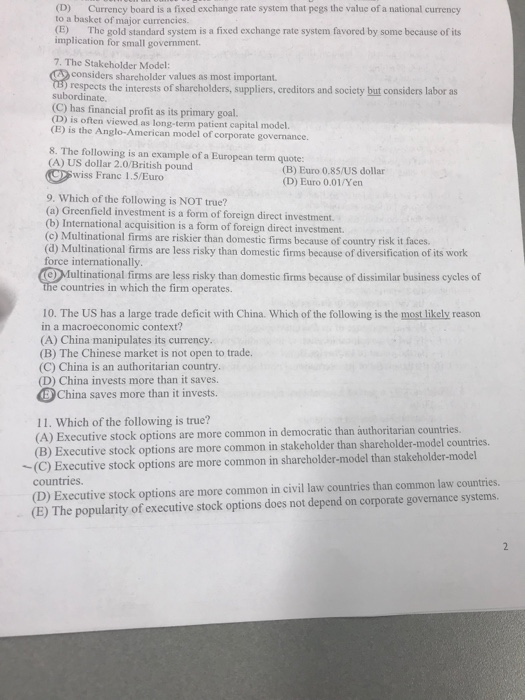

(D) Currency board is a fixed exchange rate system that pegs the valuc of a national currency to a basket of major currencies (E) The gold standard system is a fixed exchange rate system favored by some because of its implication for small government 7. The Stakeholder Model: considers sharcholder values as most important. respects the interests of sharcholders, suppliers, creditors and society but considers labor as subordinate. (C) has financial profit as its primary goal. D) is often viewed as long-term patient capital model. (E) is the Anglo-American model of corporate governance 8. The following is an example of a European term quote: (A) US dollar 2.0/British pound C)wiss Franc 15/Euro (B) Euro 0.85/US dollar (D) Euro 0.01/Yen 9. Which of the following is NOT true? (a) Greenfield investment is a form of foreign direct investment. (b) International acquisition is a form of foreign direct investment. (c) Multinational firms are riskier than domestic firms because of country risk it faces. (d) Multinational firms are less risky than domestic firms because of diversification of its work force internationally Multinational firms are less risky than domestic firms because of dissimilar business cycles of countries in which the firm operates. 10. The US has a large trade deficit with China. Which of the following is the most likely reason in a macroeconomic context? (A) China manipulates its currency (B) The Chinese market is not open to trade. (C) China is an authoritarian country. (D) China invests more than it saves. DChina saves more than it invests. 11. Which of the following is true? (A) Executive stock options are more common in democratic than authoritarian countries (B) Executive stock options are more common in stakeholder than shareholder-model countries. (C) Executive stock options are more common in shareholder-model than stakeholder-model countries (D) Executive stock options are more common in civil law countries than common law countries. (E) The popularity of executive stock options does not depend on corporate governance systems