Answered step by step

Verified Expert Solution

Question

1 Approved Answer

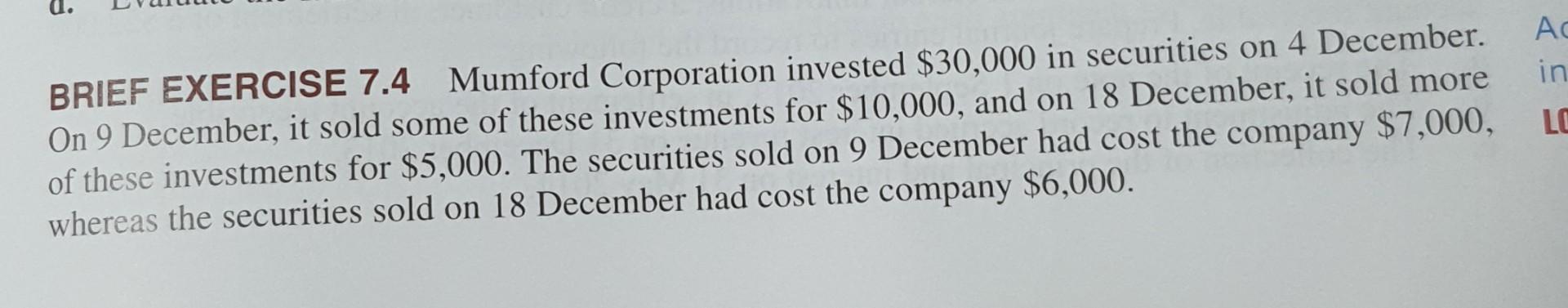

d. AC in LC BRIEF EXERCISE 7.4 Mumford Corporation invested $30,000 in securities on 4 December. On 9 December, it sold some of these investments

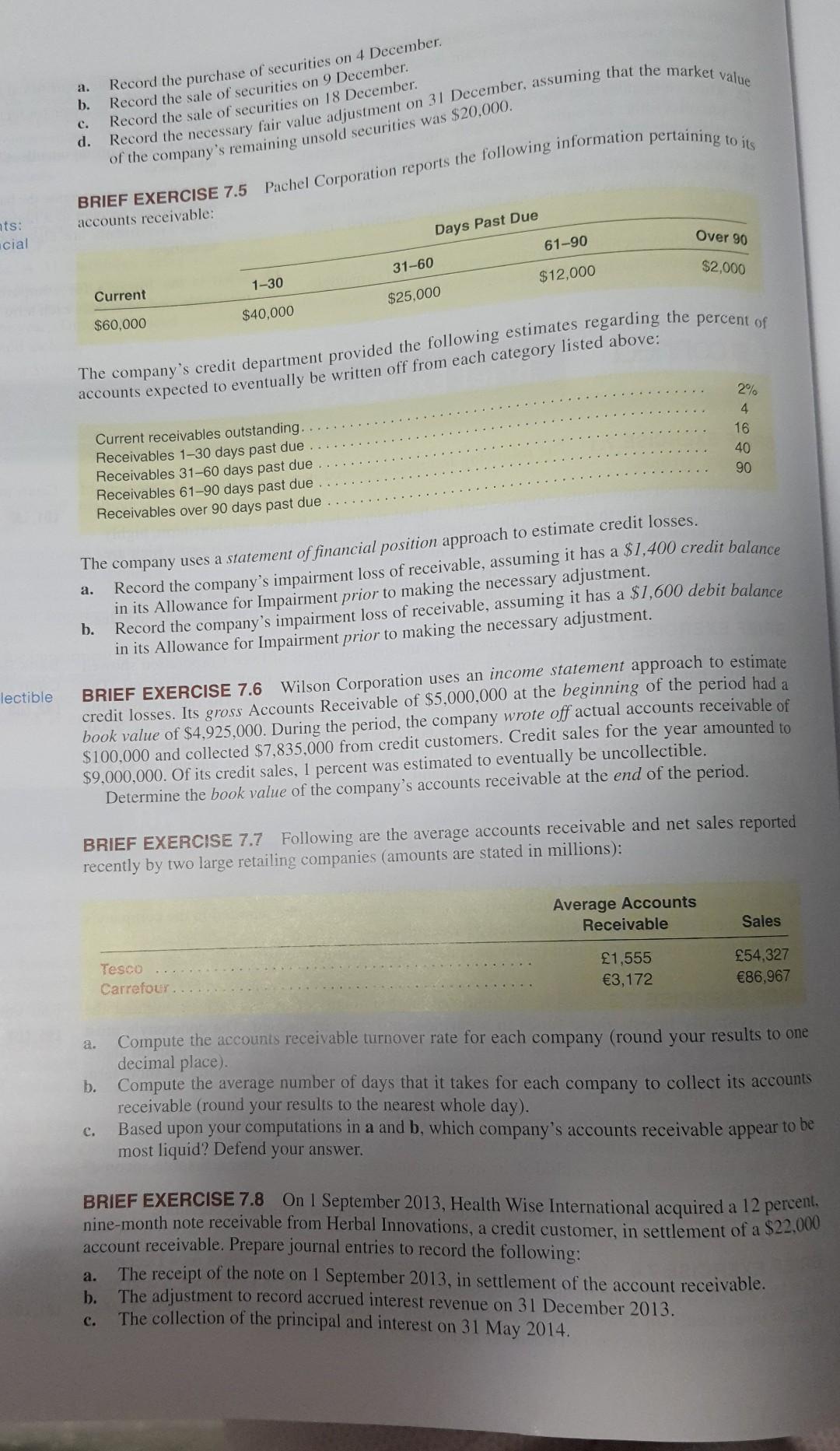

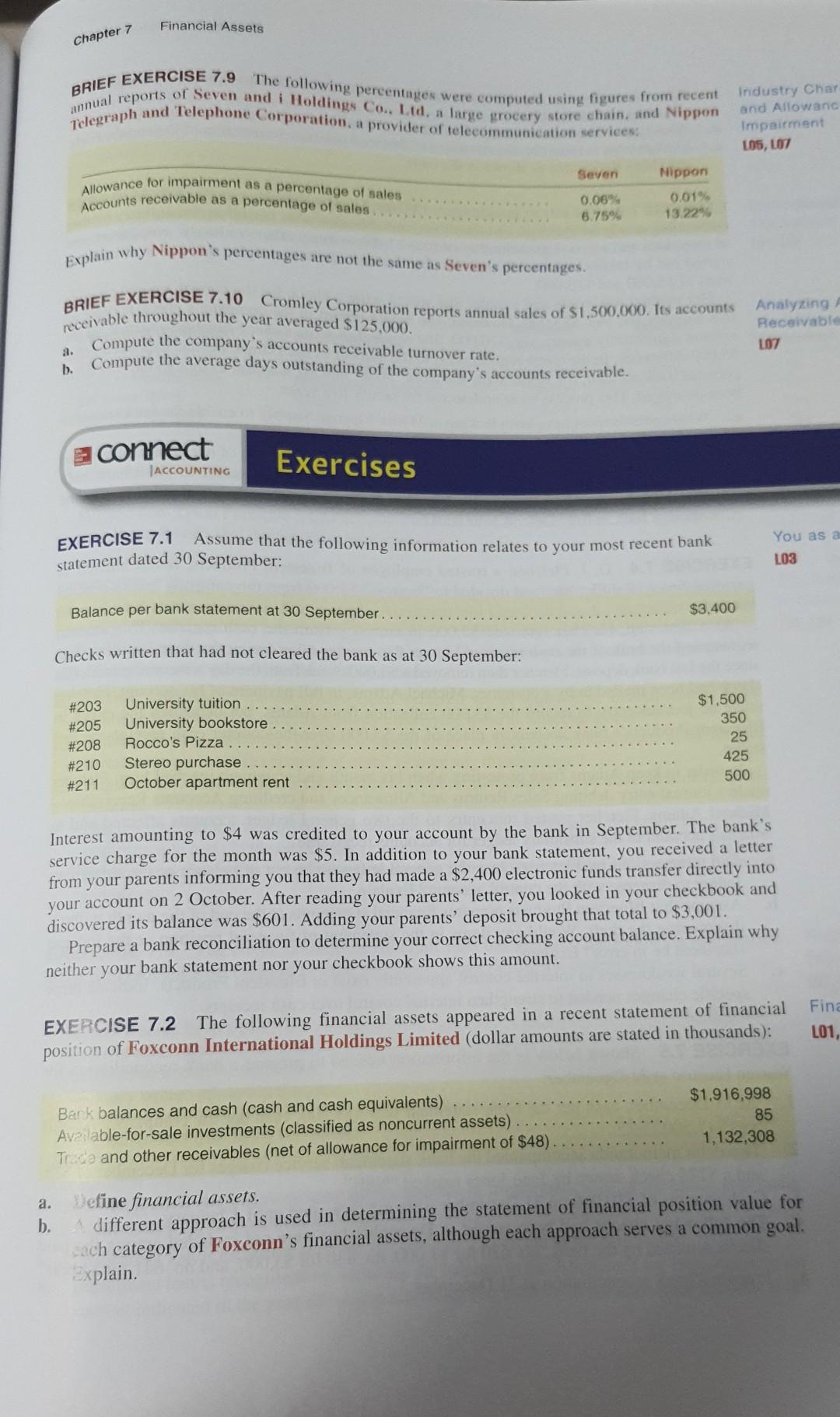

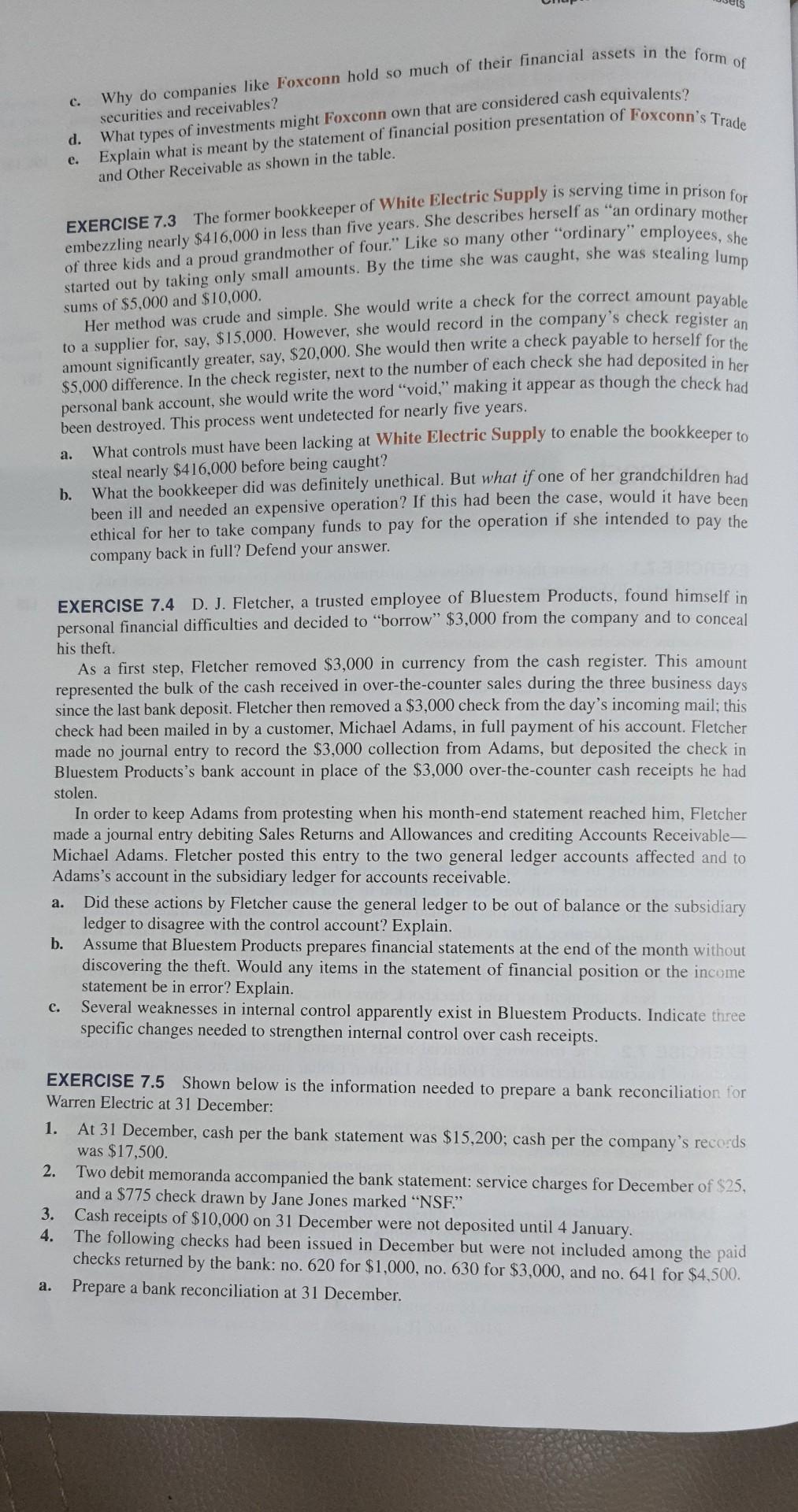

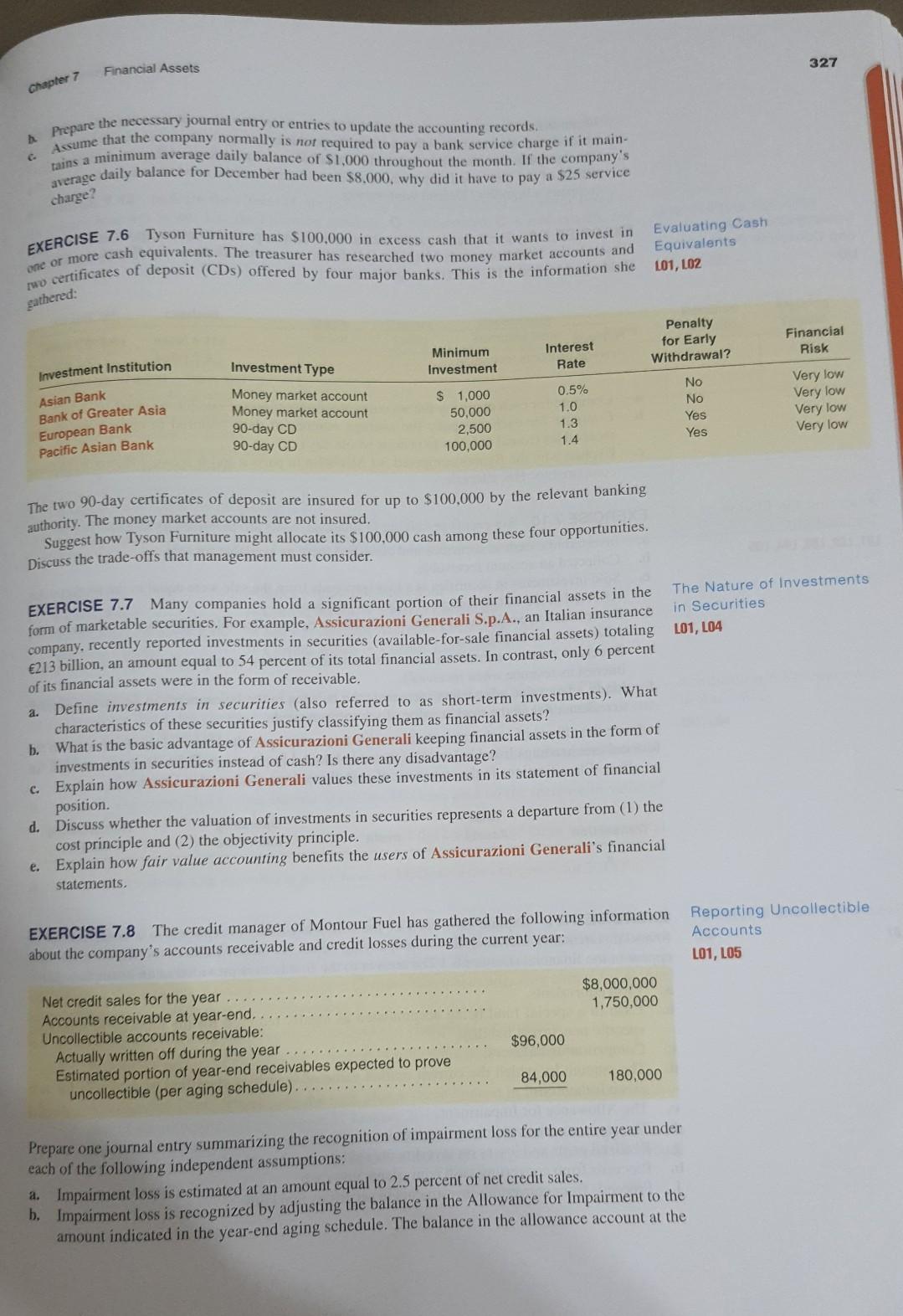

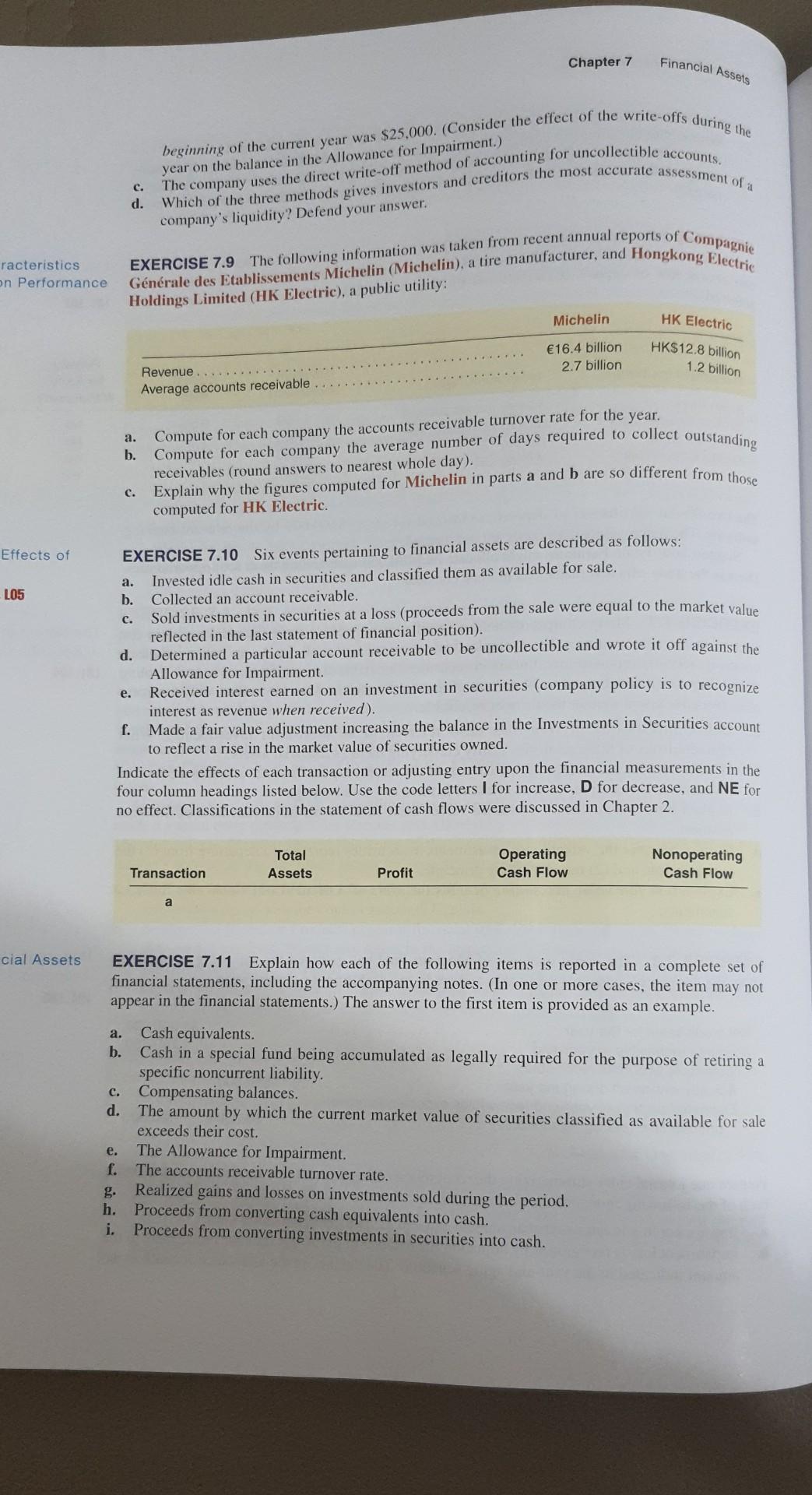

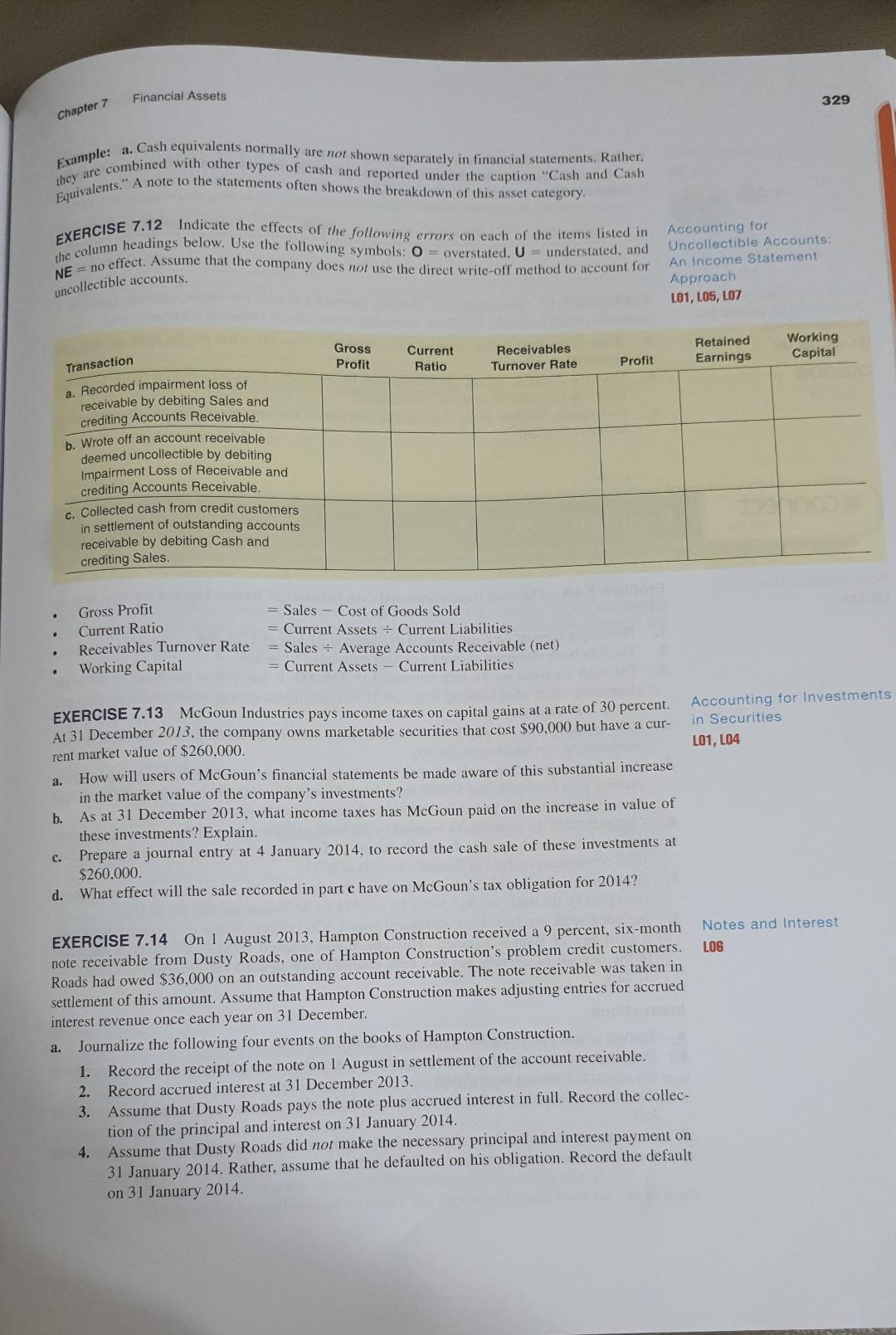

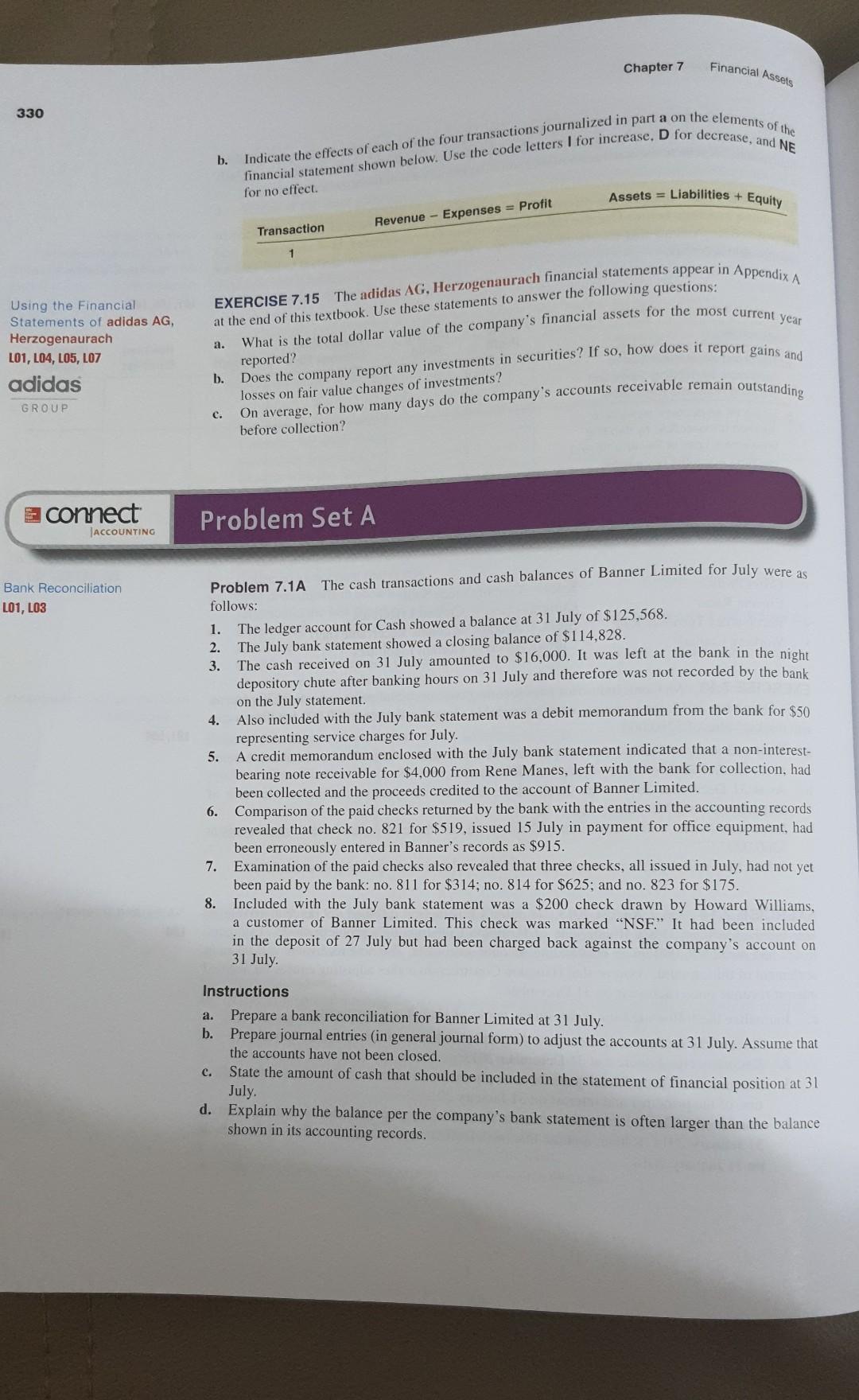

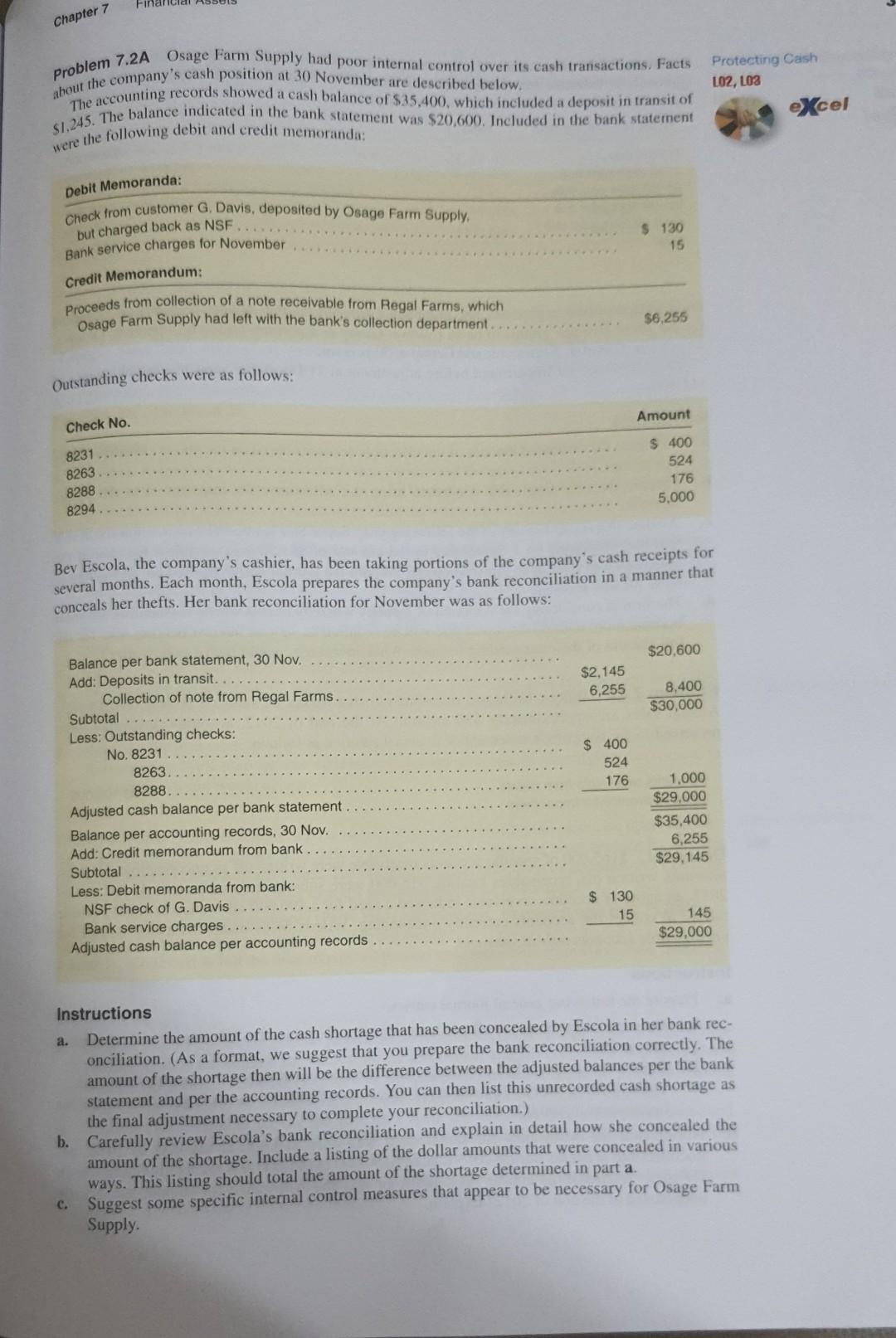

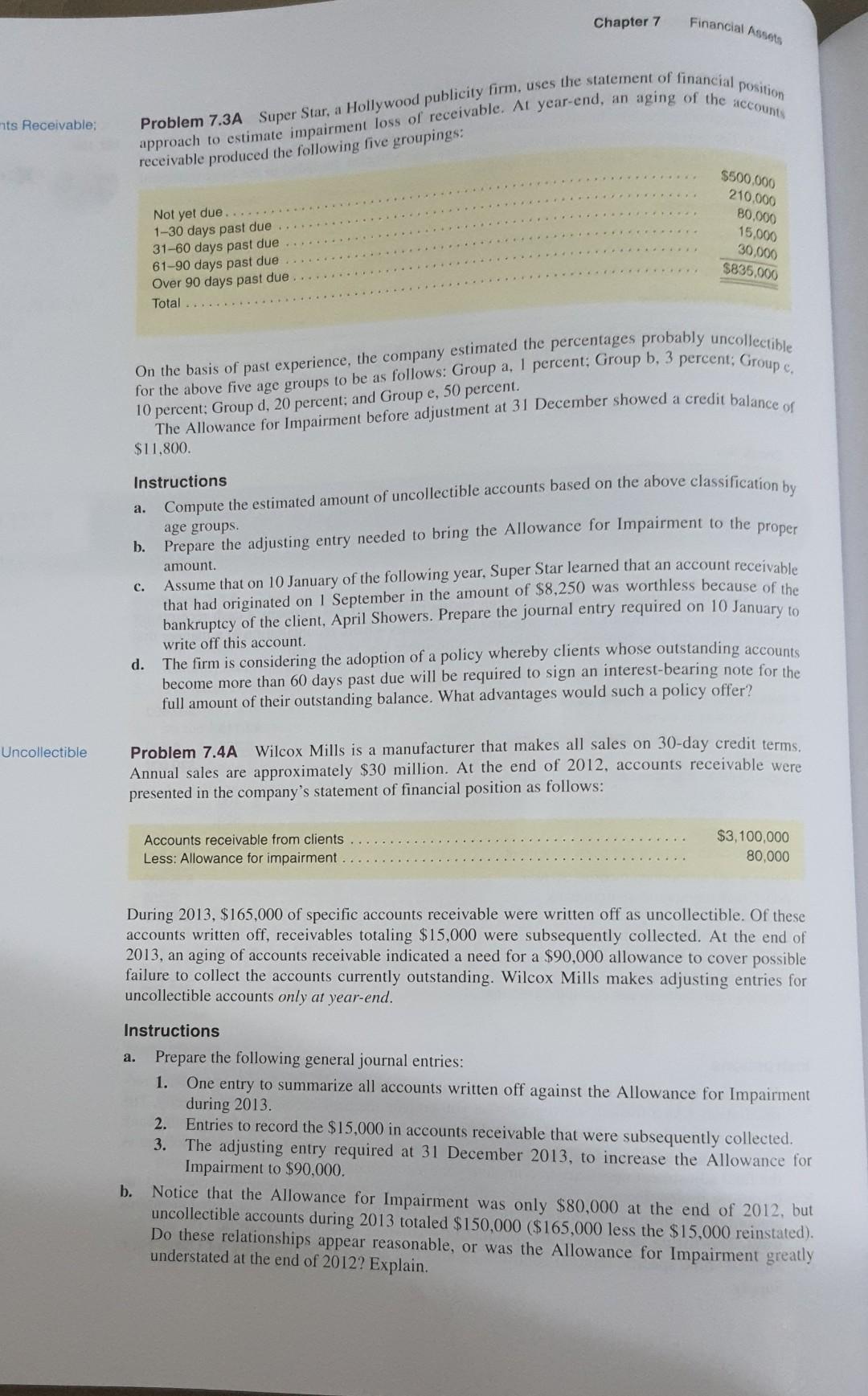

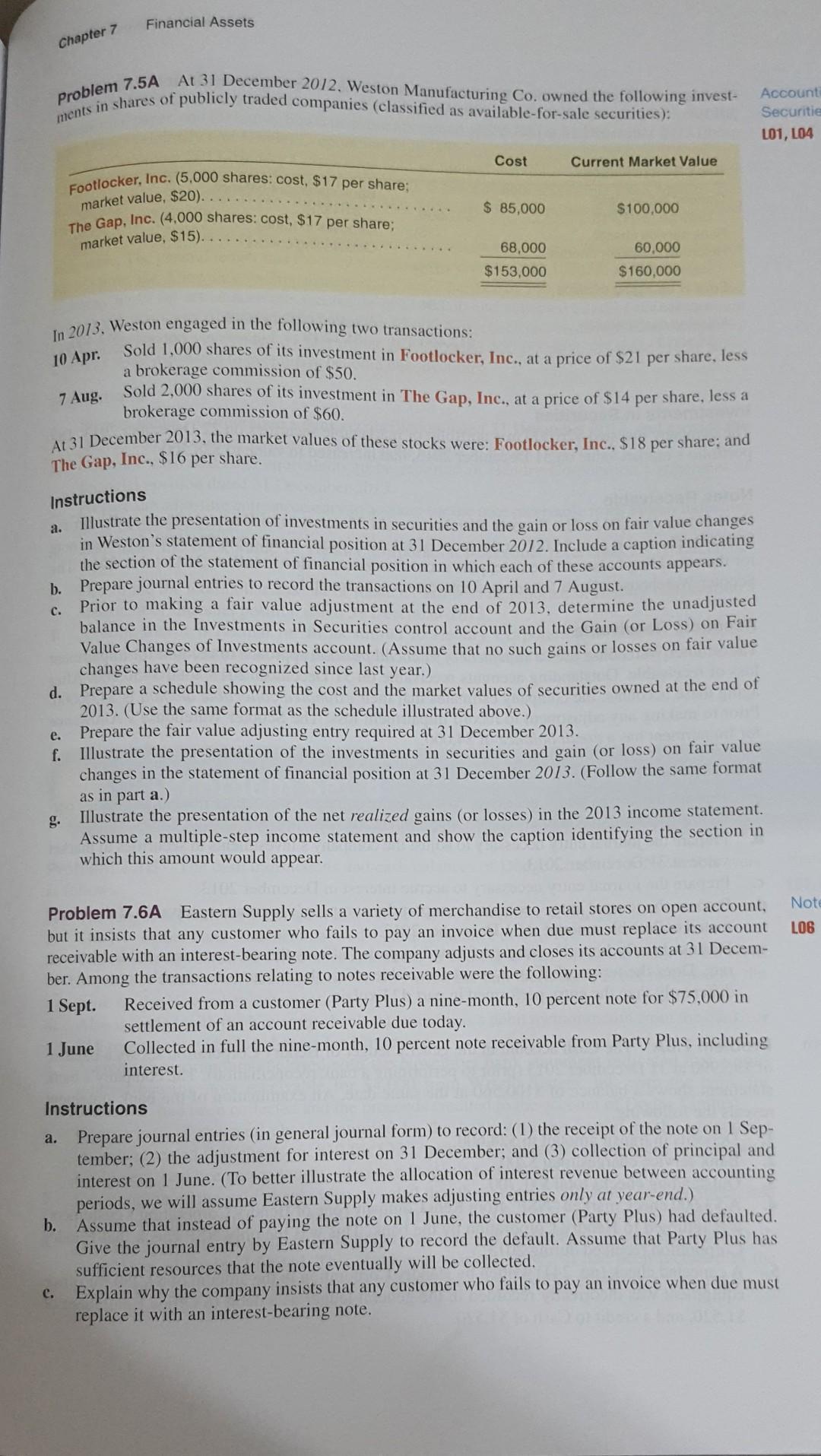

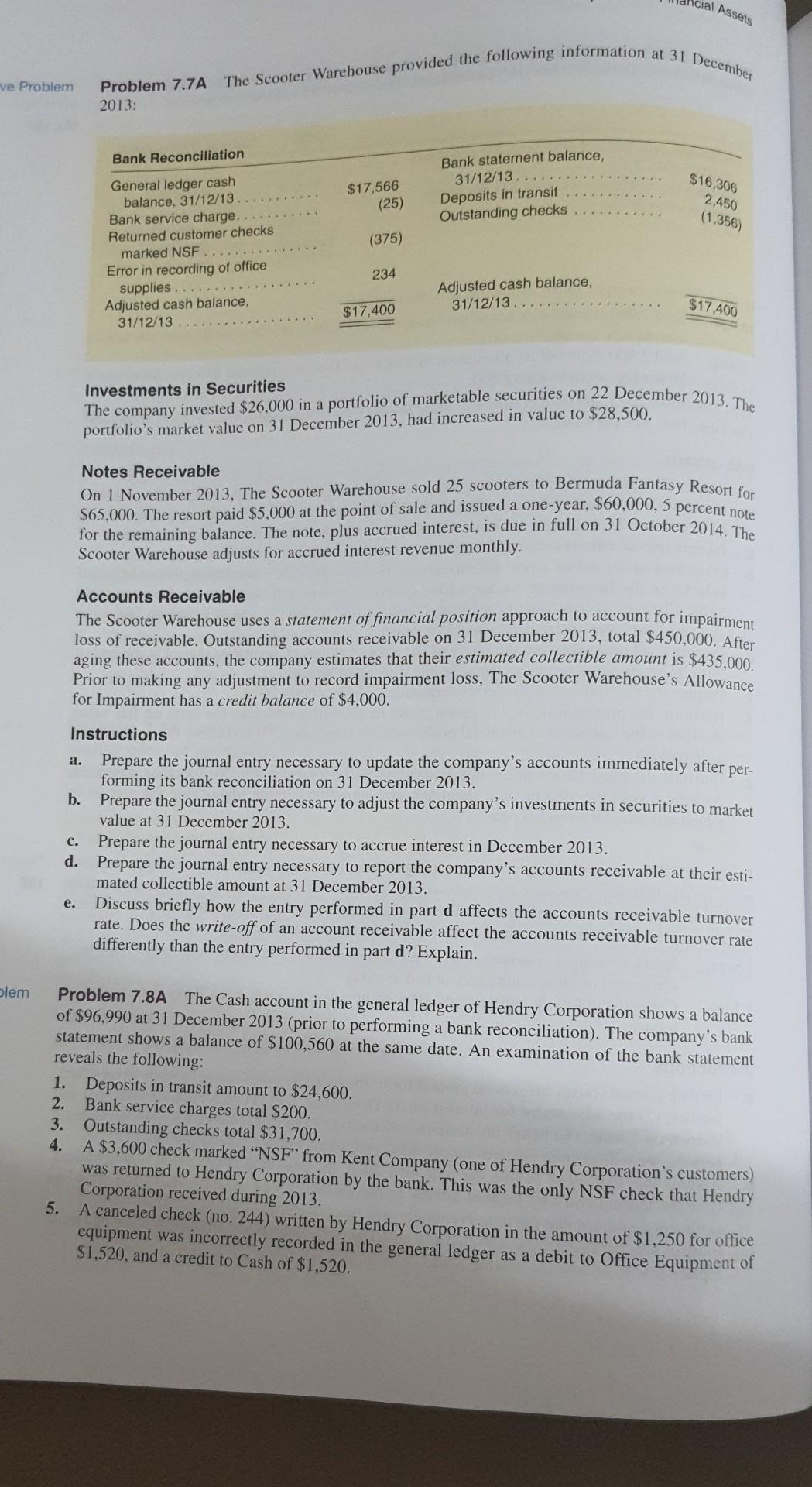

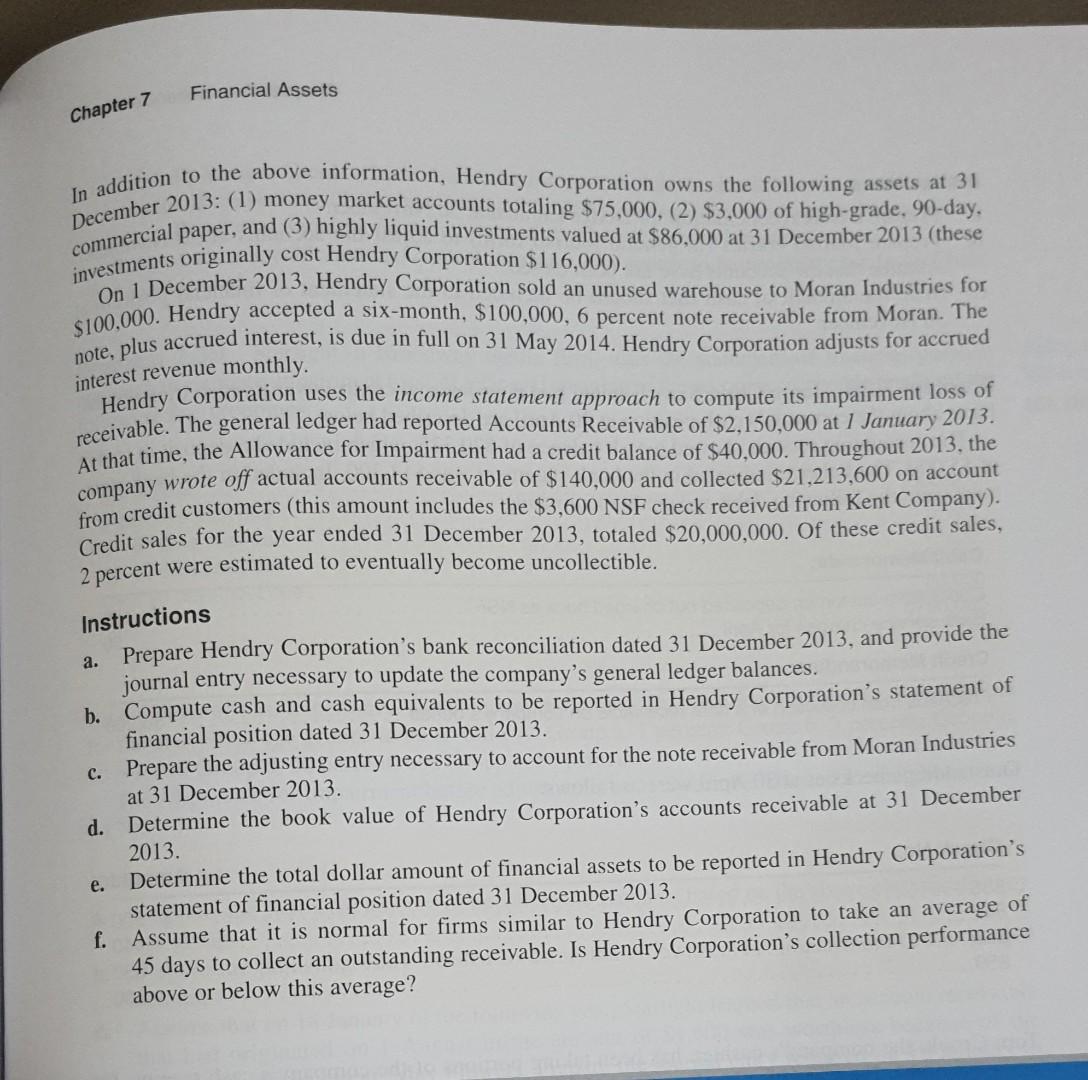

d. AC in LC BRIEF EXERCISE 7.4 Mumford Corporation invested $30,000 in securities on 4 December. On 9 December, it sold some of these investments for $10,000, and on 18 December, it sold more of these investments for $5,000. The securities sold on 9 December had cost the company $7,000, whereas the securities sold on 18 December had cost the company $6,000. b. c. d. Record the purchase of securities on 4 December. Record the sale of securities on 9 December. Record the sale of securities on 18 December. Record the necessary fair value adjustment on 31 December, assuming that the market value of the company's remaining unsold securities was $20,000. BRIEF EXERCISE 7.5 Pachel Corporation reports the following information pertaining to its accounts receivable: ats: cial Days Past Due Over 90 $2,000 Current $25,000 61-90 1-30 31-60 $60,000 $12,000 $40,000 The company's credit department provided the following estimates regarding the percent of accounts expected to eventually be written off from each category listed above: 2% 4 16 40 90 Current receivables outstanding Receivables 1-30 days past due Receivables 31-60 days past due Receivables 61-90 days past due Receivables over 90 days past due a. The company uses a statement of financial position approach to estimate credit losses. Record the company's impairment loss of receivable, assuming it has a $1,400 credit balance in its Allowance for Impairment prior to making the necessary adjustment. Record the company's impairment loss of receivable, assuming it has a $1,600 debit balance in its Allowance for Impairment prior to making the necessary adjustment. b. lectible BRIEF EXERCISE 7.6 Wilson Corporation uses an income statement approach to estimate credit losses. Its gross Accounts Receivable of $5,000,000 at the beginning of the period had a book value of $4,925,000. During the period, the company wrote off actual accounts receivable of $100,000 and collected $7,835,000 from credit customers. Credit sales for the year amounted to $9,000,000. Of its credit sales, 1 percent was estimated to eventually be uncollectible. Determine the book value of the company's accounts receivable at the end of the period. BRIEF EXERCISE 7.7 Following are the average accounts receivable and net sales reported recently by two large retailing companies (amounts are stated in millions): Average Accounts Receivable Sales Tesco Carrefour 1,555 3,172 54,327 86,967 a. Compute the accounts receivable turnover rate for each company (round your results to one decimal place). b. Compute the average number of days that it takes for each company to collect its accounts receivable (round your results to the nearest whole day). Based upon your computations in a and b, which company's accounts receivable appear to be most liquid? Defend your answer. C. BRIEF EXERCISE 7.8 On 1 September 2013, Health Wise International acquired a 12 percent, nine-month note receivable from Herbal Innovations, a credit customer, in settlement of a $22.000 account receivable. Prepare journal entries to record the following: The receipt of the note on 1 September 2013, in settlement of the account receivable. The adjustment to record accrued interest revenue on 31 December 2013. The collection of the principal and interest on 31 May 2014. a. b. Financial Assets Chapter 7 BRIEF EXERCISE 7.9 The following percentages were computed using figures from recent annual reports of Seven and i Holdings Co., Ltd. a large grocery store chain, and Nippon Telegraph and Telephone Corporation, a provider of telecommunication services: Industry Char and Allowanc Impairment LOS, L07 Allowance for impairment as a percentage of sales Accounts receivable as a percentage of sales Seven 0.06% 6.7594 Nippon 0.01% 13.22% Explain why Nippon's percentages are not the same as Seven's percentages. receivable throughout the year averaged $125,000. BRIEF EXERCISE 7.10 Cromley Corporation reports annual sales of $1.500.000. Its accounts Compute the company's accounts receivable turnover rate. Compute the average days outstanding of the company's accounts receivable. Analyzing Receivable LO7 b. connect Exercises JACCOUNTING EXERCISE 7.1 Assume that the following information relates to your most recent bank statement dated 30 September: You as a L03 Balance per bank statement at 30 September.. $3.400 Checks written that had not cleared the bank as at 30 September: #203 #205 #208 #210 #211 University tuition University bookstore Rocco's Pizza Stereo purchase October apartment rent $1,500 350 25 425 500 Interest amounting to $4 was credited to your account by the bank in September. The bank's service charge for the month was $5. In addition to your bank statement, you received a letter from your parents informing you that they had made a $2,400 electronic funds transfer directly into your account on 2 October. After reading your parents' letter, you looked in your checkbook and discovered its balance was $601. Adding your parents' deposit brought that total to $3,001. Prepare a bank reconciliation to determine your correct checking account balance. Explain why neither your bank statement nor your checkbook shows this amount. EXERCISE 7.2 The following financial assets appeared in a recent statement of financial position of Foxconn International Holdings Limited (dollar amounts are stated in thousands): Fin L01, Bark balances and cash (cash and cash equivalents) Ava: able-for-sale investments (classified as noncurrent assets) Te se and other receivables (net of allowance for impairment of $48) $1,916,998 85 1,132,308 a. b. Define financial assets. different approach is used in determining the statement of financial position value for sach category of Foxconn's financial assets, although each approach serves a common goal. Explain. c. Why do companies like Foxconn hold so much of their financial assets in the form of securities and receivables? d. What types of investments might Foxconn own that are considered cash equivalents? Explain what is meant by the statement of financial position presentation of Foxconn's Trade e. and Other Receivable as shown in the table. EXERCISE 7.3 The former bookkeeper of White Electric Supply is serving time in prison for embezzling nearly $416,000 in less than five years. She describes herself as "an ordinary mother of three kids and a proud grandmother of four." Like so many other "ordinary employees, she started out by taking only small amounts. By the time she was caught, she was stealing lump sums of $5,000 and $10,000. Her method was crude and simple. She would write a check for the correct amount payable to a supplier for, say, $15,000. However , she would record in the company's check register an amount significantly greater, say, $20,000. She would then write a check payable to herself for the $5,000 difference. In the check register, next to the number of each check she had deposited in her personal bank account, she would write the word "void," making it appear as though the check had been destroyed. This process went undetected for nearly five years. What controls must have been lacking White Electric Supply to enable the bookkeeper to steal nearly $416,000 before being caught? b. What the bookkeeper did was definitely unethical. But what if one of her grandchildren had been ill and needed an expensive operation? If this had been the case, would it have been ethical for her to take company funds to pay for the operation if she intended to pay the company back in full? Defend your answer. a. EXERCISE 7.4 D. J. Fletcher, a trusted employee of Bluestem Products, found himself in personal financial difficulties and decided to "borrow" $3,000 from the company and to conceal his theft. As a first step, Fletcher removed $3,000 in currency from the cash register. This amount represented the bulk of the cash received in over-the-counter sales during the three business days since the last bank deposit. Fletcher then removed a $3,000 check from the day's incoming mail; this check had been mailed in by a customer, Michael Adams, in full payment of his account. Fletcher made no journal entry to record the $3,000 collection from Adams, but deposited the check in Bluestem Products's bank account in place of the $3,000 over-the-counter cash receipts he had stolen. In order to keep Adams from protesting when his month-end statement reached him, Fletcher made a journal entry debiting Sales Returns and Allowances and crediting Accounts Receivable- Michael Adams. Fletcher posted this entry to the two general ledger accounts affected and to Adams's account in the subsidiary ledger for accounts receivable. Did these actions by Fletcher cause the general ledger to be out of balance or the subsidiary ledger to disagree with the control account? Explain. b. Assume that Bluestem Products prepares financial statements at the end of the month without discovering the theft. Would any items in the statement of financial position or the income statement be in error? Explain. Several weaknesses in internal control apparently exist in Blueste Products. Indicate three specific changes needed to strengthen internal control over cash receipts. a. c. EXERCISE 7.5 Shown below is the information needed to prepare a bank reconciliation for Warren Electric at 31 December: 1. At 31 December, cash per the bank statement was $15,200; cash per the company's records was $17,500. 2. Two debit memoranda accompanied the bank statement: service charges for December of $25, and a $775 check drawn by Jane Jones marked "NSF." 3. Cash receipts of $10,000 on 31 December were not deposited until 4 January. 4. The following checks had been issued in December but were not included among the paid checks returned by the bank: no. 620 for $1,000, no. 630 for $3,000, and no. 641 for $4,500. Prepare a bank reconciliation at 31 December a. 327 Financial Assets Chapter 7 a Prepare the necessary joumal entry or entries to update the accounting records. Assume that the company normally is not required to pay a bank service charge if it main- tains a minimum average daily balance of $1,000 throughout the month. If the company's average daily balance for December had been $8.000, why did it have to pay a $25 service charge? EXERCISE 7.6 Tyson Furniture has $100.000 in excess cash that it wants to invest in one or more cash equivalents. The treasurer has researched two money market accounts and Two certificates of deposit (CDs) offered by four major banks. This is the information she Evaluating Cash Equivalents L01, LO2 gathered: Financial Risk Minimum Investment Interest Rate Investment Type Investment Institution Asian Bank Bank of Greater Asia European Bank Pacific Asian Bank Penalty for Early Withdrawal? No No Yes Money market account Money market account 90-day CD 90-day CD $ 1,000 50,000 2,500 100,000 0.5% 1.0 1.3 1.4 Very low Very low Very low Very low Yes The two 90-day certificates of deposit are insured for up to $100.000 by the relevant banking authority. The money market accounts are not insured. Suggest how Tyson Furniture might allocate its $100.000 cash among these four opportunities. Discuss the trade-offs that management must consider. EXERCISE 7.7 Many companies hold a significant portion of their financial assets in the The Nature of Investments form of marketable securities. For example, Assicurazioni Generali S.p.A., an Italian insurance in Securities company, recently reported investments in securities (available-for-sale financial assets) totaling L01, L04 213 billion, an amount equal to 54 percent of its total financial assets. In contrast, only 6 percent of its financial assets were in the form of receivable. a. Define investments in securities (also referred to as short-term investments). What characteristics of these securities justify classifying them as financial assets? b. What is the basic advantage of Assicurazioni Generali keeping financial assets in the form of investments in securities instead of cash? Is there any disadvantage? c. Explain how Assicurazioni Generali values these investments in its statement of financial position. d. Discuss whether the valuation of investments in securities represents a departure from (1) the cost principle and (2) the objectivity principle. e. Explain how fair value accounting benefits the users of Assicurazioni Generali's financial statements, EXERCISE 7.8 The credit manager of Montour Fuel has gathered the following information about the company's accounts receivable and credit losses during the current year: Reporting Uncollectible Accounts LO1, LOS $8,000,000 1,750,000 Net credit sales for the year ... Accounts receivable at year-end. Uncollectible accounts receivable: Actually written off during the year Estimated portion of year-end receivables expected to prove uncollectible (per aging schedule). $96,000 84,000 180,000 Prepare one journal entry summarizing the recognition of impairment loss for the entire year under each of the following independent assumptions: a. Impairment loss is estimated at an amount equal to 2.5 percent of net credit sales. b. Impairment loss is recognized by adjusting the balance in the Allowance for Impairment to the amount indicated in the year-end aging schedule. The balance in the allowance account at the Chapter 7 Financial Assets beginning of the current year was $25,000. (Consider the effect of the write-offs during the Which of the three methods gives investors and creditors the most accurate assessment of a The company uses the direct write-off method of accounting for uncollectible accounts. year on the balance in the Allowance for Impairment.) c. d. company's liquidity? Defend your answer. racteristics on Performance EXERCISE 7.9 The following information was taken from recent annual reports of Compagnie Gnrale des Etablissements Michelin (Michelin), a tire manufacturer, and Hongkong Electric Holdings Limited (HK Electric), a public utility: Michelin HK Electric 16.4 billion 2.7 billion HK$12.8 billion 1.2 billion Revenue...... Average accounts receivable a. b. Compute for each company the accounts receivable turnover rate for the year. Compute for each company the average number of days required to collect outstanding receivables (round answers to nearest whole day). Explain why the figures computed for Michelin in parts a and b are so different from those computed for HK Electric. C. Effects of a. L05 EXERCISE 7.10 Six events pertaining to financial assets are described as follows: Invested idle cash in securities and classified them as available for sale. b. Collected an account receivable. c. Sold investments in securities at a loss (proceeds from the sale were equal to the market value reflected in the last statement of financial position). d. Determined a particular account receivable to be uncollectible and wrote it off against the Allowance for Impairment. Received interest earned on an investment in securities (company policy is to recognize interest as revenue when received). f. Made a fair value adjustment increasing the balance in the Investments in Securities account to reflect a rise in the market value of securities owned. Indicate the effects of each transaction or adjusting entry upon the financial measurements in the four column headings listed below. Use the code letters I for increase, D for decrease, and NE for no effect. Classifications in the statement of cash flows were discussed in Chapter 2. e. Total Assets Operating Cash Flow Nonoperating Cash Flow Transaction Profit a cial Assets EXERCISE 7.11 Explain how each of the following items is reported in a complete set of financial statements, including the accompanying notes. (In one or more cases, the item may not appear in the financial statements.) The answer to the first item is provided as an example. a. c. Cash equivalents. b. Cash in a special fund being accumulated as legally required for the purpose of retiring a specific noncurrent liability. Compensating balances. d. The amount by which the current market value of securities classified as available for sale exceeds their cost. e. The Allowance for Impairment. f. The accounts receivable turnover rate. g. Realized gains and losses on investments sold during the period. h. Proceeds from converting cash equivalents into cash. i. Proceeds from converting investments in securities into cash. Financial Assets 329 Chapter 7 they are combined with other types of cash and reported under the caption "Cash and Cash Example: a. Cash equivalents normally are not shown separately in financial statements. Rather. Equivalents." A note to the statements often shows the breakdown of this asset category. EXERCISE 7.12 Indicate the effects of the following errors on each of the items listed in the column headings below. Use the following symbols: 0 = overstated. U = understated, and NE = no effect. Assume that the company does not use the direct write-off method to account for Accounting for Uncollectible Accounts: An Income Statement Approach L01, LOS, LOZ uncollectible accounts. Gross Profit Current Ratio Retained Earnings Receivables Turnover Rate Working Capital Transaction Profit a. Recorded impairment loss of receivable by debiting Sales and crediting Accounts Receivable. b. Wrote off an account receivable deemed uncollectible by debiting Impairment Loss of Receivable and crediting Accounts Receivable. c. Collected cash from credit customers in settlement of outstanding accounts receivable by debiting Cash and crediting Sales . Gross Profit Current Ratio Receivables Turnover Rate Working Capital Sales - Cost of Goods Sold Current Assets - Current Liabilities Sales Average Accounts Receivable (net) = Current Assets - Current Liabilities Accounting for Investments in Securities L01, L04 a. EXERCISE 7.13 McGoun Industries pays income taxes on capital gains at a rate of 30 percent. At 31 December 2013, the company owns marketable securities that cost $90,000 but have a cur- rent market value of $260,000. How will users of McGoun's financial statements be made aware of this substantial increase in the market value of the company's investments? b. As at 31 December 2013, what income taxes has McGoun paid on the increase in value of these investments? Explain. Prepare a journal entry at 4 January 2014, to record the cash sale of these investments at $260,000. d. What effect will the sale recorded in parte have on McGoun's tax obligation for 2014? c. Notes and Interest LOG a. EXERCISE 7.14 On 1 August 2013, Hampton Construction received a 9 percent, six-month note receivable from Dusty Roads, one of Hampton Construction's problem credit customers. Roads had owed $36,000 on an outstanding account receivable. The note receivable was taken in settlement of this amount. Assume that Hampton Construction makes adjusting entries for accrued interest revenue once each year on 31 December. Journalize the following four events on the books of Hampton Construction. 1. Record the receipt of the note on 1 August in settlement of the account receivable. 2. Record accrued interest at 31 December 2013. 3. Assume that Dusty Roads pays the note plus accrued interest in full. Record the collec- tion of the principal and interest on 31 January 2014. 4. Assume that Dusty Roads did not make the necessary principal and interest payment on 31 January 2014. Rather, assume that he defaulted on his obligation. Record the default on 31 January 2014 Chapter 7 Financial Assets 330 b. Indicate the effects of each of the four transactions journalized in part a on the elements of the financial statement shown below. Use the code letters I for increase, D for decrease, and NE for no effect Assets = Liabilities + Equity Revenue - Expenses = Profit Transaction EXERCISE 7.15 The adidas AG, Herzogenaurach financial statements appear in Appendix A What is the total dollar value of the company's financial assets for the most current year a. at the end of this textbook. Use these statements to answer the following questions: Using the Financial Statements of adidas AG, Herzogenaurach L01, L04, LOS, LO7 adidas GROUP reported? b. Does the company report any investments in securities? If so, how does it report gains and of ? c. On average, for how many days do the company's accounts receivable remain outstanding before collection? connect Problem Set A ACCOUNTING Bank Reconciliation L01, LO3 Problem 7.14 The cash transactions and cash balances of Banner Limited for July were as follows: 1. The ledger account for Cash showed a balance at 31 July of $125,568. 2. The July bank statement showed a closing balance of $114,828. 3. The cash received on 31 July amounted to $16,000. It was left at the bank in the night depository chute after banking hours on 31 July and therefore was not recorded by the bank on the July statement. 4. Also included with the July bank statement was a debit memorandum from the bank for $50 representing service charges for July. 5. A credit memorandum enclosed with the July bank statement indicated that a non-interest- bearing note receivable for $4,000 from Rene Manes, left with the bank for collection, had been collected and the proceeds credited to the account of Banner Limited. 6. Comparison of the paid checks returned by the bank with the entries in the accounting records revealed that check no. 821 for $519, issued 15 July in payment for office equipment, had been erroneously entered in Banner's records as $915. 7. Examination of the paid checks also revealed that three checks, all issued in July, had not yet been paid by the bank: no. 811 for $314; no. 814 for $625; and no. 823 for $175. 8. Included with the July bank statement was a $200 check drawn by Howard Williams, a customer of Banner Limited. This check was marked "NSE It had been included in the deposit of 27 July but had been charged back against the company's account on 31 July Instructions a. Prepare a bank reconciliation for Banner Limited at 31 July. b. Prepare journal entries (in general journal form) to adjust the accounts at 31 July. Assume that the accounts have not been closed. State the amount of cash that should be included in the statement of financial position at 31 July d. Explain why the balance per the company's bank statement is often larger than the balance shown in its accounting records. c. Financial Chapter 7 Problem 7.2A Osage Farm Supply had poor internal control over its cash transactions. Facts about the company's cash position at 30 November are described below. The accounting records showed a cash balance of $35.400, which included a deposit in transit of $1.245. The balance indicated in the bank statement was $20.600. Included in the bank statement were the following debit and credit memoranda: Protecting Cash L02, LOS Xcel Debit Memoranda: Check from customer G, Davis, deposited by Osage Farm Supply $ 130 15 but charged back as NSF Bank service charges for November Credit Memorandum: proceeds from collection of a note receivable from Regal Farms, which Osage Farm Supply had left with the bank's collection department $6,255 Outstanding checks were as follows: Amount Check No. 8231 8263 8288 8294 $400 524 176 5.000 Bev Escola, the company's cashier, has been taking portions of the company's cash receipts for several months. Each month, Escola prepares the company's bank reconciliation in a manner that conceals her thefts. Her bank reconciliation for November was as follows: $20.600 $2.145 6,255 8,400 $30,000 $ 400 524 176 Balance per bank statement, 30 Nov. Add: Deposits in transit.. Collection of note from Regal Farms Subtotal .... Less: Outstanding checks: No. 8231 8263 8288. Adjusted cash balance per bank statement Balance per accounting records, 30 Nov. Add: Credit memorandum from bank Subtotal ...... Less: Debit memoranda from bank: NSF check of G. Davis Bank service charges... Adjusted cash balance per accounting records 1,000 $29.000 $35,400 6,255 $29,145 $ 130 15 145 $29,000 a. Instructions Determine the amount of the cash shortage that has been concealed by Escola in her bank rec- onciliation. (As a format, we suggest that you prepare the bank reconciliation correctly. The amount of the shortage then will be the difference between the adjusted balances per the bank statement and per the accounting records. You can then list this unrecorded cash shortage as the final adjustment necessary to complete your reconciliation.) b. Carefully review Escola's bank reconciliation and explain in detail how she concealed the amount of the shortage. Include a listing of the dollar amounts that were concealed in various ways. This listing should total the amount of the shortage determined in part a. c. Suggest some specific internal control measures that appear to be necessary for Osage Farm Supply Chapter 7 Financial Assets an aging of the accounts Problem 7.3A Super Star, a Hollywood publicity firm, uses the statement of financial position mts Receivable; approach to estimate impairment loss of receivable. At year-end, receivable produced the following five groupings: Not yet due 1-30 days past due 31-60 days past due 61-90 days past due Over 90 days past due Total $500,000 210,000 80.000 15,000 30,000 $835,000 On the basis of past experience, the company estimated the percentages probably uncollectible for the above five age groups to be as follows: Group a. I percent: Group b, 3 percent; Groupe The Allowance for Impairment before adjustment at 31 December showed a credit balance of $11.800. 10 percent; Group d, 20 percent; and Group e, 50 percent. a. age groups c. Instructions Compute the estimated amount of uncollectible accounts based on the above classification by b. Prepare the adjusting entry needed to bring the Allowance for Impairment to the proper Assume that on 10 January of the following year, Super Star learned that an account receivable that had originated on 1 September in the amount of $8,250 was worthless because of the bankruptcy of the client, April Showers. Prepare the journal entry required on 10 January to The firm is considering the adoption of a policy whereby clients whose outstanding accounts become more than 60 days past due will be required to sign an interest-bearing note for the full amount of their outstanding balance. What advantages would such a policy offer? write off this account. d. Uncollectible Problem 7.44 Wilcox Mills is a manufacturer that makes all sales on 30-day credit terms, Annual sales are approximately $30 million. At the end of 2012, accounts receivable were presented in the company's statement of financial position as follows: Accounts receivable from clients Less: Allowance for impairment. $3,100,000 80,000 During 2013, $165,000 of specific accounts receivable were written off as uncollectible. Of these accounts written off, receivables totaling $15,000 were subsequently collected. At the end of 2013, an aging of accounts receivable indicated a need for a $90,000 allowance to cover possible failure to collect the accounts currently outstanding. Wilcox Mills makes adjusting entries for uncollectible accounts only at year-end. Instructions a. Prepare the following general journal entries: 1. One entry to summarize all accounts written off against the Allowance for Impairment during 2013 2. Entries to record the $15,000 in accounts receivable that were subsequently collected. 3. The adjusting entry required at 31 December 2013, to increase the Allowance for Impairment to $90,000. b. Notice that the Allowance for Impairment was only $80,000 at the end of 2012, but uncollectible accounts during 2013 totaled $150,000 ($165,000 less the $15,000 reinstated). Do these relationships appear reasonable, or was the Allowance for Impairment greatly understated at the end of 2012? Explain. Financial Assets Chapter 7 Problem 7.5A At 31 December 2012, Weston Manufacturing Co. owned the following invest- ments in shares of publicly traded companies (classified as available-for-sale securities): Account Securitie L01, L04 Cost Current Market Value Footlocker, Inc. (5,000 shares: cost, $17 per share: market value, $20). $ 85,000 $100,000 The Gap, Inc. (4,000 shares: cost, $17 per share; market value, $15). 68,000 $153,000 60,000 $160,000 10 Apr. In 2013. Weston engaged in the following two transactions: Sold 1,000 shares of its investment in Footlocker, Inc., at a price of $21 per share, less a brokerage commission of $50. Sold 2,000 shares of its investment in The Gap, Inc., at a price of $14 per share, less a brokerage commission of $60. At 31 December 2013, the market values of these stocks were: Footlocker, Inc., $18 per share; and The Gap, Inc., $16 per share. 7 Aug Instructions a. c. Illustrate the presentation of investments in securities and the gain or loss on fair value changes in Weston's statement of financial position at 31 December 2012. Include a caption indicating the section of the statement of financial position in which each of these accounts appears. b. Prepare journal entries to record the transactions on 10 April and 7 August. Prior to making a fair value adjustment at the end of 2013, determine the unadjusted balance in the Investments in Securities control account and the Gain (or Loss) on Fair Value Changes of Investments account. (Assume that no such gains or losses on fair value changes have been recognized since last year.) d. Prepare a schedule showing the cost and the market values of securities owned at the end of 2013. (Use the same format as the schedule illustrated above.) Prepare the fair value adjusting entry required at 31 December 2013. f. Illustrate the presentation of the investments in securities and gain (or loss) on fair value changes in the statement of financial position at 31 December 2013. (Follow the same format as in part a.) Illustrate the presentation of the net realized gains (or losses) in the 2013 income statement. Assume a multiple-step income statement and show the caption identifying the section in which this amount would appear. e. g. Not LOG Problem 7.64 Eastern Supply sells a variety of merchandise to retail stores on open account, but it insists that any customer who fails to pay an invoice when due must replace its account receivable with an interest-bearing note. The company adjusts and closes its accounts at 31 Decem- ber. Among the transactions relating to notes receivable were the following: 1 Sept. Received from a customer (Party Plus) a nine-month, 10 percent note for $75,000 in settlement of an account receivable due today. 1 June Collected in full the nine-month, 10 percent note receivable from Party Plus, including interest. a. Instructions Prepare journal entries (in general journal form) to record: (1) the receipt of the note on 1 Sep- tember; (2) the adjustment for interest on 31 December; and (3) collection of principal and interest on 1 June. (To better illustrate the allocation of interest revenue between accounting periods, we will assume Eastern Supply makes adjusting entries only at year-end.) b. Assume that instead of paying the note on 1 June, the customer (Party Plus) had defaulted. Give the journal entry by Eastern Supply to record the default. Assume that Party Plus has sufficient resources that the note eventually will be collected, c. Explain why the company insists that any customer who fails to pay an invoice when due must replace it with an interest-bearing note. cial Assets Problem 7.7A The Scooter Warehouse provided the following information at 31 December ve Problem 2013: Bank Reconciliation $17,566 (25) Bank statement balance, 31/12/13... Deposits in transit Outstanding checks $16.306 2.450 (1,356) (375) General ledger cash balance. 31/12/13 Bank service charge, Returned customer checks marked NSF Error in recording of office supplies Adjusted cash balance, 31/12/13 234 Adjusted cash balance, 31/12/13 $17 400 $17,400 Investments in Securities The company invested $26,000 in a portfolio of marketable securities on 22 December 2013. The portfolio's market value on 31 December 2013, had increased in value to $28,500. Notes Receivable On 1 November 2013, The Scooter Warehouse sold 25 scooters to Bermuda Fantasy Resort for $65,000. The resort paid $5,000 at the point of sale and issued a one-year, $60,000, 5 percent note for the remaining balance. The note, plus accrued interest, is due in full on 31 October 2014. The Scooter Warehouse adjusts for accrued interest revenue monthly. Accounts Receivable The Scooter Warehouse uses a statement of financial position approach to account for impairment loss of receivable. Outstanding accounts receivable on 31 December 2013, total $450,000. After aging these accounts, the company estimates that their estimated collectible amount is $435.000 Prior to making any adjustment to record impairment loss, The poter Warehouse's Allowance for Impairment has a credit balance of $4,000. a. Instructions Prepare the journal entry necessary to update the company's accounts immediately after per- forming its bank reconciliation on 31 December 2013. b. Prepare the journal entry necessary to adjust the company's investments in securities to market value at 31 December 2013. Prepare the journal entry necessary to accrue interest in December 2013. d. Prepare the journal entry necessary to report the company's accounts receivable at their esti- mated collectible amount at 31 December 2013. Discuss briefly how the entry performed in part d affects the accounts receivable turnover rate. Does the write-off of an account receivable affect the accounts receivable turnover rate differently than the entry performed in part d? Explain. c. e. blem Problem 7.84 The Cash account in the general ledger of Hendry Corporation shows a balance of $96,990 at 31 December 2013 (prior to performing a bank reconciliation). The company's bank statement shows a balance of $100,560 at the same date. An examination of the bank statement reveals the following: 1. Deposits in transit amount to $24,600. 2. Bank service charges total $200. 3. Outstanding checks total $31,700. 4. A $3,600 check marked "NSF" from Kent Company (one of Hendry Corporation's customers) was returned to Hendry Corporation by the bank. This was the only NSF check that Hendry Corporation received during 2013. 5. A canceled check (no. 244) written by Hendry Corporation in the amount of $1,250 for office equipment was incorrectly recorded in the general ledger as a debit to Office Equipment of $1,520, and a credit to Cash of $1,520. Financial Assets Chapter 7 interest revenue monthly. December 2013: (1) money market accounts totaling $75,000, (2) $3,000 of high-grade, 90-day. In addition to the above information, Hendry Corporation owns the following assets at 31 commercial paper, and (3) highly liquid investments valued at $86,000 at 31 December 2013 (these investments originally cost Hendry Corporation $116,000). On 1 December 2013, Hendry Corporation sold an unused warehouse to Moran Industries for $100,000. Hendry accepted a six-month, $100,000, 6 percent note receivable from Moran. The note, plus accrued interest, is due in full on 31 May 2014. Hendry Corporation adjusts for accrued Hendry Corporation uses the income statement approach to compute its impairment loss of receivable . The general ledger had reported Accounts Receivable of $2,150,000 at 1 January 2013. At that time, the Allowance for Impairment had a credit balance of $40,000. Throughout 2013, the company wrote off actual accounts receivable of $140,000 and collected $21,213,600 on account from credit customers (this amount includes the $3,600 NSF check received from Kent Company). Credit sales for the year ended 31 December 2013, totaled $20,000,000. Of these credit sales, 2 percent were estimated to eventually become uncollectible. Instructions a. Prepare Hendry Corporation's bank reconciliation dated 31 December 2013, and provide the journal entry necessary to update the company's general ledger balances. b. Compute cash and cash equivalents to be reported in Hendry Corporation's statement of financial position dated 31 December 2013. c. Prepare the adjusting entry necessary to account for the note receivable from Moran Industries at 31 December 2013. d. Determine the book value of Hendry Corporation's accounts receivable at 31 December 2013. Determine the total dollar amount of financial assets to be reported in Hendry Corporation's statement of financial position dated 31 December 2013. f. Assume that it is normal for firms similar to Hendry Corporation to take an average of 45 days to collect an outstanding receivable. Is Hendry Corporation's collection performance above or below this average? e

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started