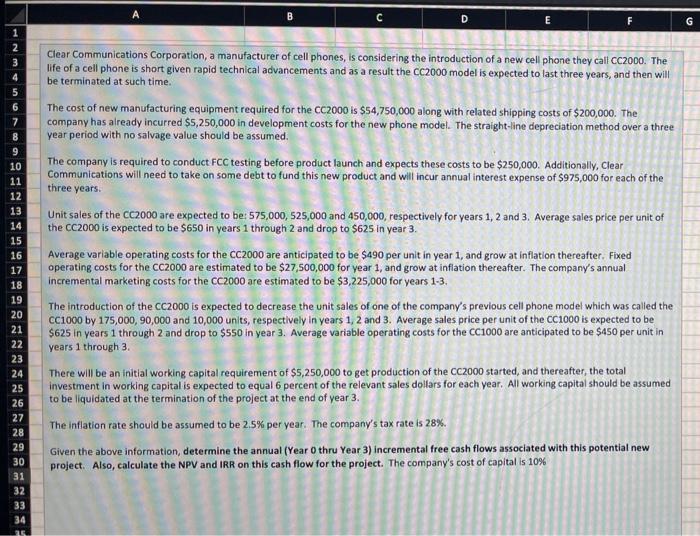

D G 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 Clear Communications Corporation, a manufacturer of cell phones, is considering the introduction of a new cell phone they call CC2000. The life of a cell phone is short given rapid technical advancements and as a result the CC2000 model is expected to last three years, and then will be terminated at such time. The cost of new manufacturing equipment required for the CC2000 is $54,750,000 along with related shipping costs of $200,000. The company has already incurred $5,250,000 in development costs for the new phone model. The straight-line depreciation method over a three year period with no salvage value should be assumed. The company is required to conduct FCC testing before product launch and expects these costs to be $250,000. Additionally, Clear Communications will need to take on some debt to fund this new product and will incur annual interest expense of $975,000 for each of the three years. Unit sales of the CC2000 are expected to be: 575,000, 525,000 and 450,000, respectively for years 1, 2 and 3. Average sales price per unit of the CC2000 is expected to be $650 in years 1 through 2 and drop to $625 in year 3. Average variable operating costs for the CC2000 are anticipated to be $490 per unit in year 1, and grow at inflation thereafter. Fixed operating costs for the CC2000 are estimated to be $27,500,000 for year 1, and grow at inflation thereafter. The company's annual incremental marketing costs for the CC2000 are estimated to be $3,225,000 for years 1-3. The introduction of the CC2000 is expected to decrease the unit sales of one of the company's previous cell phone model which was called the CC1000 by 175,000, 90,000 and 10,000 units, respectively in years 1, 2 and 3. Average sales price per unit of the CC1000 is expected to be $625 in years 1 through 2 and drop to $550 in year 3. Average variable operating costs for the CC1000 are anticipated to be $450 per unit in years 1 through There will be an initial working capital requirement of $5,250,000 to get production of the CC2000 started, and thereafter, the total investment in working capital is expected to equal 6 percent of the relevant sales dollars for each year. All working capital should be assumed to be liquidated at the termination of the project at the end of year 3. The inflation rate should be assumed to be 2.5% per year. The company's tax rate is 28%. Given the above information, determine the annual (Year Othru Year 3) incremental free cash flows associated with this potential new project. Also, calculate the NPV and IRR on this cash flow for the project. The company's cost of capital is 10% TE