Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cynthia and Mike Connor files a Joint return. Mike owns a small accounting firm with revenue base of less than $199,500 per year. Cynthia's

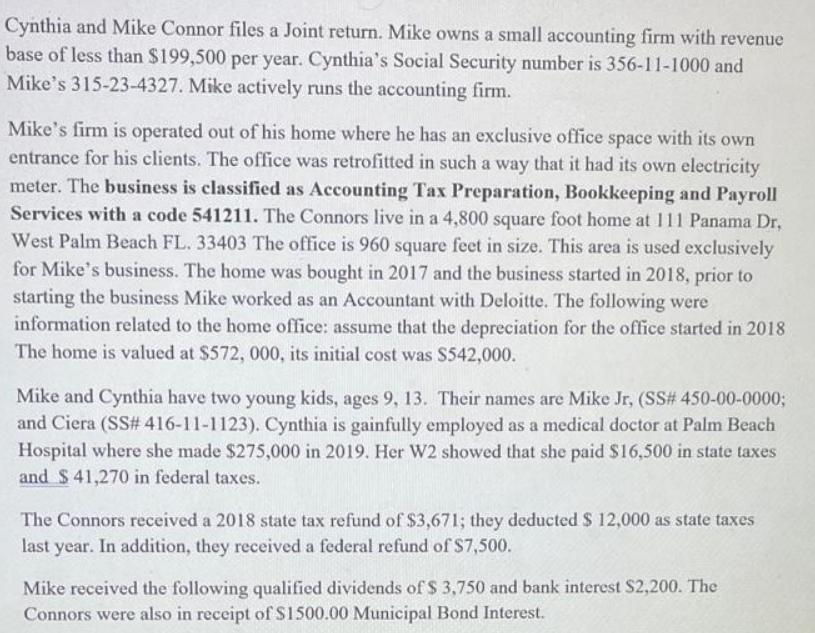

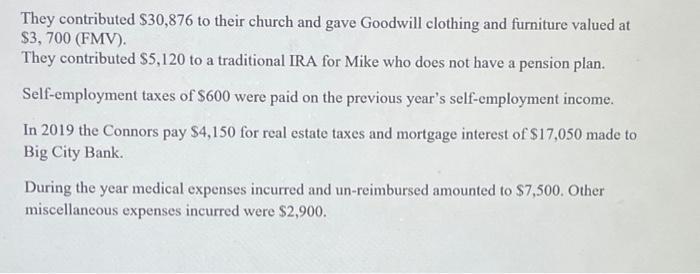

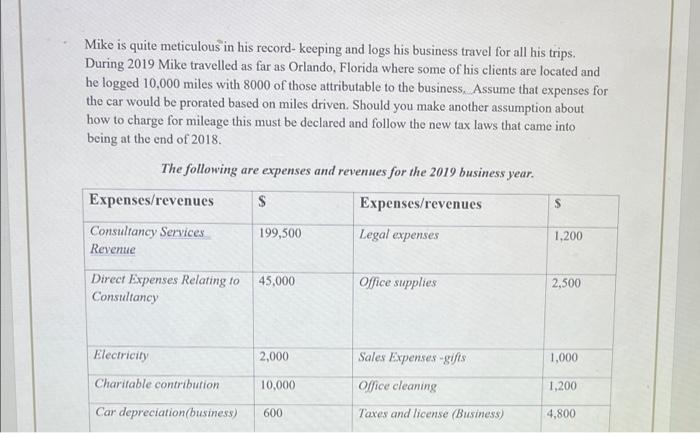

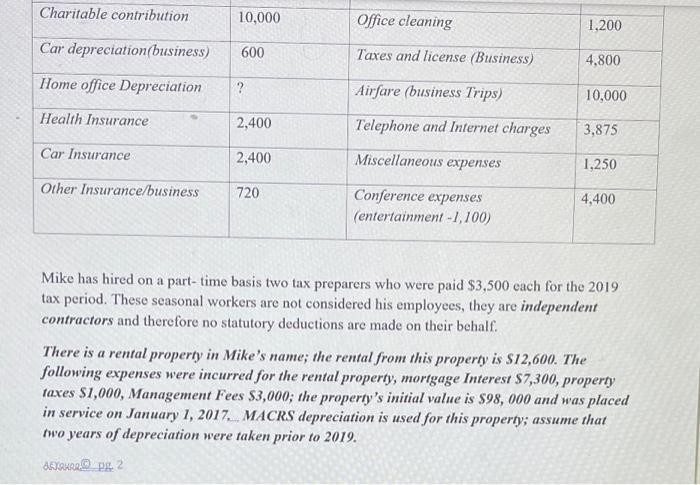

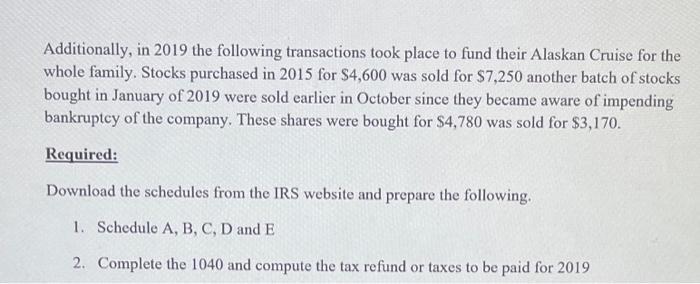

Cynthia and Mike Connor files a Joint return. Mike owns a small accounting firm with revenue base of less than $199,500 per year. Cynthia's Social Security number is 356-11-1000 and Mike's 315-23-4327. Mike actively runs the accounting firm. Mike's firm is operated out of his home where he has an exclusive office space with its own entrance for his clients. The office was retrofitted in such a way that it had its own electricity meter. The business is classified as Accounting Tax Preparation, Bookkeeping and Payroll Services with a code 541211. The Connors live in a 4,800 square foot home at 111 Panama Dr, West Palm Beach FL. 33403 The office is 960 square feet in size. This area is used exclusively for Mike's business. The home was bought in 2017 and the business started in 2018, prior to starting the business Mike worked as an Accountant with Deloitte. The following were information related to the home office: assume that the depreciation for the office started in 2018 The home is valued at $572, 000, its initial cost was $542,000. Mike and Cynthia have two young kids, ages 9, 13. Their names are Mike Jr, (SS# 450-00-0000; and Ciera (SS# 416-11-1123). Cynthia is gainfully employed as a medical doctor at Palm Beach Hospital where she made $275,000 in 2019. Her W2 showed that she paid $16,500 in state taxes and $ 41,270 in federal taxes. The Connors received a 2018 state tax refund of $3,671; they deducted $ 12,000 as state taxes last year. In addition, they received a federal refund of $7,500. Mike received the following qualified dividends of $ 3,750 and bank interest S2,200. The Connors were also in receipt of $1500.00 Municipal Bond Interest. They contributed $30,876 to their church and gave Goodwill clothing and furniture valued at $3,700 (FMV). They contributed $5,120 to a traditional IRA for Mike who does not have a pension plan. Self-employment taxes of $600 were paid on the previous year's self-employment income. In 2019 the Connors pay $4,150 for real estate taxes and mortgage interest of $17,050 made to Big City Bank. During the year medical expenses incurred and un-reimbursed amounted to $7,500. Other miscellaneous expenses incurred were $2,900. Mike is quite meticulous in his record- keeping and logs his business travel for all his trips. During 2019 Mike travelled as far as Orlando, Florida where some of his clients are located and he logged 10,000 miles with 8000 of those attributable to the business. Assume that expenses for the car would be prorated based on miles driven. Should you make another assumption about how to charge for mileage this must be declared and follow the new tax laws that came into being at the end of 2018. The following are expenses and revenues for the 2019 business year. $ Expenses/revenues Legal expenses Expenses/revenues Consultancy Services Revenue 199,500 Direct Expenses Relating to 45,000 Consultancy Electricity Charitable contribution Car depreciation(business) 2,000 10,000 600 Office supplies Sales Expenses -gifts Office cleaning Taxes and license (Business) S 1,200 2,500 1,000 1,200 4,800 Charitable contribution Car depreciation(business) Home office Depreciation Health Insurance Car Insurance Other Insurance/business 10,000 600 ? 2,400 2,400 720 Office cleaning Taxes and license (Business) Airfare (business Trips) Telephone and Internet charges Miscellaneous expenses Conference expenses (entertainment -1,100) 1,200 4,800 10,000 3,875 1,250 4,400 Mike has hired on a part-time basis two tax preparers who were paid $3,500 each for the 2019 tax period. These seasonal workers are not considered his employees, they are independent contractors and therefore no statutory deductions are made on their behalf. There is a rental property in Mike's name; the rental from this property is $12,600. The following expenses were incurred for the rental property, mortgage Interest $7,300, property taxes $1,000, Management Fees $3,000; the property's initial value is $98, 000 and was placed in service on January 1, 2017. MACRS depreciation is used for this property; assume that two years of depreciation were taken prior to 2019. AFXAURRO Pg 2 Additionally, in 2019 the following transactions took place to fund their Alaskan Cruise for the whole family. Stocks purchased in 2015 for $4,600 was sold for $7,250 another batch of stocks bought in January of 2019 were sold earlier in October since they became aware of impending bankruptcy of the company. These shares were bought for $4,780 was sold for $3,170. Required: Download the schedules from the IRS website and prepare the following. 1. Schedule A, B, C, D and E 2. Complete the 1040 and compute the tax refund or taxes to be paid for 2019

Step by Step Solution

★★★★★

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Based on the information provided here are the tax schedules and Form 1040 for the Connors Schedule ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started