Question: d) evaluate whether the current ratios calculated indicate an improved liquidity or not. Identify any other change that has contributed to meeting this goal and

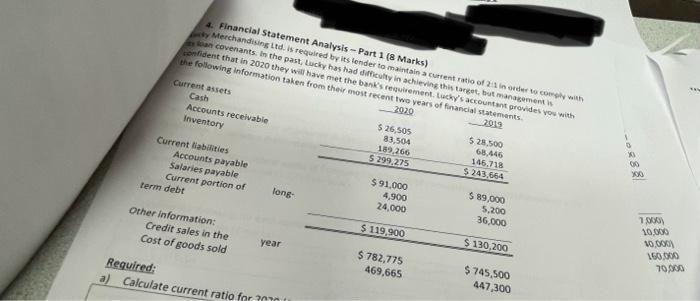

4. Financial Statement Analysis - Part 1 (8 Marks) ky Merchandising Ltd. is required by its lender to maintain a current ratio of 2:1 in order to comply with loan covenants. In the past, Lucky has had difficulty in achieving this target, but management is confident that in 2020 they will have met the bank's requirement. Lucky's accountant provides you with the following information taken from their most recent two years of financial statements. 2920 2019 Current assets Cash Accounts receivable Inventory Current liabilities Accounts payable Salaries payable Current portion of term debt Other information: Credit sales in the Cost of goods sold long- year Required: a) Calculate current ratio for 70 $ 26,505 83,504 189,266 $ 299,275 $91,000 4,900 24,000 $ 119,900 $ 782,775 469,665 $ 28,500 68,446 146,718 $ 243,664 $ 89,000 5,200 36,000 $ 130,200 $745,500 447,300 -0288 00 300 1,000) 10,000 10,000) 160,000 70,000 www

Step by Step Solution

3.48 Rating (168 Votes )

There are 3 Steps involved in it

Current Ratio of an organisation is a liquidity ratio which helps in judging the liquidity positiono... View full answer

Get step-by-step solutions from verified subject matter experts