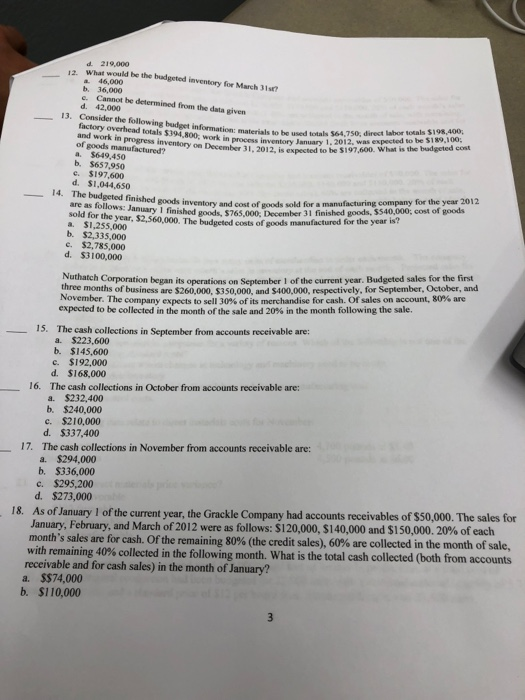

d. 219,000 2. What would be the budgeted inventory for March 31st? a. 46,000 b. 36,000o c. Cannot be determined from the data given Consider the following budget information d. 42,000 13. and work sthead totals $34800ion: materials to be used totals $64,750, direct labor tosals $198,400 of goods num Progress inventory on rx im, process inventory January 1, 2012, was expected to be S189,100 manufactured?mber 31, 2012, is expected to be S197,600. What is the badgeted cost a. $649,450 b. $657,950 c. $197,600 d. $1,044,650 14. The budgeted finished goods inventory and cost of goods sold for a manufacturing company for the year 2012 aary I finished goods, $765,000: December 31 finished goods, $540,000, cost of goods sold for the year, $2,560,000. The budgeted costs of goods manut a. manufactured for the year is? $1,255,000 b. $2,335,000 c. $2,785,000 d. $3100,000 Nuthatch Corporation began its operations on September I of the current year. Budgeted sales for the first three months of business are $260,000, $350,000, and $400,000, respectively, for September, October, and November. The company expects to sell 30% of its merchandise for cash of sales on account, go% are expected to be collected in the month of the sale and 20% in the month following the sale. 15. The cash collections in September from accounts receivable are: a. $223,600 b. $145,600 c. $192,000 d. $168,000 16. The cash collections in October from accounts receivable are: a. $232,400 b. $240,000 c. $210,000 d. $337,400 17. The cash collections in November from accounts receivable are: a. $294,000 b. $336,000 c. $295,200 d. $273,000 As of January 1 of the current year, the Grackle Company had accounts receivables of S50,000. The sales for January, February, and March of 2012 were as follows: $120,000, $140,000 and $150,000, 20% of each month's sales are for cash. Of the remaining 80% (the credit sales), 60% are collected in the month of sale, with remaining 40% collected in the following month. What is the total cash collected (both from accounts 18. receivable and for cash sales) in the month of January? a. $$74,000 b. $110,000