Question

CVP Analysis of Alternative Products Pegasus Shoe Company plans to expand its manufacturing capacity to allow up to 20,000 pairs of a new product each

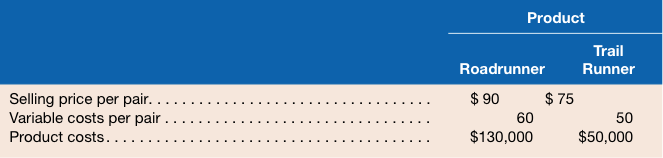

CVP Analysis of Alternative Products Pegasus Shoe Company plans to expand its manufacturing capacity to allow up to 20,000 pairs of a new product each year. Because only one product can be produced, management is deciding between the production of the Roadrunner for backpacking and the Trail Runner for exercising. A marketing analysis indicates Pegasus could sell between 8,000 and 14,000 pairs of either product. The accounting department has developed the following price and cost information: Facility costs for expansion, regardless of product, are $150,000. Pegasus is subject to a 40 percent income tax rate.

Required

a. Determine the number of pairs of Roadrunner shoes Pegasus must sell to obtain an after-tax profit of $30,000.

b. Determine the number of pairs of each product Pegasus must sell to obtain identical before-tax profit.

c. For the solution to requirement b, calculate Pegasus after-tax profit or loss.

d. Which product should Pegasus produce if both products were guaranteed to sell at least 13,000 pairs? Verify your solution with calculations.

e. How much would the variable costs per pair of the product not selected in requirement d have to fall before both products provide the same profit at sales of 13,000 pairs? Verify your solution with calculations.

Please use excel spreedsheet with formulas. Thank you! :)

Product Trail Runner Roadrunner ....$90 $75 60 50 130,000 $%50,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started