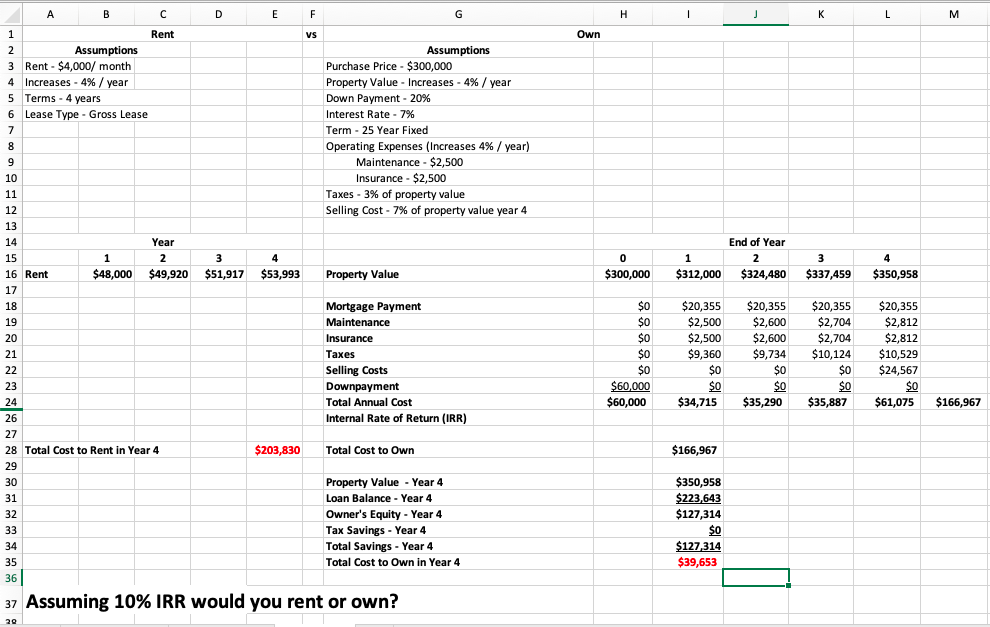

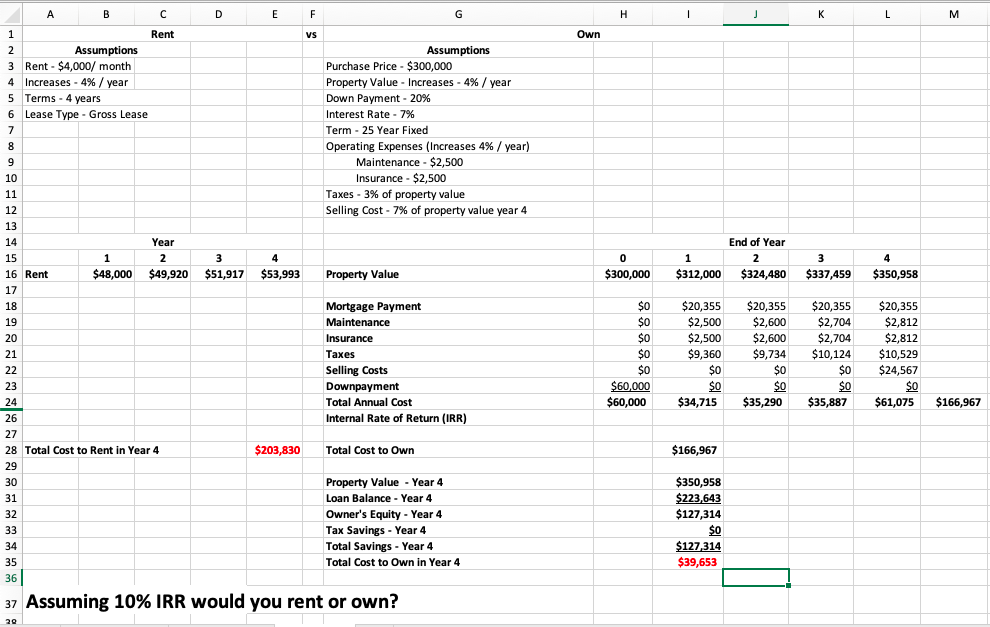

D E F HIJ K L M Own A B C Rent Assumptions Rent - $4,000/ month Increases - 4% / year Terms - 4 years Lease Type - Gross Lease 5 Assumptions Purchase Price - $300,000 Property Value - Increases - 4% / year Down Payment - 20% Interest Rate - 7% Term - 25 Year Fixed Operating Expenses (Increases 4% / year) Maintenance - $2,500 Insurance - $2,500 Taxes - 3% of property value Selling Cost - 7% of property value year 4 End of Year Year 2 $49,920 3 $51,917 4 $53,993 Rent $48,000 Property Value 1 $312,000 $300,000 $324,480 $337,459 $350,958 Mortgage Payment Maintenance Insurance Taxes Selling Costs Downpayment Total Annual Cost Internal Rate of Return (IRR) $0 $0 $60,000 $60,000 $20,355 $2,500 $2,500 $9,360 $0 $0 $34,715 $20,355 $2,600 $2,600 $9,734 $0 $0 $35,290 $20,355 $2,704 $2,704 $10,124 $0 $0 $35,887 $20,355 $2,812 $2,812 $10,529 $24,567 $0 $61,075 $166,967 28 Total Cost to Rent in Year 4 $203,830 Total Cost to Own $166,967 $350,958 $223,643 $127,314 Property Value - Year 4 Loan Balance - Year 4 Owner's Equity - Year 4 Tax Savings - Year 4 Total Savings - Year 4 Total Cost to Own in Year 4 $0 $127,314 $39,653 37 Assuming 10% IRR would you rent or own? D E F HIJ K L M Own A B C Rent Assumptions Rent - $4,000/ month Increases - 4% / year Terms - 4 years Lease Type - Gross Lease 5 Assumptions Purchase Price - $300,000 Property Value - Increases - 4% / year Down Payment - 20% Interest Rate - 7% Term - 25 Year Fixed Operating Expenses (Increases 4% / year) Maintenance - $2,500 Insurance - $2,500 Taxes - 3% of property value Selling Cost - 7% of property value year 4 End of Year Year 2 $49,920 3 $51,917 4 $53,993 Rent $48,000 Property Value 1 $312,000 $300,000 $324,480 $337,459 $350,958 Mortgage Payment Maintenance Insurance Taxes Selling Costs Downpayment Total Annual Cost Internal Rate of Return (IRR) $0 $0 $60,000 $60,000 $20,355 $2,500 $2,500 $9,360 $0 $0 $34,715 $20,355 $2,600 $2,600 $9,734 $0 $0 $35,290 $20,355 $2,704 $2,704 $10,124 $0 $0 $35,887 $20,355 $2,812 $2,812 $10,529 $24,567 $0 $61,075 $166,967 28 Total Cost to Rent in Year 4 $203,830 Total Cost to Own $166,967 $350,958 $223,643 $127,314 Property Value - Year 4 Loan Balance - Year 4 Owner's Equity - Year 4 Tax Savings - Year 4 Total Savings - Year 4 Total Cost to Own in Year 4 $0 $127,314 $39,653 37 Assuming 10% IRR would you rent or own