO would like sales to increase by 25% next

cute Camel woodcraft company's income statement reports data for its first year of operation. The firms CEO would like sales to increase by 25% next year

1) cute camel is able to achieve this level of increased sales but its interest costs increase from 10% to 15% of earnings before interest and taxes

2) the company operating a costs excluding depreciation and amortization remain at 75% of net sales and its depreciation and amortization expenses remain constant from year to year

3) the company's tax rate remains constant at 40% of its pretax income or earnings before taxes

4) in year 2 cute camel expects to pay $100,000 and $1,389,750 of preferred and common stock dividends respectively

In year 2 if cute camel has 5,000 shares of preferred stock issued and outstanding then each preferred share should expect to receive blank in annual dividends

If cute camel has 400,000 shares of common stock issues and outstanding then the firms earnings per share is expected to change from blank in year 1 to blank in year 2

Cute camel before interest taxes depreciation and amortization value changed from blank in year 1 to blank in year 2

It's is blank to say that cute camel net inflows and outflows of cash at the end of years 1 and 2 are equal to the company's annual contribution to retained earnings $1,601,000 and $1,984,625 respectively this is because blank of the item reported in the income statement involve payments and receipts of cash

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started