Answered step by step

Verified Expert Solution

Question

1 Approved Answer

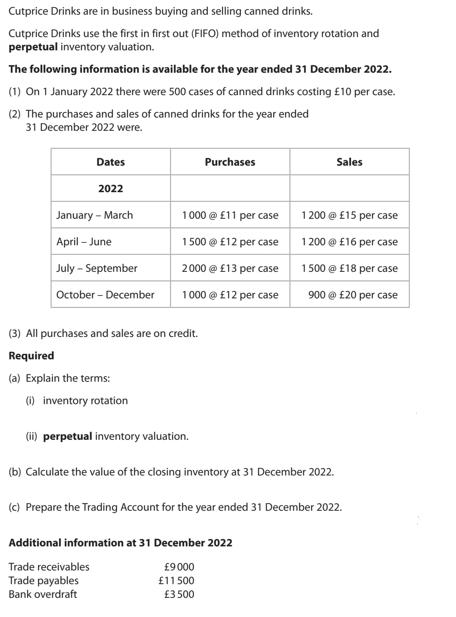

Cutprice Drinks are in business buying and selling canned drinks. Cutprice Drinks use the first in first out (FIFO) method of inventory rotation and

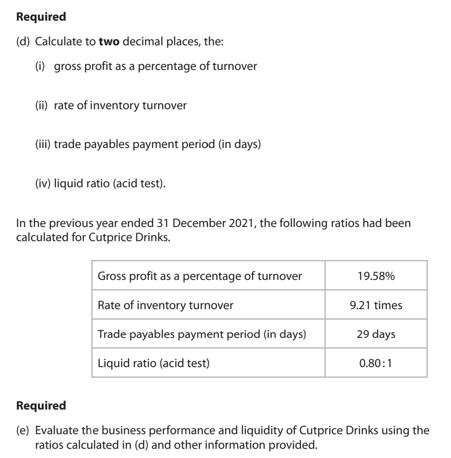

Cutprice Drinks are in business buying and selling canned drinks. Cutprice Drinks use the first in first out (FIFO) method of inventory rotation and perpetual inventory valuation. The following information is available for the year ended 31 December 2022. (1) On 1 January 2022 there were 500 cases of canned drinks costing 10 per case. (2) The purchases and sales of canned drinks for the year ended 31 December 2022 were. Dates 2022 January - March April - June July - September October - December (3) All purchases and sales are on credit. Required (a) Explain the terms: (i) inventory rotation 1000 @ 11 per case 1500 @ 12 per case 2000 @ 13 per case 1000 @ 12 per case (ii) perpetual inventory valuation. Purchases Trade receivables Trade payables Bank overdraft Additional information at 31 December 2022 9000 11500 3 500 Sales (b) Calculate the value of the closing inventory at 31 December 2022. (c) Prepare the Trading Account for the year ended 31 December 2022. 1200 @ 15 per case 1200 @ 16 per case 1500 @ 18 per case 900 @ 20 per case Required (d) Calculate to two decimal places, the: (i) gross profit as a percentage of turnover (ii) rate of inventory turnover (iii) trade payables payment period (in days) (iv) liquid ratio (acid test). In the previous year ended 31 December 2021, the following ratios had been calculated for Cutprice Drinks. Gross profit as a percentage of turnover Rate of inventory turnover Trade payables payment period (in days) Liquid ratio (acid test) 19.58% 9.21 times. 29 days 0.80:1 Required (e) Evaluate the business performance and liquidity of Cutprice Drinks using the ratios calculated in (d) and other information provided.

Step by Step Solution

★★★★★

3.43 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

a Inventory rotation refers to the method of managing inventory by rotating or using up the oldest inventory first FIFO first in first out is a common ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started