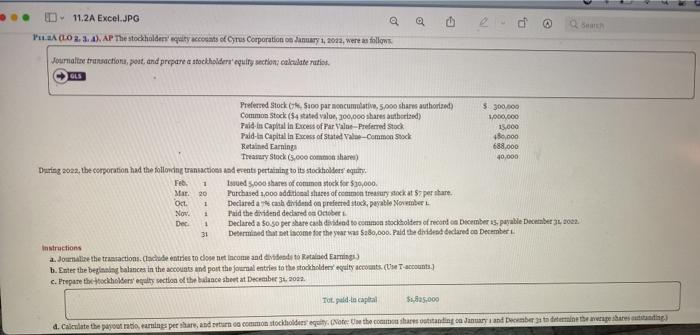

D- 11.2A Excel.JPG LA CLO 2. 3. A). AP The stockholderiquity accounts of Cyrus Corporation on January 1, 2003, were as follows a d Journal transaction, part and prepare a stockholde equity section calculate ratio GLS 40.000 20 Preferred Stock $100 par noncurative, 5.000 shares authorized $ 300.000 Common Stock (54 stated alon, 300,000 shares wied) 1,000,000 Paid in Capital in Excess of Par Value-Preferred Stock 15.000 Pald-in Capital in Excess of Stated Vale-Common Stock 480,000 Bated Earning 688.000 Treasury Stock (5.000 common shares) During 2022. the corporation had the folloding transactions erents pertaining to its stockholders equity Feb sued 5,000 shares of common stock for $30,000 Mar Purchased 1,000 additional stages of common treasury sexkat pershare. Oct 1 Declared as cash divided on preferred stock, payable November Now Paid the dividend declared on October 1 Declared a so so per share cash dividend to common stockholder of record in December 5, payable December 22 31 Determined that come for the year was 580,000. Paid the divide clared on December Instructions a..Jom the transactions.Cadde entre todos net income and divided to Realed Earnings b. Enter the beginninghalances in the accounts and post the journal entries to the stockholders equity account. (Taccounts.) c. Prepare the ockholders equity section of the bace sheet at December 31, 2011 Tot peld-la capital $95.000 1 4. Calculate the payout aboarings per share, and turn a common stockholdes equity. Note: the comes outstanding on January and December to determine therapeutstanding) D- 11.2A Excel.JPG LA CLO 2. 3. A). AP The stockholderiquity accounts of Cyrus Corporation on January 1, 2003, were as follows a d Journal transaction, part and prepare a stockholde equity section calculate ratio GLS 40.000 20 Preferred Stock $100 par noncurative, 5.000 shares authorized $ 300.000 Common Stock (54 stated alon, 300,000 shares wied) 1,000,000 Paid in Capital in Excess of Par Value-Preferred Stock 15.000 Pald-in Capital in Excess of Stated Vale-Common Stock 480,000 Bated Earning 688.000 Treasury Stock (5.000 common shares) During 2022. the corporation had the folloding transactions erents pertaining to its stockholders equity Feb sued 5,000 shares of common stock for $30,000 Mar Purchased 1,000 additional stages of common treasury sexkat pershare. Oct 1 Declared as cash divided on preferred stock, payable November Now Paid the dividend declared on October 1 Declared a so so per share cash dividend to common stockholder of record in December 5, payable December 22 31 Determined that come for the year was 580,000. Paid the divide clared on December Instructions a..Jom the transactions.Cadde entre todos net income and divided to Realed Earnings b. Enter the beginninghalances in the accounts and post the journal entries to the stockholders equity account. (Taccounts.) c. Prepare the ockholders equity section of the bace sheet at December 31, 2011 Tot peld-la capital $95.000 1 4. Calculate the payout aboarings per share, and turn a common stockholdes equity. Note: the comes outstanding on January and December to determine therapeutstanding)