Answered step by step

Verified Expert Solution

Question

1 Approved Answer

D) . A worker aged 40 wishes to accumulate a fund for retirement by depositing $3000 at the beginning of each year for 25 years.

D) . A worker aged 40 wishes to accumulate a fund for retirement by depositing $3000 at the beginning of each year for 25 years. Starting at age 65 the worker plans to make 15 annual equal withdrawals at the beginning of each year. Assuming all payments are certain to be made, find the amount of each withdrawal starting at age 65 to the nearest dollar, if the effective interest rate is 8% during the first 25 years but only 7% thereafter

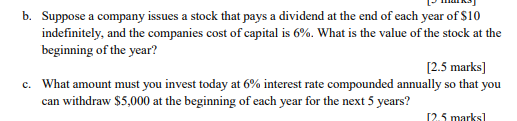

b. Suppose a company issues a stock that pays a dividend at the end of each year of $10 indefinitely, and the companies cost of capital is 6%. What is the value of the stock at the beginning of the year? [2.5 marks ] c. What amount must you invest today at 6% interest rate compounded annually so that you can withdraw $5,000 at the beginning of each year for the next 5 yearsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started