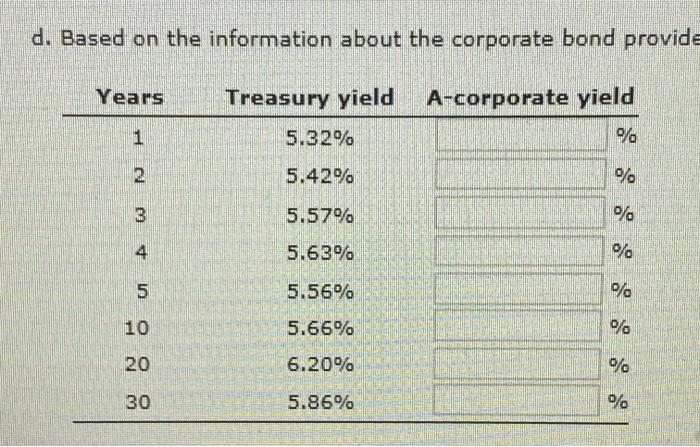

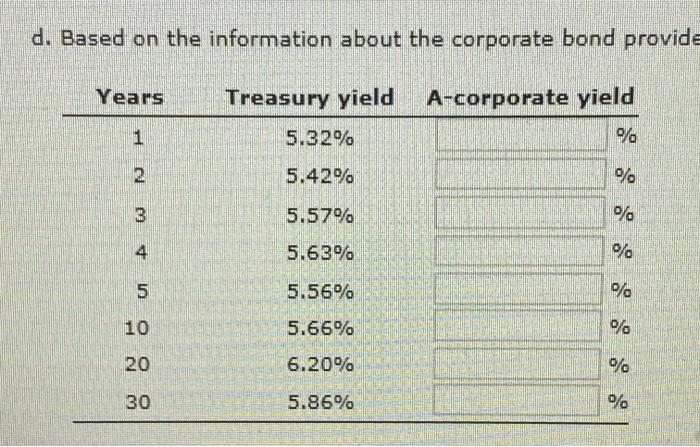

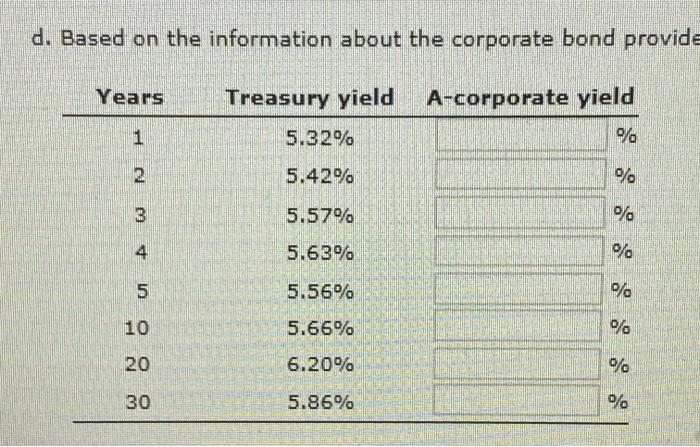

D. Based on the information about the corp bond provided in part b, calc yields and then construct a new yield curve graph that shows both Treasury and the corp bonds. 2 dec places

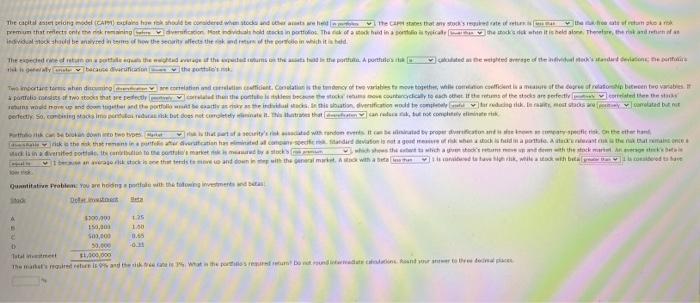

3. Risk and rates of return: risk in portfolio context

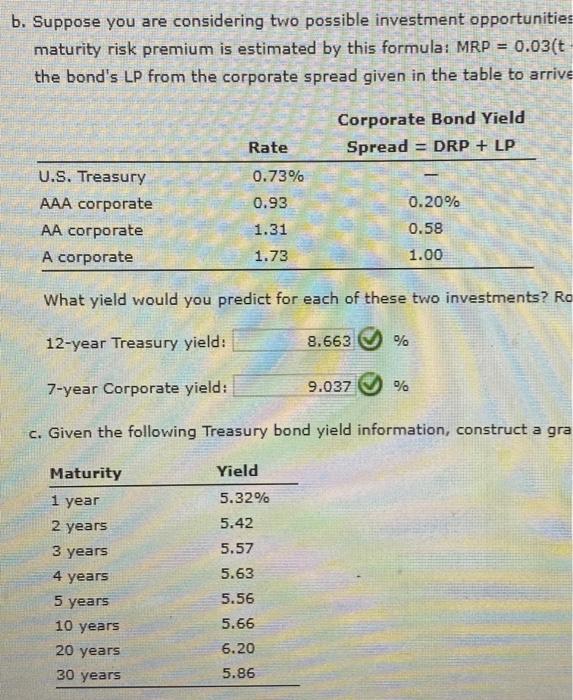

please check my answers in the top portion and help me with the quantitive problem on the bottom. Please show the formulas. Thank you

d. Based on the information about the corporate bond provide Years Treasury yield A-corporate yield 1 5.32% % 2 5.42% % 3 5.57% % 4 5.63% % ( n + 1 = 0 5 5.56% % 5.66% % 20 6.20% % 30 5.86% % b. Suppose you are considering two possible investment opportunities maturity risk premium is estimated by this formula: MRP = 0.03(t the bond's LP from the corporate spread given in the table to arrive Corporate Bond Yield Spread = DRP + LP Rate 0.73% 0.93 0.20% U.S. Treasury AAA corporate AA corporate A corporate 1.31 0.58 1.73 1.00 What yield would you predict for each of these two investments? Ro 12-year Treasury yield: 8.663 % 7-year Corporate yield: 9.037 % c. Given the following Treasury bond yield information, construct a gra Maturity Yield 5.32% 5.42 5.57 5.63 1 year 2 years 3 years 4 years 5 years 10 years 20 years 30 years 5.56 5.66 6.20 5.86 The capital strong model cant should be comidered when stod and wat wel the cases tratate the water som premium that is one think he dicono di holdt sin portfolio Thank of adhuid in a series are the initis held on Therefore, the risk and Individual hdd be and show the staffects that there with the The ones the weat the pictumst the state the porta a porta illy because diverthe Bottom Two mortistme shendetin medicinos they ofte beste mottogether, we con came of the core of between two variables sportists of two to that were the potete controly teacher for the ads are efectiva led the wo in one pieces to diversification would be completed hos y cated but perfectly so, con il dik but does not come with that and to content to con co two types that it was reconstruction in the risk on the make the mother in a privation commodi di devono kwenda na mane Made invented to come by which the which are the bette na ticket and down the market that we will win between 1 cod Quantitate problem your home with the testments and Det Beta 900.000 US 13.30 1.50 500,000 1.65 50,000 -0 Tatate 1.100.000 There is the the point bonds d. Based on the information about the corporate bond provide Years Treasury yield A-corporate yield 1 5.32% % 2 5.42% % 3 5.57% % 4 5.63% % ( n + 1 = 0 5 5.56% % 5.66% % 20 6.20% % 30 5.86% % b. Suppose you are considering two possible investment opportunities maturity risk premium is estimated by this formula: MRP = 0.03(t the bond's LP from the corporate spread given in the table to arrive Corporate Bond Yield Spread = DRP + LP Rate 0.73% 0.93 0.20% U.S. Treasury AAA corporate AA corporate A corporate 1.31 0.58 1.73 1.00 What yield would you predict for each of these two investments? Ro 12-year Treasury yield: 8.663 % 7-year Corporate yield: 9.037 % c. Given the following Treasury bond yield information, construct a gra Maturity Yield 5.32% 5.42 5.57 5.63 1 year 2 years 3 years 4 years 5 years 10 years 20 years 30 years 5.56 5.66 6.20 5.86 The capital strong model cant should be comidered when stod and wat wel the cases tratate the water som premium that is one think he dicono di holdt sin portfolio Thank of adhuid in a series are the initis held on Therefore, the risk and Individual hdd be and show the staffects that there with the The ones the weat the pictumst the state the porta a porta illy because diverthe Bottom Two mortistme shendetin medicinos they ofte beste mottogether, we con came of the core of between two variables sportists of two to that were the potete controly teacher for the ads are efectiva led the wo in one pieces to diversification would be completed hos y cated but perfectly so, con il dik but does not come with that and to content to con co two types that it was reconstruction in the risk on the make the mother in a privation commodi di devono kwenda na mane Made invented to come by which the which are the bette na ticket and down the market that we will win between 1 cod Quantitate problem your home with the testments and Det Beta 900.000 US 13.30 1.50 500,000 1.65 50,000 -0 Tatate 1.100.000 There is the the point bonds