Answered step by step

Verified Expert Solution

Question

1 Approved Answer

d) Estimate the price and yield of a two-year bond providing a semiannual coupon of 7% per annum. + L a) The zero rate

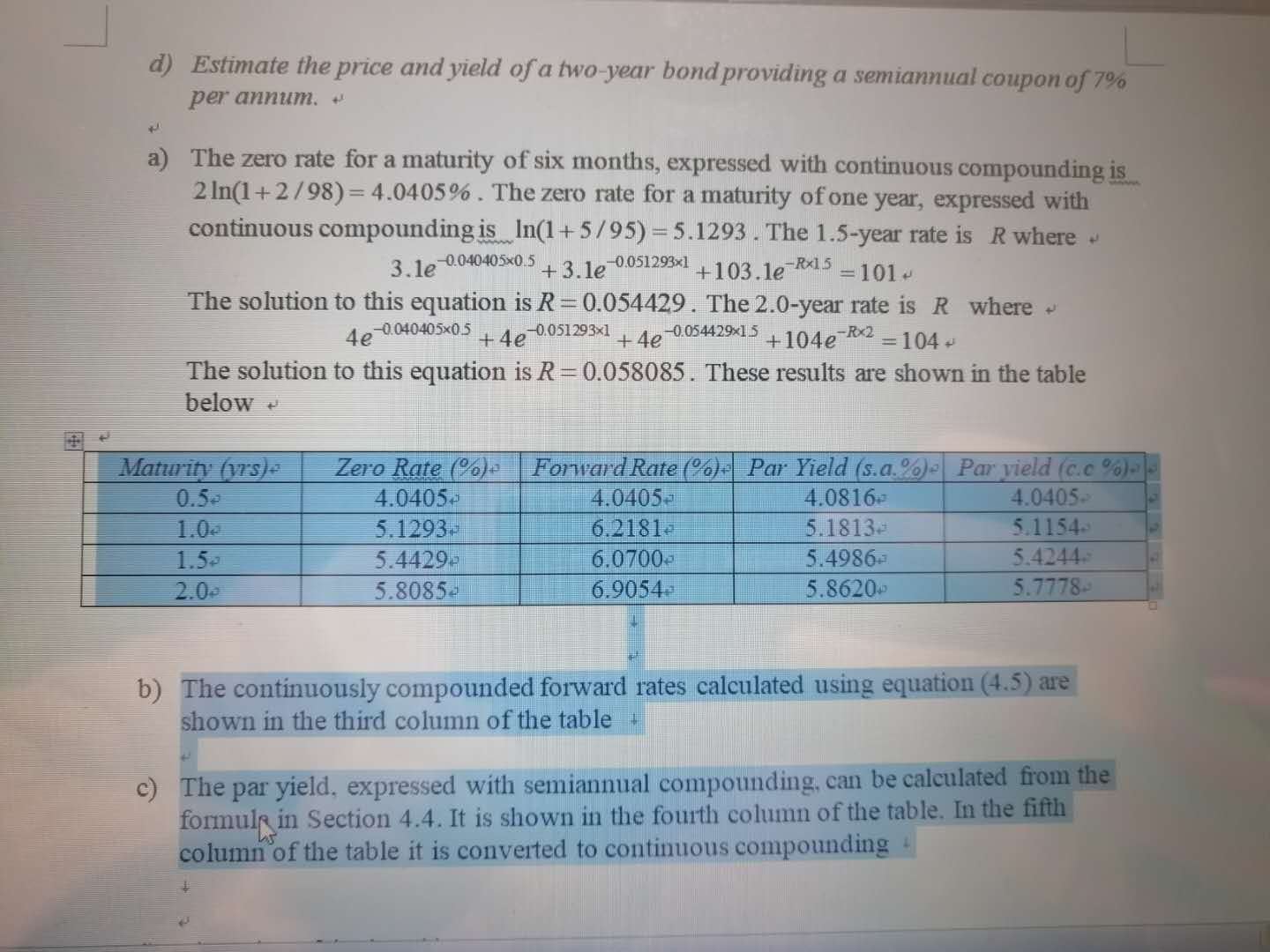

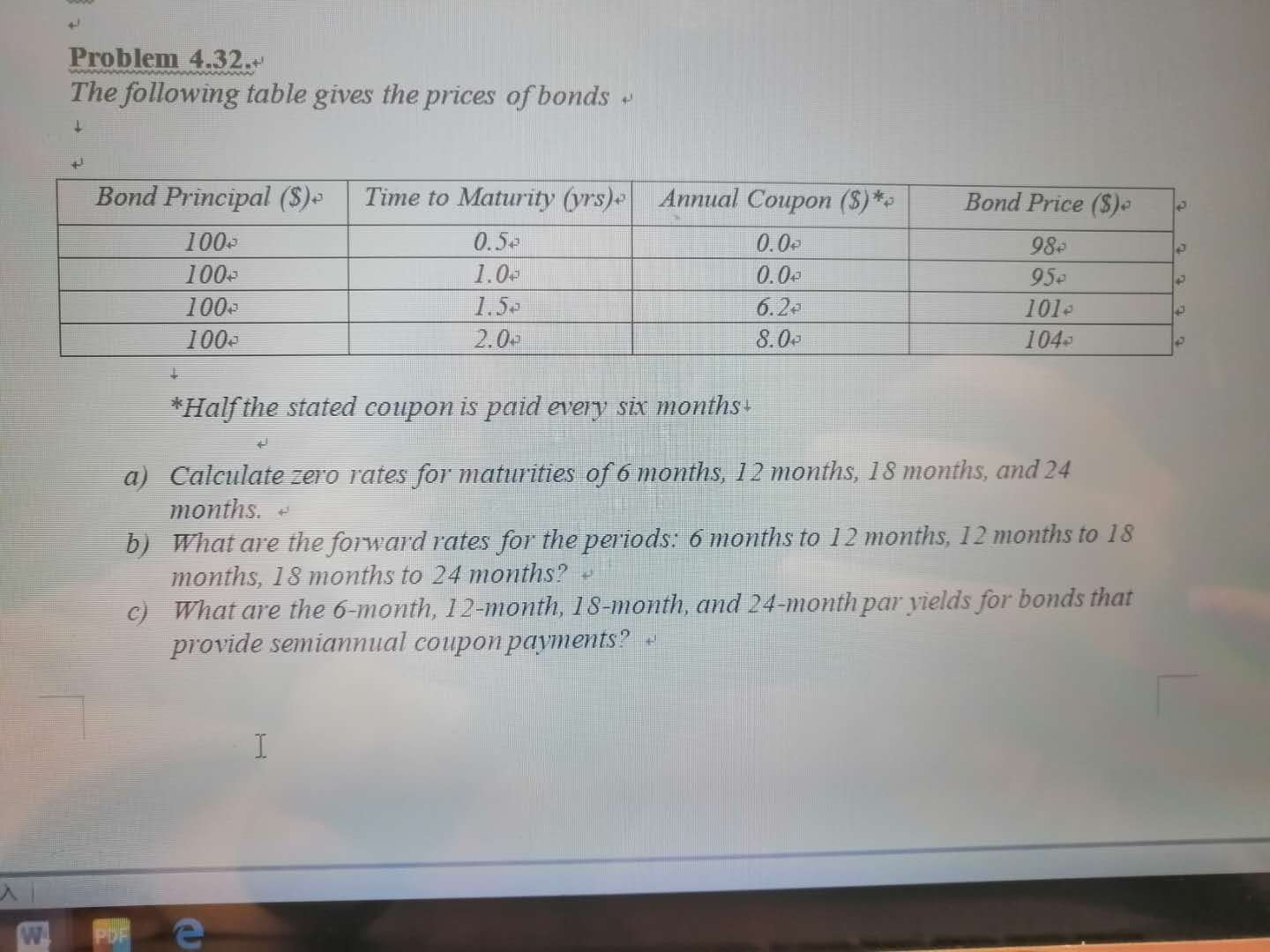

d) Estimate the price and yield of a two-year bond providing a semiannual coupon of 7% per annum. + L a) The zero rate for a maturity of six months, expressed with continuous compounding is 2 In(1+2/98)= 4.0405%. The zero rate for a maturity of one year, expressed with continuous compounding is_In(1+5/95)=5.1293. The 1.5-year rate is R where 3.1e0.040405x0.5 +3.1e -0.051293x1 -Rx15 +103.le = 101 + The solution to this equation is R = 0.054429. The 2.0-year rate is R where 4e-0.040405x0.5 +4e -0.051293x1 +4e -0.0544291.5 -Rx2 +104e =104+ The solution to this equation is R = 0.058085. These results are shown in the table below Maturity (yrs) Zero Rate (%) Forward Rate (%)+| Par Yield (s.a.%) Par yield (c.c %)- 0.5 4.0405 4.0405 4.0816 4.0405-> 1.0 5.1293- 6.2181 5.1813 5.1154- 1.56 5.4429 6.0700- 5.4986- 5.4244 - 2.00 5.8085- 6.9054 5.8620 5.7778 -> b) The continuously compounded forward rates calculated using equation (4.5) are shown in the third column of the table- c) The par yield, expressed with semiannual compounding, can be calculated from the formule in Section 4.4. It is shown in the fourth column of the table. In the fifth column of the table it is converted to continuous compounding + Problem 4.32. The following table gives the prices of bonds Bond Principal ($)+ Time to Maturity (yrs) Annual Coupon ($)* Bond Price ($)* 100 0.5 0.0+ 98% 4 100 1.0+ 0.0+ 954 4 100 1.5 6.20 1014 4 100 2.0+ 8.00 104 9 W PDF *Half the stated coupon is paid every six months+ a) Calculate zero rates for maturities of 6 months, 12 months, 18 months, and 24 months. b) What are the forward rates for the periods: 6 months to 12 months, 12 months to 18 months, 18 months to 24 months? c) What are the 6-month, 12-month, 18-month, and 24-month par yields for bonds that provide semiannual coupon payments? e I

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started