Answered step by step

Verified Expert Solution

Question

1 Approved Answer

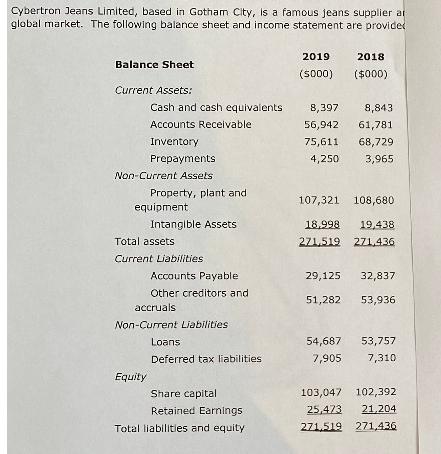

Cybertron Jeans Limited, based in Gotham City, is a famous jeans supplier ar global market. The following balance sheet and income statement are provided

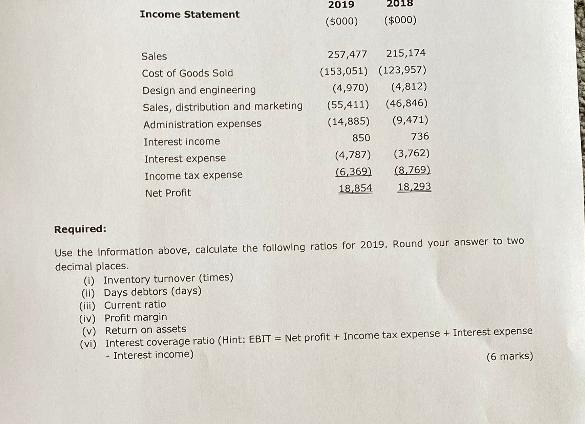

Cybertron Jeans Limited, based in Gotham City, is a famous jeans supplier ar global market. The following balance sheet and income statement are provided Balance Sheet Current Assets: Cash and cash equivalents Accounts Receivable Inventory Prepayments Non-Current Assets Property, plant and. equipment Intangible Assets Total assets Current Liabilities Equity Accounts Payable Other creditors and accruals Non-Current Liabilities: Loans Deferred tax liabilities. Share capital Retained Earnings Total liabilities and equity 2019 ($000) 2018 ($000) 8,397 8,843 56,942 61,781 75,611 68,729 4,250 3,965 107,321 108,680 18,998 19,438 271,519 271,436 29,125 32,837 51,282 53,936 54,687 53,757 7,905 7,310 103,047 102,392 25,473 21,204 271,519 271,436 Income Statement Sales Cost of Goods Sold Design and engineering Sales, distribution and marketing Administration expenses Interest income Interest expense Income tax expense Net Profit 2019 (5000) (1) Inventory turnover (times) (1) Days debtors (days) (iii) Current ratio. 2018 ($000) 257,477 215,174 (153,051) (123,957) (4,812) (4,970) (55,411) (46,846) (14,885) (9,471) 850 736 (4,787) (3,762) (6,369) (8,769) 18,854 18,293 Required: Use the information above, calculate the following ratios for 2019. Round your answer to two decimal places. (iv) Profit margin (v) Return on assets. (vi) Interest coverage ratio (Hint: EBIT = Net profit + Income tax expense + Interest expense - Interest income) (6 marks) CONOPPTRE

Step by Step Solution

★★★★★

3.41 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the requested ratios for 2019 using the provided information i Inventory turnover times ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started