Answered step by step

Verified Expert Solution

Question

1 Approved Answer

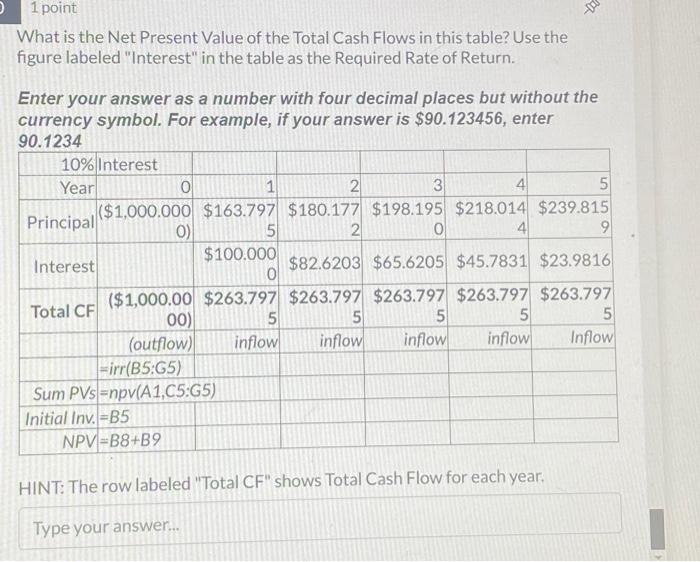

D 1 point What is the Net Present Value of the Total Cash Flows in this table? Use the figure labeled Interest in the table

D 1 point What is the Net Present Value of the Total Cash Flows in this table? Use the figure labeled "Interest" in the table as the Required Rate of Return. Enter your answer as a number with four decimal places but without the currency symbol. For example, if your answer is $90.123456, enter 90.1234 10% Interest Year Principal Interest Total CF 0 0) 00) (outflow) NPV=B8+B9 1 ($1,000.000 $163.797 $180.177 $198.195 $218.014 $239.815 =irr(B5:G5) Sum PVs-npv(A1,C5:G5) Initial Inv.-B5 5 $100.000 2 0 5 inflow 2 3 $82.6203 $65.6205 $45.7831 $23.9816 ($1,000.00 $263.797 $263.797 $263.797 $263.797 $263.797 5 inflow 0 4 5 inflow 4 5 5 inflow HINT: The row labeled "Total CF" shows Total Cash Flow for each year. Type your answer... 9 5 Inflow

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started