Answered step by step

Verified Expert Solution

Question

1 Approved Answer

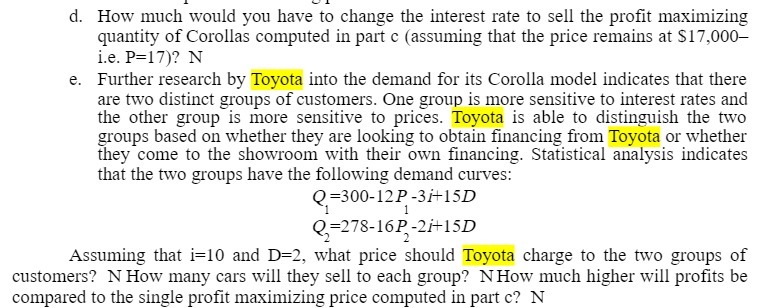

d. How much would you have to change the interest rate to sell the profit maximizing quantity of Corollas computed in part c (assuming

d. How much would you have to change the interest rate to sell the profit maximizing quantity of Corollas computed in part c (assuming that the price remains at $17,000- i.e. P=17)? N e. Further research by Toyota into the demand for its Corolla model indicates that there are two distinct groups of customers. One group is more sensitive to interest rates and the other group is more sensitive to prices. Toyota is able to distinguish the two groups based on whether they are looking to obtain financing from Toyota or whether they come to the showroom with their own financing. Statistical analysis indicates that the two groups have the following demand curves: Q=300-12P-3i+15D 1 Q=278-16P-2i+15D Assuming that i=10 and D=2, what price should Toyota charge to the two groups of customers? N How many cars will they sell to each group? N How much higher will profits be compared to the single profit maximizing price computed in part c? N

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started