Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(d) CAPITAL ASSET PRICING MODEL APPROACH (CAPM): CAPM model describes the risk-return trade-off for securities. It describes the linear relationship between risk and return for

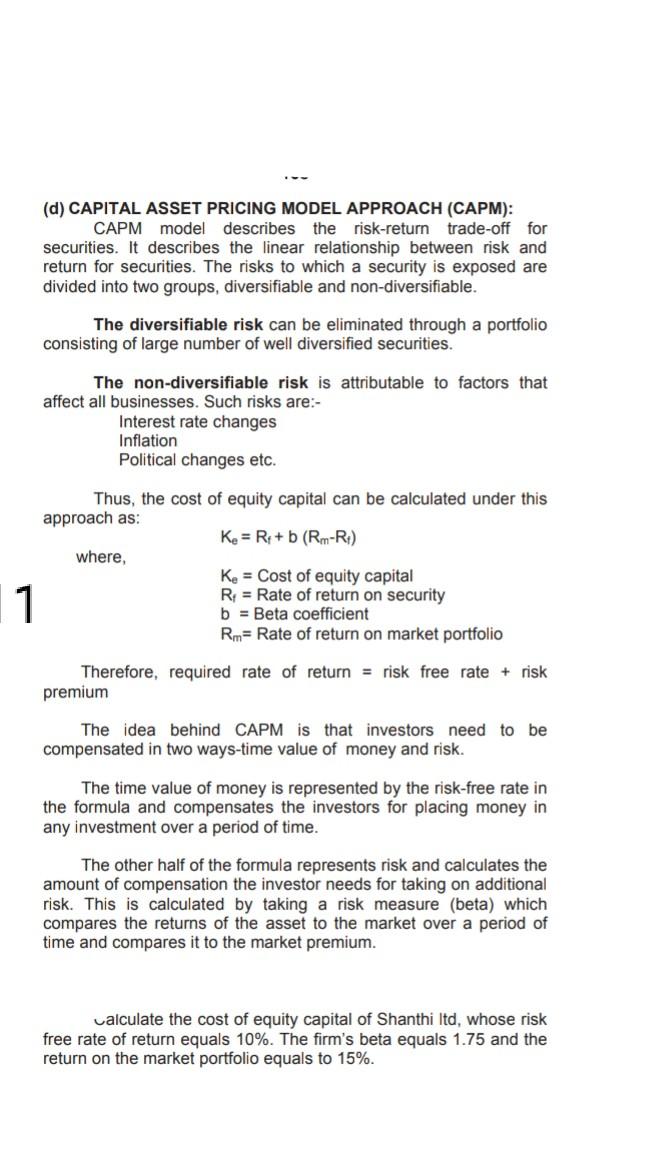

(d) CAPITAL ASSET PRICING MODEL APPROACH (CAPM): CAPM model describes the risk-return trade-off for securities. It describes the linear relationship between risk and return for securities. The risks to which a security is exposed are divided into two groups, diversifiable and non-diversifiable. The diversifiable risk can be eliminated through a portfolio consisting of large number of well diversified securities. The non-diversifiable risk is attributable to factors that affect all businesses. Such risks are:- Interest rate changes Inflation Political changes etc. Thus, the cost of equity capital can be calculated under this approach as: Ke = R + b (Rm-RI) where, Ke = Cost of equity capital R = Rate of return on security b = Beta coefficient Rm= Rate of return on market portfolio 1 Therefore, required rate of return = risk free rate + risk premium The idea behind CAPM is that investors need to be compensated in two ways-time value of money and risk. The time value of money is represented by the risk-free rate in the formula and compensates the investors for placing money in any investment over a period of time. The other half of the formula represents risk and calculates the amount of compensation the investor needs for taking on additional risk. This is calculated by taking a risk measure (beta) which compares the returns of the asset to the market over a period of time and compares it to the market premium. calculate the cost of equity capital of Shanthi ltd, whose risk free rate of return equals 10%. The firm's beta equals 1.75 and the return on the market portfolio equals to 15%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started