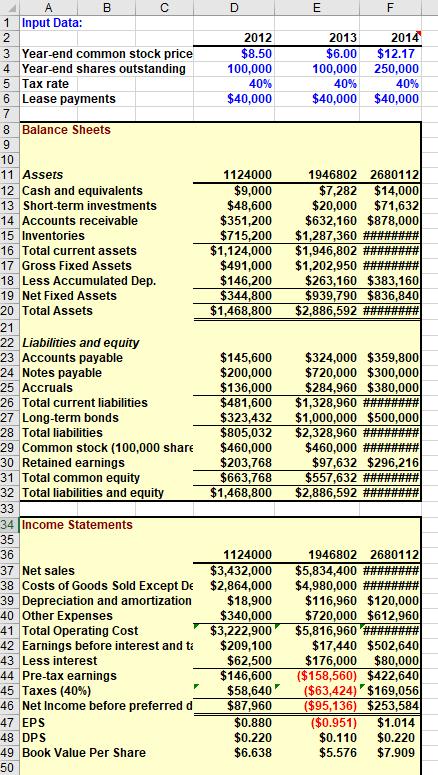

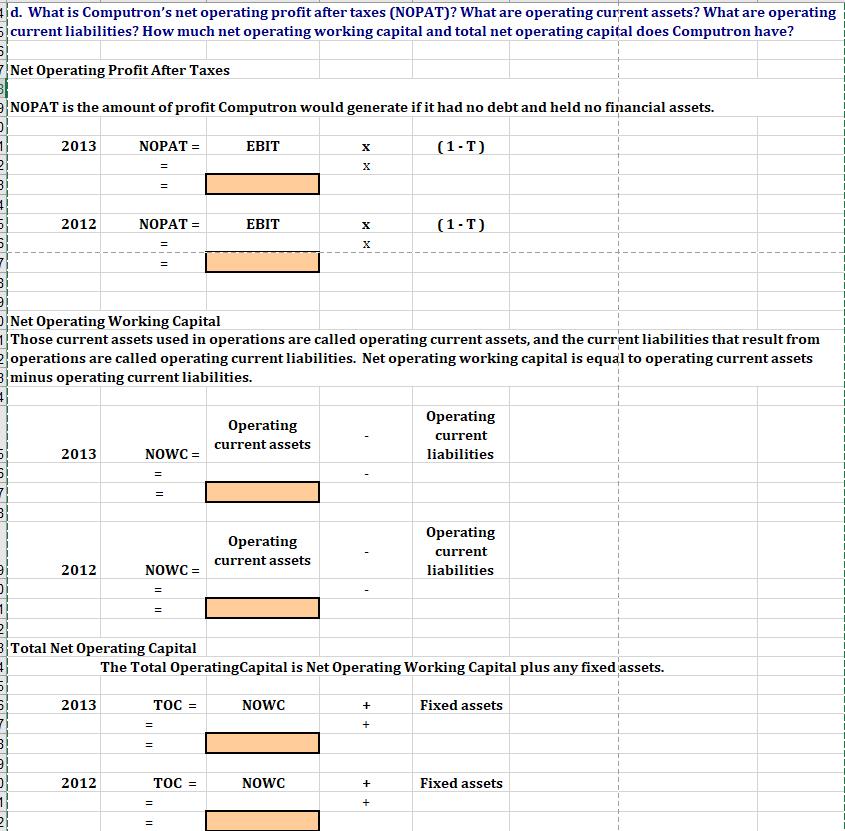

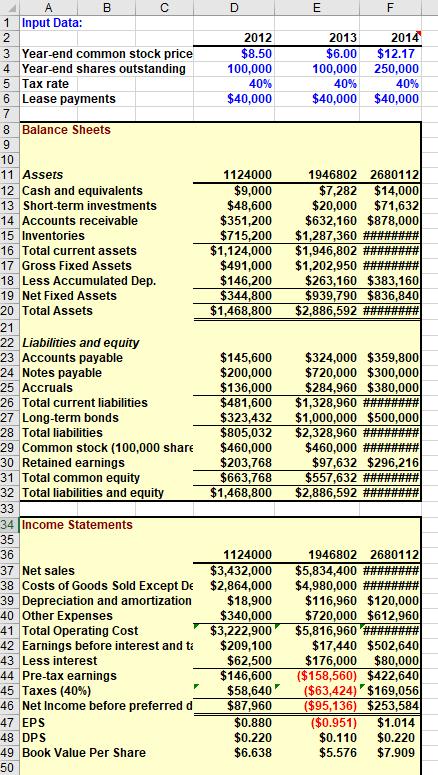

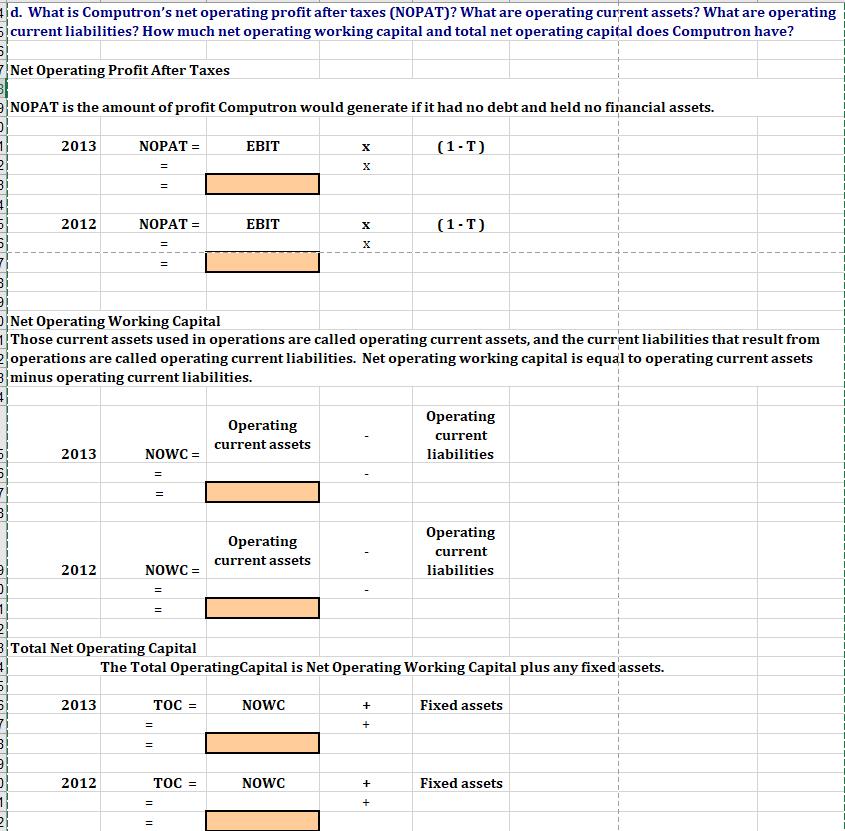

D E F 2013 2014 $6.00 $12.17 100,000 250,000 40% 40% $40,000 $40,000 1946802 2680112 $7,282 $14,000 $20,000 $71,632 $632,160 $878,000 $1,287,360 ## $1,946,802 #### $1,202,950 #### $263,160 $383,160 $939,790 $836,840 $2,886,592 ######## A B 1 Input Data: 2 2012 3 Year-end common stock price $8.50 4 Year-end shares outstanding 100,000 5 Tax rate 40% 6 Lease payments $40,000 7 8 Balance Sheets 9 10 11 Assets 1124000 12 Cash and equivalents $9,000 13 Short-term investments $48,600 14 Accounts receivable $351,200 15 Inventories $715,200 16 Total current assets $1,124,000 17 Gross Fixed Assets $491,000 18 Less Accumulated Dep. $146,200 19 Net Fixed Assets $344,800 20 Total Assets $1,468,800 21 22 Liabilities and equity 23 Accounts payable $145,600 24 Notes payable $200,000 25 Accruals $136,000 26 Total current liabilities $481,600 27 Long-term bonds $323,432 28 Total liabilities $805,032 29 Common stock (100,000 share $460,000 30 Retained earnings $203,768 31 Total common equity $663,768 32 Total liabilities and equity $1,468,800 33 34 Income Statements 35 36 1124000 37 Net sales $3,432,000 38 Costs of Goods Sold Except De $2,864,000 39 Depreciation and amortization $18,900 40 Other Expenses $340,000 41 Total Operating Cost $3,222,900 42 Earnings before interest and ti $209,100 43 Less interest $62,500 44 Pre-tax earnings $146,600 45 Taxes (40%) $58,640 46 Net Income before preferred d $87,960 47 EPS $0.880 48 DPS $0.220 49 Book Value Per Share $6.638 50 $324,000 $359,800 $720,000 $300,000 $284,960 $380,000 $1,328,960 ######## $1,000,000 $500,000 $2,328,960 ## $460,000 ###### $97,632 $296,216 $557,632 ######## $2,886,592 ######## 1946802 2680112 $5,834,400 ## $4,980,000 ##### $116,960 $120,000 $720,000 $612,960 $5,816,960 ######## $17,440 $502,640 $176,000 $80,000 ($158,560) $422,640 ($63,424) $169,056 ($95,136) $253,584 ($0.951) $1.014 $0.110 $0.220 $5.576 $7.909 d. What is Computron's net operating profit after taxes (NOPAT)? What are operating current assets? What are operating current liabilities? How much net operating working capital and total net operating capital does Computron have? Net Operating Profit After Taxes NOPAT is the amount of profit Computron would generate if it had no debt and held no financial assets. 2: 1 2013 NOPAT = EBIT (1-T) = 1 2012 NOPAT = EBIT X X (1-T) Net Operating Working Capital Those current assets used in operations are called operating current assets, and the current liabilities that result from operations are called operating current liabilities. Net operating working capital is equal to operating current assets 8 minus operating current liabilities. Operating current assets Operating current liabilities 2013 NOWC = = Operating current assets Operating current liabilities 2012 NOWC= 1 3 Total Net Operating Capital The Total OperatingCapital is Net Operating Working Capital plus any fixed assets. 2013 TOC = NOWC + Fixed assets + B 2012 TOC = NOWC + Fixed assets +