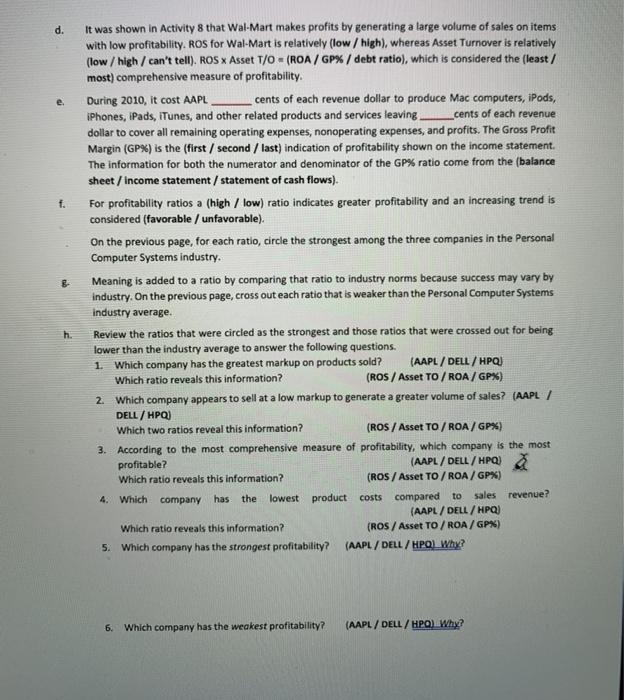

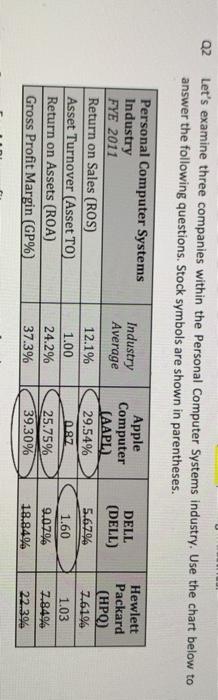

d. e. f. & It was shown in Activity 8 that Wal-Mart makes profits by generating a large volume of sales on items with low profitability. ROS for Wal-Mart is relatively (low/high), whereas Asset Turnover is relatively (low/high/can't tell). ROS X Asset T/O - (ROA/GPX/debt ratio), which is considered the least / most) comprehensive measure of profitability, During 2010, it cost AAPL cents of each revenue dollar to produce Mac computers, iPods, iPhone, iPads, iTunes, and other related products and services leaving _cents of each revenue dollar to cover all remaining operating expenses, nonoperating expenses, and profits. The Gross Profit Margin (GP%) is the first / second / last) indication of profitability shown on the income statement The information for both the numerator and denominator of the GP% ratio come from the balance sheet / income statement / statement of cash flows). For profitability ratios a (high / low) ratio indicates greater profitability and an increasing trend is considered (favorable / unfavorable). On the previous page, for each ratio, circle the strongest among the three companies in the Personal Computer Systems industry. Meaning is added to a ratio by comparing that ratio to industry norms because success may vary by industry. On the previous page, cross out each ratio that is weaker than the Personal Computer Systems industry average. Review the ratios that were circled as the strongest and those ratios that were crossed out for being lower than the industry average to answer the following questions. 1. Which company has the greatest markup on products sold? (AAPL / DELL / HPQU Which ratio reveals this information? (ROS / Asset TO / ROA/GP%) Which company appears to sell at a low markup to generate a greater volume of sales? (AAPL / DELL / HPQ) Which two ratios reveal this information? (ROS / Asset TO / ROA/GP%) 3. According to the most comprehensive measure of profitability, which company is the most profitable? (AAPL / DELL/HP) Which ratio reveals this information? (ROS / Asset TO / ROA/GPX) 4. Which company has the lowest product costs compared to sales revenue? (AAPL / DELL/HPQ) Which ratio reveals this information? (ROS / Asset TO / ROA/GPX) 5. Which company has the strongest profitability? (AAPL / DELL/HPQ) Why? h 2 6. Which company has the weakest profitability? (AAPL / DELL / HP) Why? QZ Let's examine three companies within the Personal Computer Systems industry. Use the chart below to answer the following questions. Stock symbols are shown in parentheses. Industry Average Personal Computer Systems Industry FYE 2011 Return on Sales (ROS) Asset Turnover Asset TO Return on Assets (ROA) Gross Profit Margin GP% 12.1% 1.00 24.2% 37.3% Apple Computer (AAPL) 29.54% 0497 25.75% 39.30% DELL (DELL) 5.679 1.60 9.07% 18.84% Hewlett Packard (HPQ) 7.61% 1.03 7.8494 22.3% d. e. f. & It was shown in Activity 8 that Wal-Mart makes profits by generating a large volume of sales on items with low profitability. ROS for Wal-Mart is relatively (low/high), whereas Asset Turnover is relatively (low/high/can't tell). ROS X Asset T/O - (ROA/GPX/debt ratio), which is considered the least / most) comprehensive measure of profitability, During 2010, it cost AAPL cents of each revenue dollar to produce Mac computers, iPods, iPhone, iPads, iTunes, and other related products and services leaving _cents of each revenue dollar to cover all remaining operating expenses, nonoperating expenses, and profits. The Gross Profit Margin (GP%) is the first / second / last) indication of profitability shown on the income statement The information for both the numerator and denominator of the GP% ratio come from the balance sheet / income statement / statement of cash flows). For profitability ratios a (high / low) ratio indicates greater profitability and an increasing trend is considered (favorable / unfavorable). On the previous page, for each ratio, circle the strongest among the three companies in the Personal Computer Systems industry. Meaning is added to a ratio by comparing that ratio to industry norms because success may vary by industry. On the previous page, cross out each ratio that is weaker than the Personal Computer Systems industry average. Review the ratios that were circled as the strongest and those ratios that were crossed out for being lower than the industry average to answer the following questions. 1. Which company has the greatest markup on products sold? (AAPL / DELL / HPQU Which ratio reveals this information? (ROS / Asset TO / ROA/GP%) Which company appears to sell at a low markup to generate a greater volume of sales? (AAPL / DELL / HPQ) Which two ratios reveal this information? (ROS / Asset TO / ROA/GP%) 3. According to the most comprehensive measure of profitability, which company is the most profitable? (AAPL / DELL/HP) Which ratio reveals this information? (ROS / Asset TO / ROA/GPX) 4. Which company has the lowest product costs compared to sales revenue? (AAPL / DELL/HPQ) Which ratio reveals this information? (ROS / Asset TO / ROA/GPX) 5. Which company has the strongest profitability? (AAPL / DELL/HPQ) Why? h 2 6. Which company has the weakest profitability? (AAPL / DELL / HP) Why? QZ Let's examine three companies within the Personal Computer Systems industry. Use the chart below to answer the following questions. Stock symbols are shown in parentheses. Industry Average Personal Computer Systems Industry FYE 2011 Return on Sales (ROS) Asset Turnover Asset TO Return on Assets (ROA) Gross Profit Margin GP% 12.1% 1.00 24.2% 37.3% Apple Computer (AAPL) 29.54% 0497 25.75% 39.30% DELL (DELL) 5.679 1.60 9.07% 18.84% Hewlett Packard (HPQ) 7.61% 1.03 7.8494 22.3%