Answered step by step

Verified Expert Solution

Question

1 Approved Answer

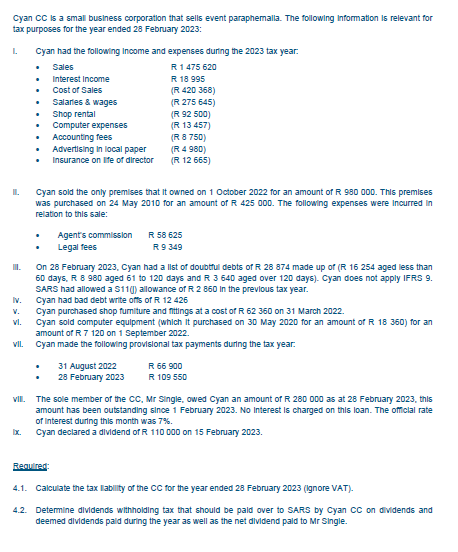

Cyan CC is a small business corporation that sells event paraphemalla. The following information is relevant for tax purposes for the year ended 28 February

Cyan CC is a small business corporation that sells event paraphemalla. The following information is relevant for tax purposes for the year ended 28 February 2023 : L. Cyan had the following Income and expenses during the 2023 tax year: II. Cyan sold the only premises that It owned on 1 October 2022 for an amount of R980000. This premises was purchased on 24 May 2010 for an amount of R 425000 . The following expenses were incurred in relation to this sale: - Agent's commission - Legal fees R 58625 R 9349 III. On 28 February 2023, Cyan had a llst of doubtul debts of R 28874 made up of ( R 16254 aged less than 60 days, R8980 aged 61 to 120 days and R3640 aged over 120 days). Cyan does not apply IFRS 9 . SARS had allowed a S11(0) allowance of R2860 in the previous tax year. Iv. Cyan had bad debt write offs of R 12426 v. Cyan purchased shop furnliture and fntings at a cost of R 62360 on 31 March 2022. vl. Cyan sold computer equlpment (which It purchased on 30 May 2020 for an amount of R 18 360 ) for an amount of R7120 on 1 September 2022. vil. Cyan made the following provisional tax payments during the tax year: - 31 August 2022 - 28 February 2023 R 66900 R 109550 vIL. The sole member of the CC, Mr Single, owed Cyan an amount of R 280000 as at 28 February 2023, thls amount has been outstanding since 1 February 2023. No Interest is charged on this loan. The officlal rate of interest during this month was 7%. Ix. Cyan declared a dlvidend of R110000 on 15 February 2023. Regulred: 4.1. Calculate the tax labllity of the CC for the year ended 28 February 2023 (Ignore VAT). 4.2. Determine dlvidends withholding tax that should be pald over to SARS by Cyan CC on dividends and deemed dlvidends pald during the year as well as the net dlvidend pald to Mr Single

Cyan CC is a small business corporation that sells event paraphemalla. The following information is relevant for tax purposes for the year ended 28 February 2023 : L. Cyan had the following Income and expenses during the 2023 tax year: II. Cyan sold the only premises that It owned on 1 October 2022 for an amount of R980000. This premises was purchased on 24 May 2010 for an amount of R 425000 . The following expenses were incurred in relation to this sale: - Agent's commission - Legal fees R 58625 R 9349 III. On 28 February 2023, Cyan had a llst of doubtul debts of R 28874 made up of ( R 16254 aged less than 60 days, R8980 aged 61 to 120 days and R3640 aged over 120 days). Cyan does not apply IFRS 9 . SARS had allowed a S11(0) allowance of R2860 in the previous tax year. Iv. Cyan had bad debt write offs of R 12426 v. Cyan purchased shop furnliture and fntings at a cost of R 62360 on 31 March 2022. vl. Cyan sold computer equlpment (which It purchased on 30 May 2020 for an amount of R 18 360 ) for an amount of R7120 on 1 September 2022. vil. Cyan made the following provisional tax payments during the tax year: - 31 August 2022 - 28 February 2023 R 66900 R 109550 vIL. The sole member of the CC, Mr Single, owed Cyan an amount of R 280000 as at 28 February 2023, thls amount has been outstanding since 1 February 2023. No Interest is charged on this loan. The officlal rate of interest during this month was 7%. Ix. Cyan declared a dlvidend of R110000 on 15 February 2023. Regulred: 4.1. Calculate the tax labllity of the CC for the year ended 28 February 2023 (Ignore VAT). 4.2. Determine dlvidends withholding tax that should be pald over to SARS by Cyan CC on dividends and deemed dlvidends pald during the year as well as the net dlvidend pald to Mr Single Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started