Answered step by step

Verified Expert Solution

Question

1 Approved Answer

D company is a floating rate borrower of $10Million but would prefer to pay a fixed interest rate. Z company has issued $10Million bonds

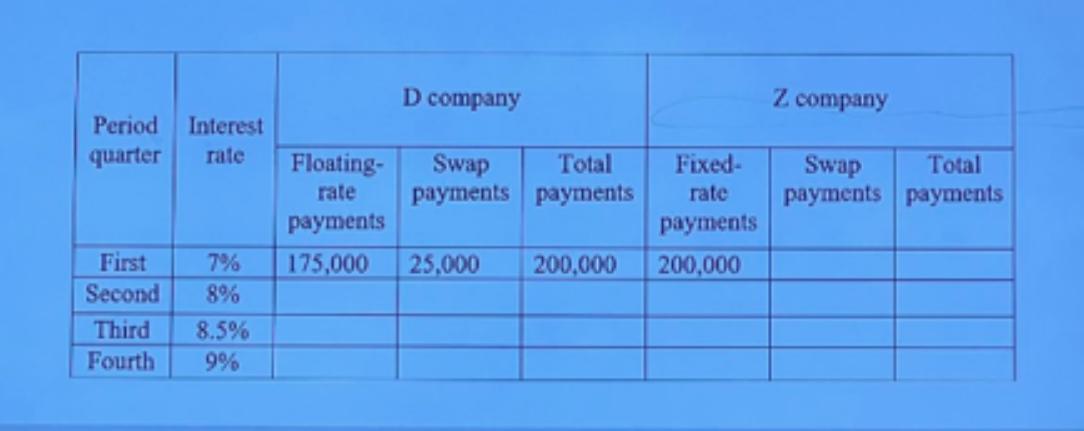

D company is a floating rate borrower of $10Million but would prefer to pay a fixed interest rate. Z company has issued $10Million bonds and pays interest at a fixed rate but would prefer to pay a floating interest rate. D and Z company enter into a SWAP contract at a swap rate 8%. Interest payments are quarterly payments. Use the below table and calculate cash settlements for each party under the given interest rates. Period Interest quarter rate First Second 8% Floating- rate payments 7% 175,000 Third 8.5% Fourth 9% D company Swap Total payments payments 25,000 200,000 Fixed- rate payments 200,000 Z company Swap Total payments payments

Step by Step Solution

There are 3 Steps involved in it

Step: 1

In a plain vanilla interest rate swap two parties exchange interest payments to alter their exposure ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started