Answered step by step

Verified Expert Solution

Question

1 Approved Answer

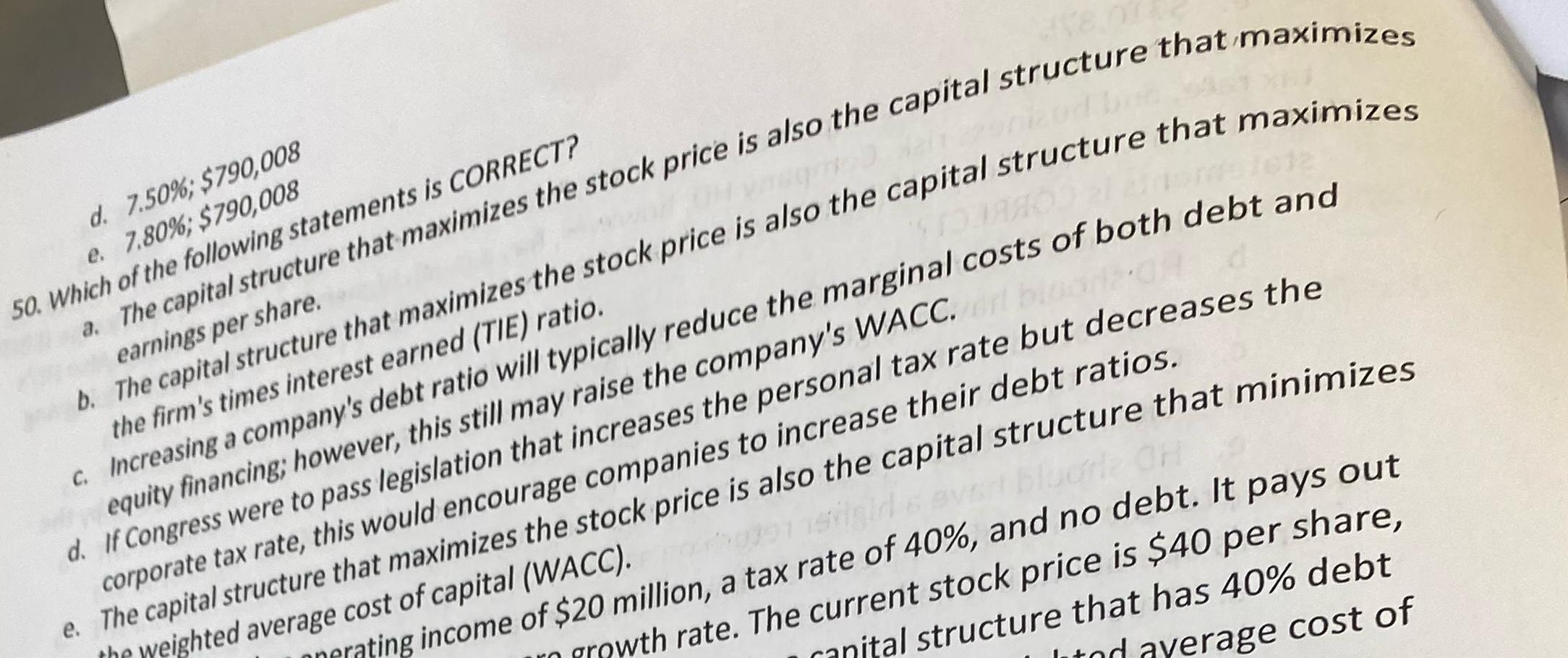

d. 7.50%;$790,008 e. 7,80%;$790,008 50. Which of the following statements is CORRECT? a. The capital structure that maximizes the stock price is also the

d.

7.50%;$790,008\ e.

7,80%;$790,00850. Which of the following statements is CORRECT?\ a. The capital structure that maximizes the stock price is also the capital structure that maximizes earnings per share. the firm's times interest earned (TIE) ratio.\ c. Increasing ancing; howeving debt ratio will typically reduce the marginal costs of both debt and d. If Congress were to pass leg\ corporate tax rate, this would enco gis\ e. The capital structure that maximizes the stock price increase their debt ratios. weighted average cost of capital (WACC).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started