d. 1434

-

$0.00

-

$80.50

-

$61.60

-

$18.90

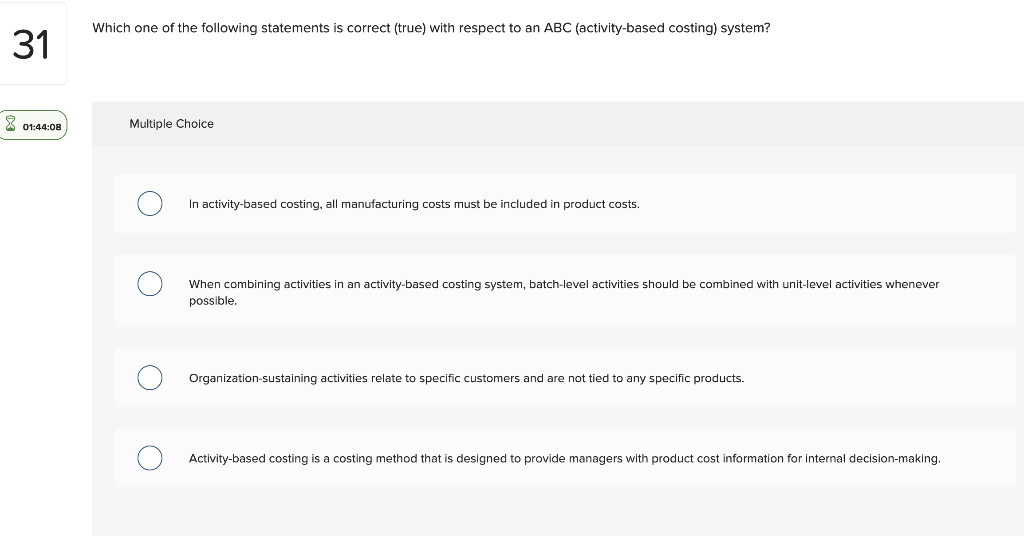

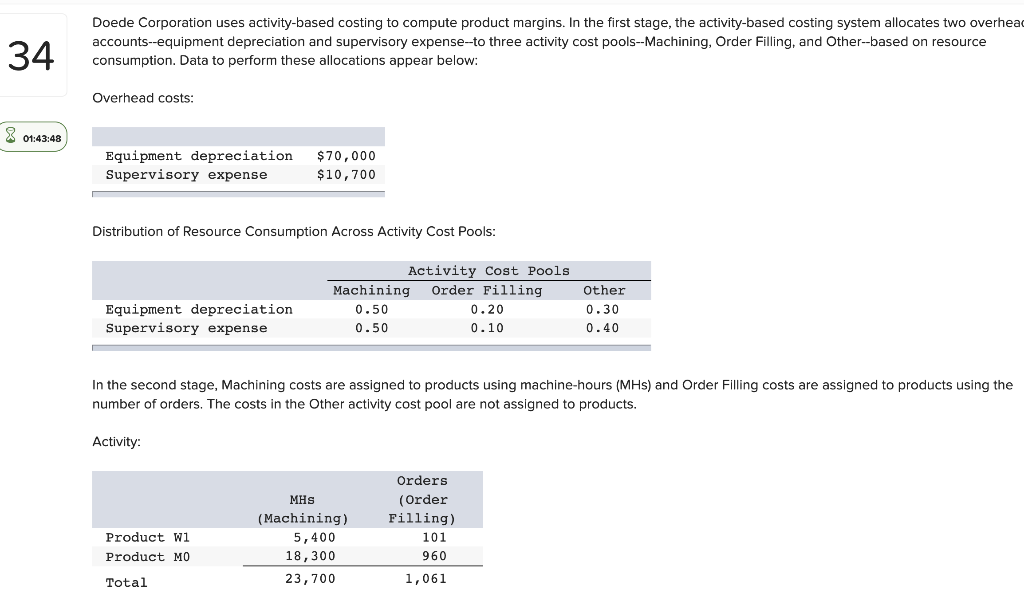

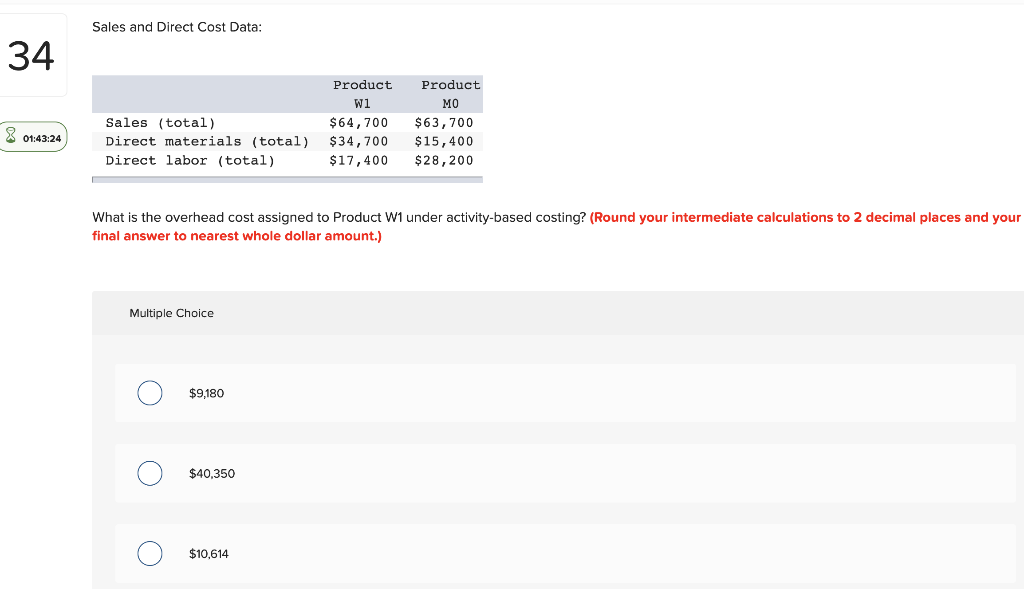

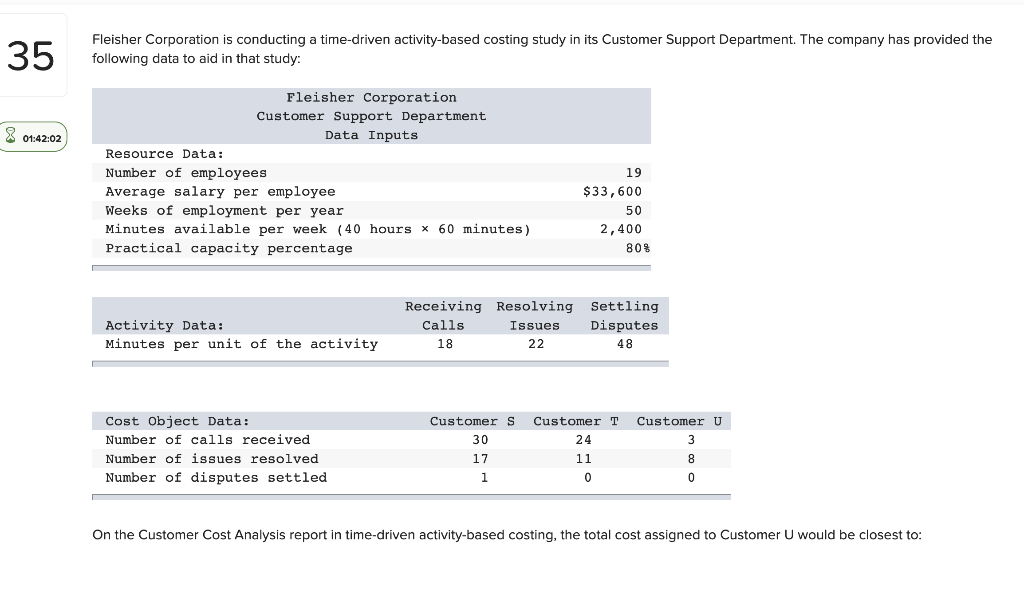

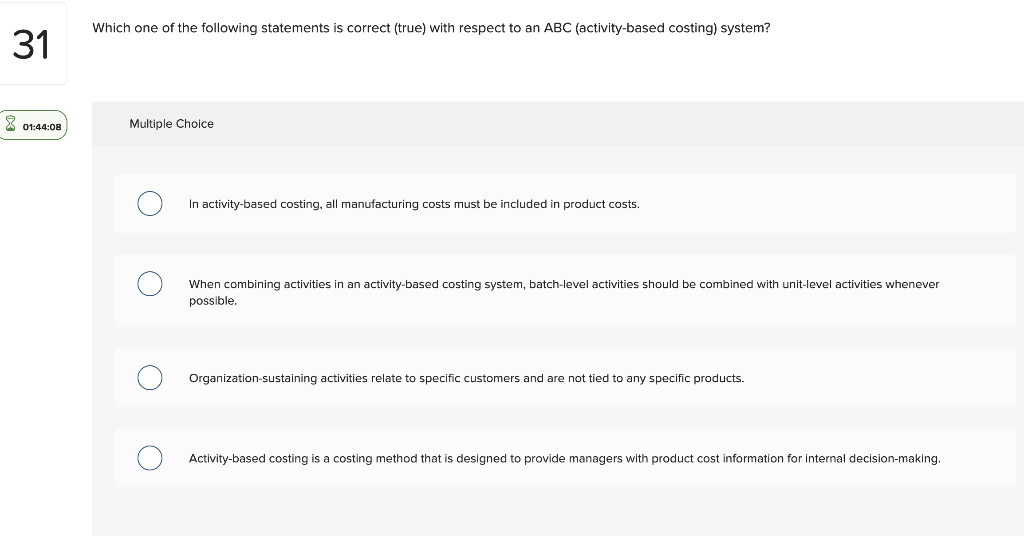

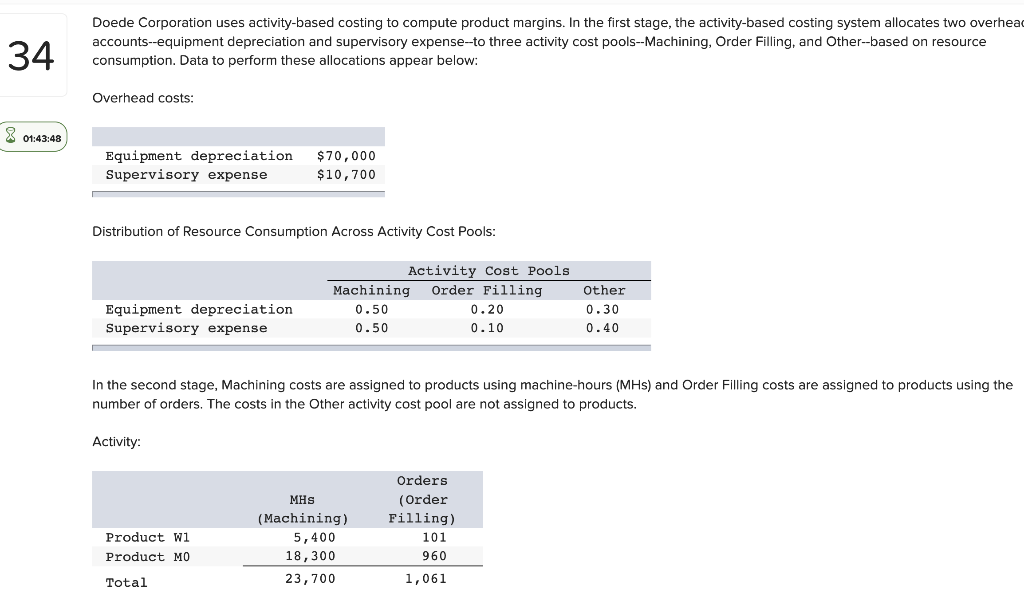

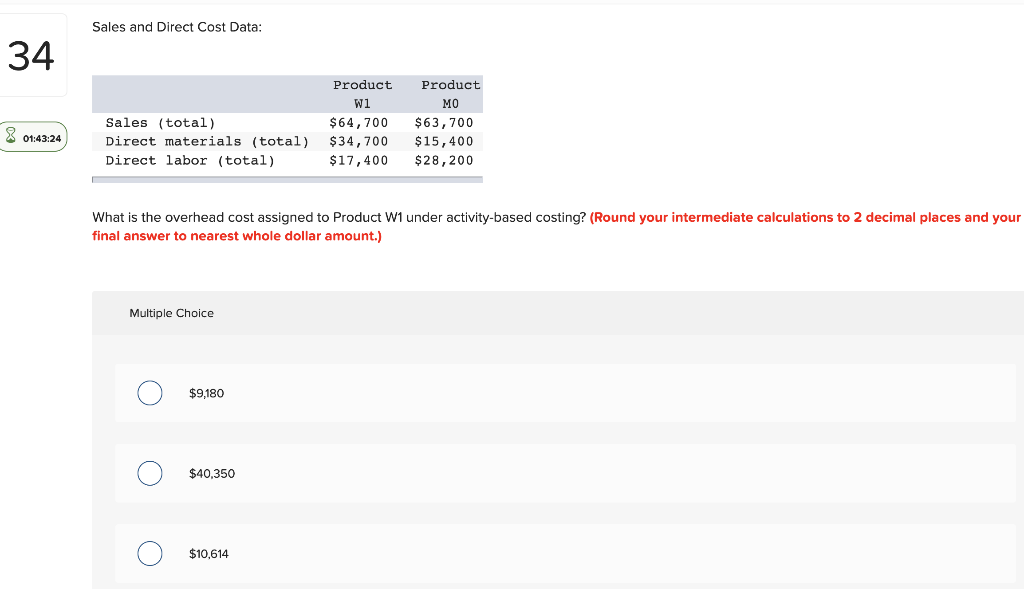

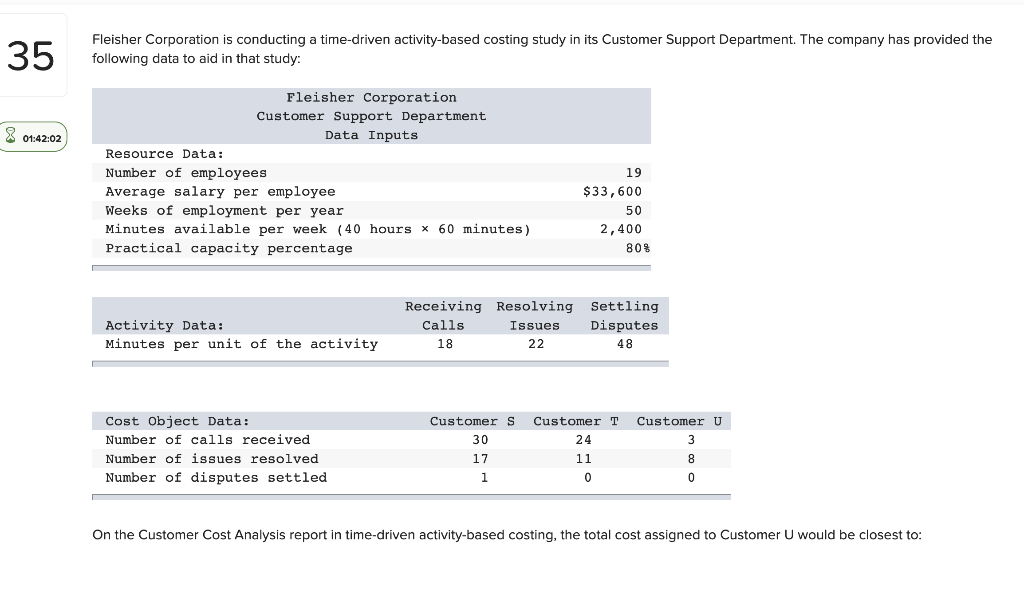

31 01:44:08 Which one of the following statements is correct (true) with respect to an ABC (activity-based costing) system? Multiple Choice O In activity-based costing, all manufacturing costs must be included in product costs. When combining activities in an activity-based costing system, batch-level activities should be combined with unit-level activities whenever possible. Organization-sustaining activities relate to specific customers and are not tied to any specific products. Activity-based costing is a costing method that designed to provide managers with product cost information for internal decision-making. 34 01:43:48 Doede Corporation uses activity-based costing to compute product margins. In the first stage, the activity-based costing system allocates two overhead accounts--equipment depreciation and supervisory expense-to three activity cost pools--Machining, Order Filling, and Other-based on resource consumption. Data to perform these allocations appear below: Overhead costs: Equipment depreciation Supervisory expense. Distribution of Resource Consumption Across Activity Cost Pools: Equipment depreciation Supervisory expense $70,000 $10,700 Activity: Product Wi Product MO Total Machining Order Filling 0.50 0.50 Activity Cost Pools In the second stage, Machining costs are assigned to products using machine-hours (MHS) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. MHS (Machining) 5,400 18,300 23,700 0.20 0.10 Orders (Order Filling) 101 960 1,061 Other 0.30 0.40 34 01:43:24 Sales and Direct Cost Data: Sales (total) Direct materials (total) Direct labor (total) Multiple Choice What is the overhead cost assigned to Product W1 under activity-based costing? (Round your intermediate calculations to 2 decimal places and your final answer to nearest whole dollar amount.) O $9,180 $40,350 Product W1 $64,700 $34,700 $17,400 $10,614 Product MO $63,700 $15,400 $28,200 35 01:42:02 Fleisher Corporation is conducting a time-driven activity-based costing study in its Customer Support Department. The company has provided the following data to aid in that study: Fleisher Corporation Customer Support Department Data Inputs Resource Data: Number of employees Average salary per employee Weeks of employment per year Minutes available per week (40 hours x 60 minutes) Practical capacity percentage Activity Data: Minutes per unit of the activity Cost Object Data: Number of calls received Number of issues resolved Number of disputes settled Receiving Resolving Calls Issues 18 22 Customer S 30 17 1 19 $33,600 50 2,400 Customer T 24 11 0 80% Settling Disputes 48 Customer U 3 8 0 On the Customer Cost Analysis report in time-driven activity-based costing, the total cost assigned to Customer U would be closest to